A CFO’s Guide to Restructuring

For CFOs, restructuring is crucial because it enables the company to optimize operations, improve financial stability, and enhance customer service, all of which directly impact profitability and long-term growth. Whether through operational or financial changes, restructuring allows CFOs to strengthen the organization’s financial position, manage debt, and adapt the corporate structure to align with strategic goals, ensuring greater efficiency and competitive advantage.

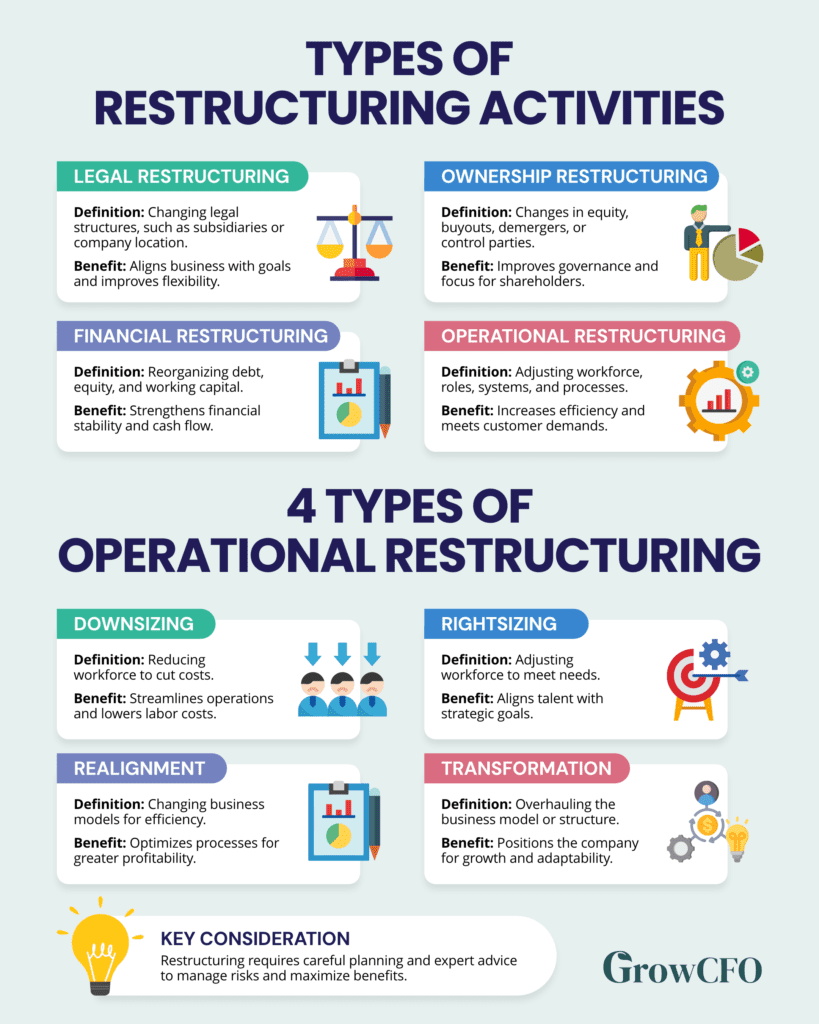

Restructuring encompasses various activities, including:

Legal Restructuring: Modifying legal structures, such as group setups, subsidiaries, or company locations.

Ownership Restructuring: Involving shareholder changes, such as buyouts, demergers, or adjusting control.

Financial Restructuring: Reorganizing debt, equity, and working capital, focusing on debt obligations and credit terms.

Operational Restructuring: Adjusting workforce, systems, processes, or organizational structures for better efficiency.

Restructuring projects require careful planning and expert advice due to the potential consequences. Four types of operational restructuring include:

Downsizing: Reducing the workforce to cut costs.

Rightsizing: Adjusting the workforce to meet needs through hiring or reassignment.

Realignment: Changing the business model for improved efficiency.

Transformation: Overhauling the business model by entering new markets or changing the organizational structure.

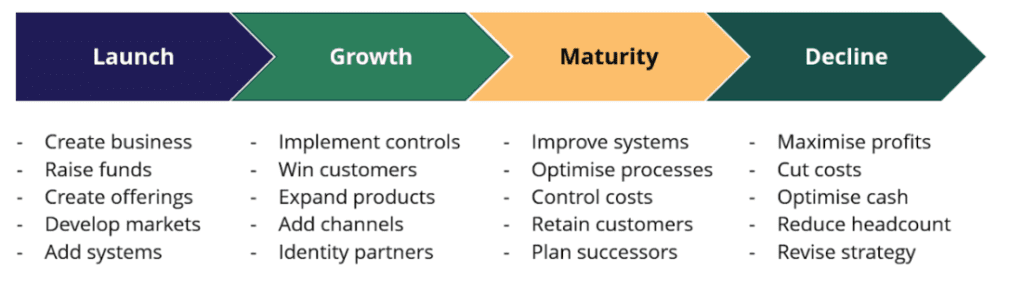

Operational restructurings can be stressful for employees, often leading to job losses, pay cuts, or changes in duties. As companies evolve through their life cycle, they must continuously restructure to adapt to changes in products, markets, and workforce, ensuring operational effectiveness.

The following diagram illustrates some of the typical strategic objectives that management need to achieve during each stage of your journey:

Many companies delay operational restructurings until faced with a crisis, missing signs like declining revenues, shrinking margins, reduced productivity, or shifts in business models. For CFOs, identifying these trends early with financial insight and data analysis is key to seizing improvement opportunities and driving success.

While operational restructurings can be disruptive, strategic planning and execution allow CFOs to minimize disruptions, ensuring smooth transitions and keeping the company on track.

Ready to lead transformative change in your finance function? Join us at the Future CFO Program Preview Event to gain the tools and insights needed to shape your career. Reserve your spot today by clicking here.

Responses