Access the World’s Leading ExLF Programs in One Affordable Package

The ExLF Program

Live Learning Experiences

Includes 24 annual credits for 24 hours of live experiential workshops, designed and facilitated by former FDs and CFOs from leading companies.

Skills Assessment & Personalized Learning Plans

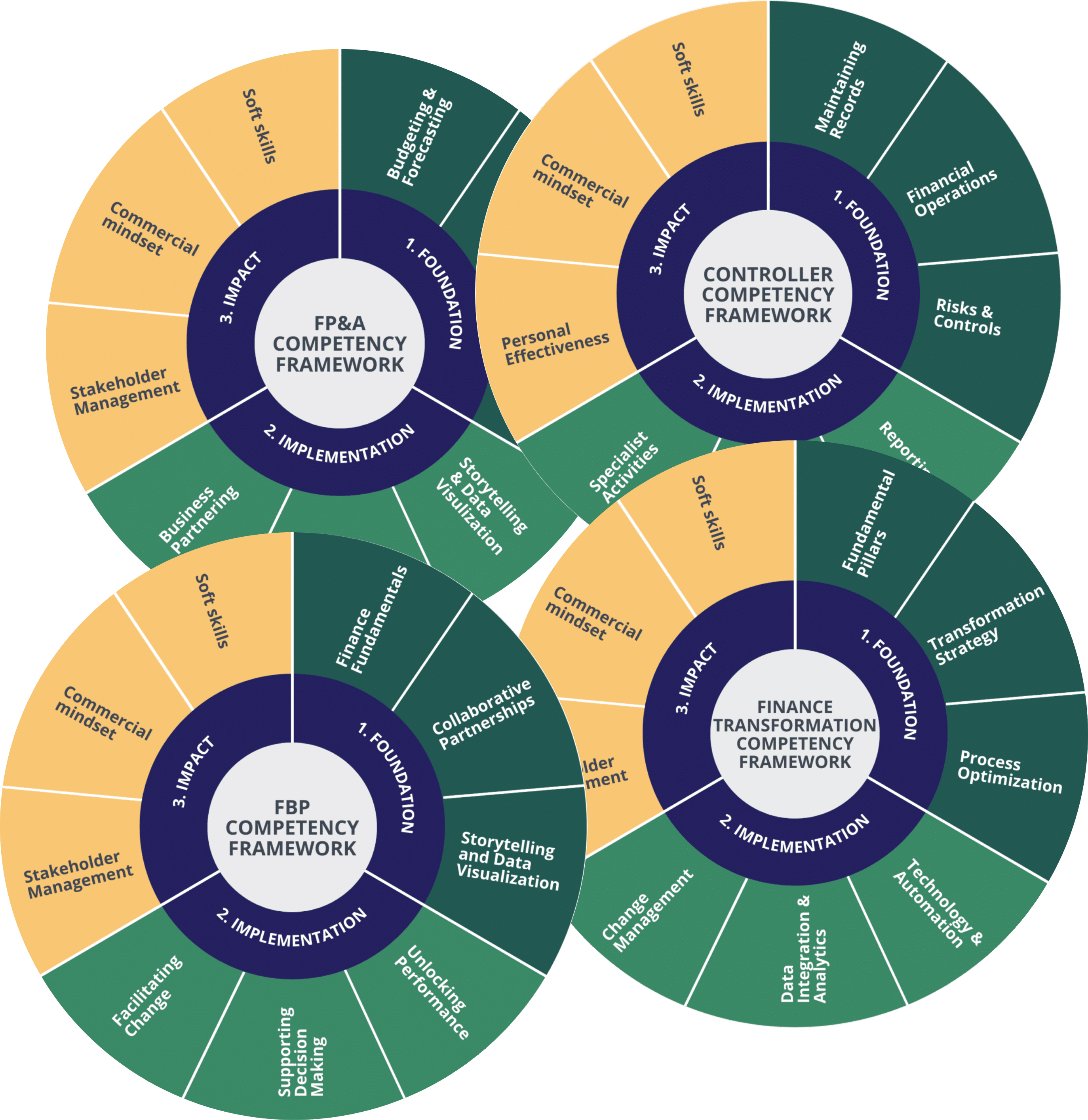

Participants take a competency assessment to identify skills gaps, leading to a personalized development plan, helping them select the relevant live workshops.

Comprehensive Syllabus

Our 30+ live workshops, run multiple times throughout the year, focusing on critical skills gaps covering; strategic finance, leadership, and operational excellence skills.

Accreditation

Courses are CPD/CPE accredited by NASBA, fulfilling annual CPD/CPE requirements.

How it works

Our program offers an engaging, CPD/CPE-accredited learning journey tailored for finance professionals across all roles and grades. Connect with global experts, explore a comprehensive finance syllabus, and apply new skills immediately to achieve impactful results. Join now to future-proof your finance team and drive success in an evolving finance landscape.

1

ExLF Credits & Dashboard

ExLF program members receive 24 credits annually in their dashboard, which equates to 24 hours of live learning.

2

Skills Assessment & Learning Plan

Participants start with an assessment to identify skills and growth areas, leading to a personalized development plan aligned with career goals.

3

Book Live Learning Experiences

The 24 credits are used to book from a selection of 30+ live workshops, ranging from 2 to 8 credits each, tailored to meet learning needs and career goals.

Need to change the currency? Select your location:

all for just £195* per month, per person

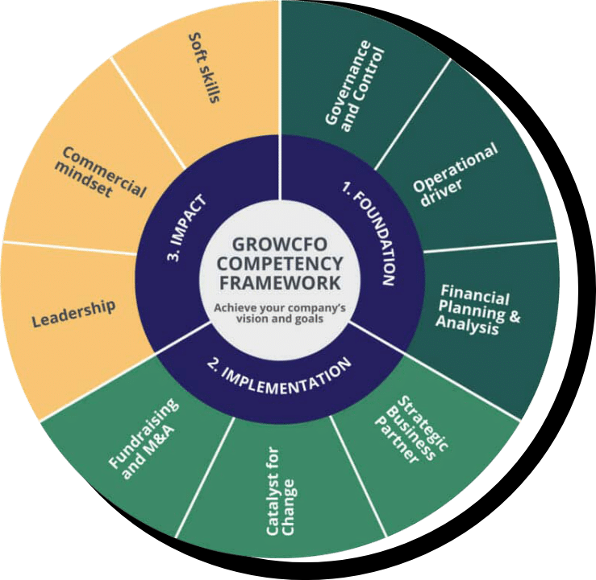

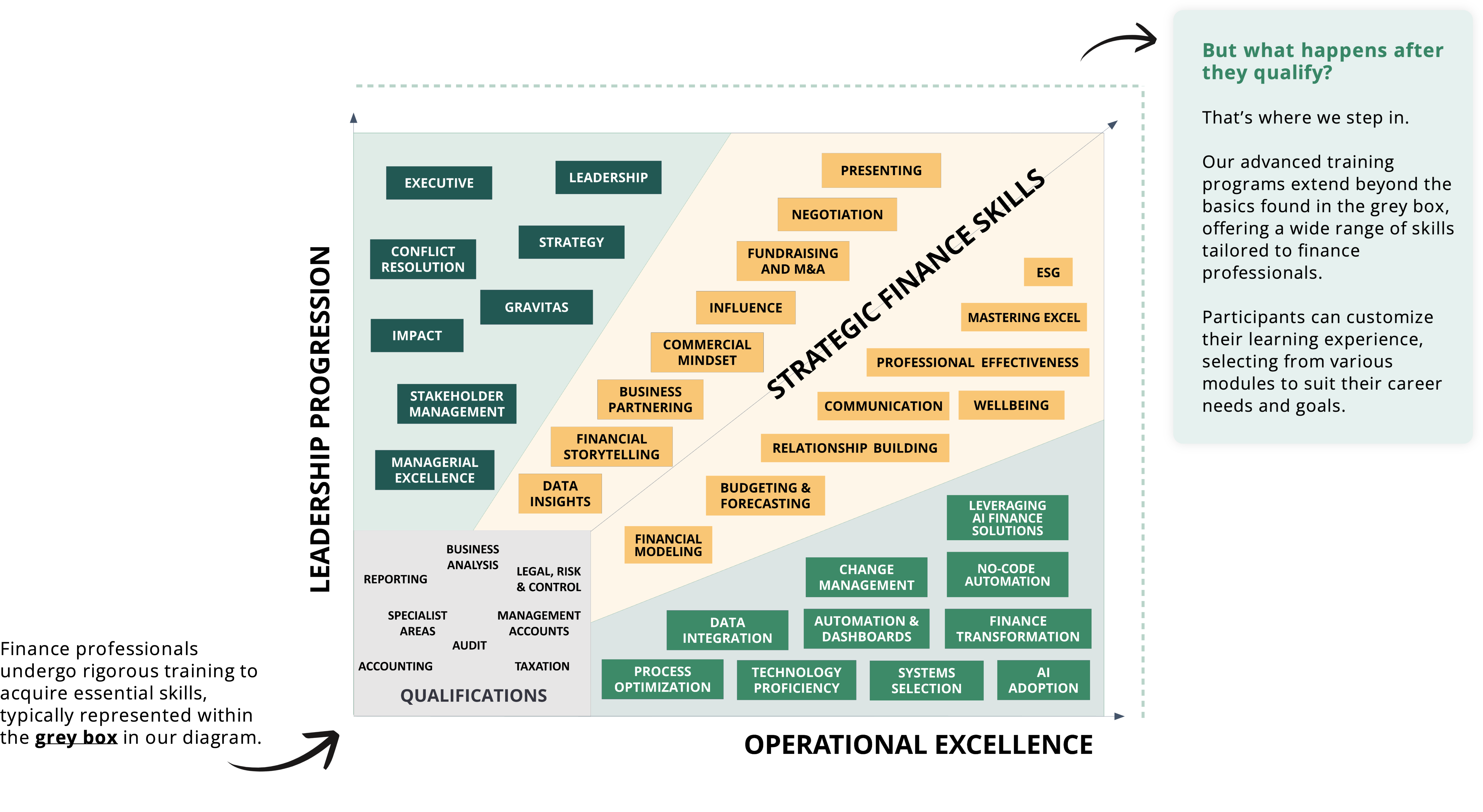

Critical Skills for Financial Excellence

Experiential Learning with Personalized Development Plans

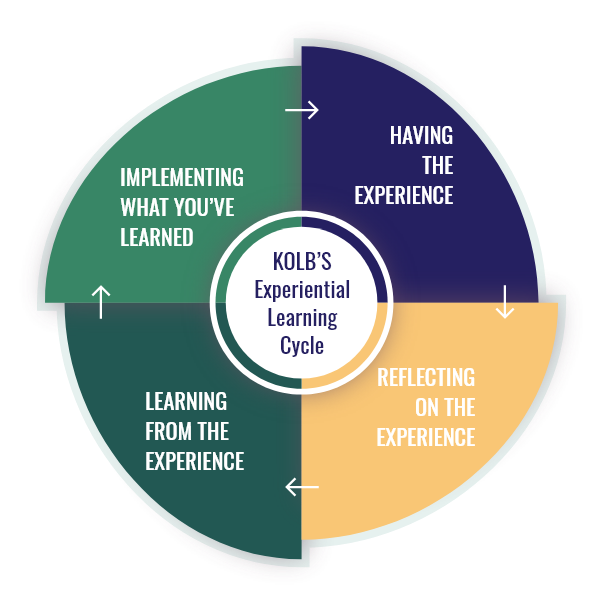

The ExLF program offers an engaging learning experience through the integration of gamification elements, designed to maintain participant engagement even amid demanding work schedules. Personalized development plans ensure that each participant’s training is tailored to their specific career paths, role requirements, and skill gaps. This approach not only enhances the learning experience but also aligns it closely with individual professional growth objectives, ensuring that participants receive relevant and effective training.

Global Networking and Expert Trainers

The ExLF program provides unparalleled peer networking opportunities, allowing participants to connect with finance professionals across various companies and locations. This is facilitated by a team of international expert trainers who bring a wealth of real-world experience and insights. These trainers deliver a comprehensive finance syllabus that covers essential skills, leadership development, and operational excellence. This global reach and expertise ensure that participants gain diverse perspectives and are well-equipped to tackle challenges in the ever-evolving finance landscape.

Customization and CPD/CPE Accreditation

The ExLF program is fully customized for finance professionals, ensuring that all content is relevant and immediately applicable. The courses are all CPD/CPE accredited, meeting the professional development requirements of most global institutes. This accreditation not only guarantees the quality and credibility of the learning experience but also provides participants with the assurance that their training is recognized and valued by industry standards. The practical application of learning outcomes is emphasized, allowing participants to seamlessly integrate new skills into their daily roles, enhancing both personal and organizational success.

Key Features of ExLF

Finance Wide

Syllabus

Finance Wide Syllabus

Facilitated by ex-Finance Leaders

Company Learning Dashboards

Credit Management System

Gamification Technology

Notifications and Reminders

Industry Skills Benchmarking

CPE/CPD Accredited Certificates

Collaborative Peer Groups

Course Reviews

Live Workshops Included in the ExLF Program

Customize learning experiences with our most sought-after boot camp courses and workshops,

designed to meet both personal and professional growth needs.

Leadership Progression

Workshops:

– Strategic Planning Fundamentals

– The strategic planning process

– Influencing Strategic Decisions

Next Live Date: TBC

6 CREDITS

Workshops:

– Management Essentials

– Best Practice Management

– Delegation and Empowerment

Next Live Date: TBC

6 CREDITS

Workshops:

– Building the Foundations of Coaching Excellence

– Mastering the Art of Coaching Conversations

Next Live Date: TBC

4 CREDITS

Workshops:

– Group Meetings

– Conflict Resolution

– Influence

– Negotiation

Next Live Date: TBC

8 CREDITS

Strategic Finance Skills

Workshops:

– Understanding Commercial Finance

– Strategically Measuring ROI

– Preparing Analysis and Influencing Decisions

Next Live Date: TBC

6 CREDITS

Workshops:

– Business Acquisitions Simulator

Parent Course: Fundraising and M&A Simulators

Simulator : On Demand

8 CREDITS

Workshops:

– Effective Communication

– Active Listening

– Relationship-Building

– Networking

Next Live Date: TBC

8 CREDITS

Workshops:

– Stress & Overwhelm

– Work-Life Balance

– Imposter Syndrome

Next Live Date: TBC

6 CREDITS

Workshops:

– Formulas for Finance

– Dynamic P&L Analytics With Pivot Tables

– Power Query and the Data Model – Consolidation and Reporting

– Data Visualisation & AI Automation

Next Live Date: TBC

8 CREDITS

Workshops:

– About Financial Modelling

– Excel Tools & Functions

– Financial Modelling Techniques

– Practical Financial Modeling

Next Live Date: TBC

8 CREDITS

Workshops:

-Planning

– Forecasting

– Financial Modeling and FP&A Tools

– Business Partnering for FP&A

– Strategy and Long-Range Planning

– Financial Storytelling

– The Future of FP&AA

Next Live Date: Oct 14th, 21st & 28th, Nov 4th, 18th, & 25th, Dec 2nd

14 CREDITS

Workshops:

– The Business Partnering Mindset

– Bringing Numbers to Life

– Turning Data into Insights

– Relationships

– Secrets of Influence

– Storytelling

– Present with Confidence

Next Live Date: TBC

14 CREDITS

Workshops:

– Commercial Decision-Making

– Persuasive Influence

– Negotiating for Win-Wins

– World Class Pricing

Next Live Date: TBC

8 CREDITS

View Course

Workshops:

– Master Your Judgement

– Courageous Thinking

– Strategic Impact

Next Live Date: TBC

6 CREDITS

Workshops:

– Strategy and Long-Range Planning

– Financial Storytelling

– The Future of FP&A

Next Live Date: 3rd, 10th, 17th June 2025

6 CREDITS

Workshops:

– Personal Awareness

– Emotional Intelligence

– Assertiveness Skills

Next Live Date: TBC

6 CREDITS

Workshops:

– Positivity

– Motivation

– Self-Care & Compassion

– Resilience

Next Live Date: TBC

8 CREDITS

Workshops:

– Task Prioritization

– Time Management

– Decision Making

Next Live Date: TBC

6 CREDITS

Workshops:

– ESG Collaboration for Success

– ESG Financial Leadership

– ESG Charter – Developing and Implementing

Next Live Date: TBC

6 CREDITS

Workshops:

– Cutting-edge Financial Modeling

– Advanced Excel Tools & Functions

– Advanced Financial Modeling Techniques

– Advanced Practical Financial Modeling

Next Live Date: TBC

8 CREDITS

Operational Excellence

Workshops:

– AI in Finance – How Do You Build Your Strategy?

– Get Your Finance Team to Embrace AI

– Fix Broken and Slow Finance Processes with AI

– Choose the Right AI Tools for Your Team

Date: TBC

8 CREDITS

Workshops:

– Core Concepts and Best Practice

– Strategic Planning

– Process Optimization

– Technology and Automation

– Data Integration and Analytics

– Change Management

– Case Studies & Practice

Next Live Date: TBC

14 CREDITS

Workshops:

– Understanding AI Chatbots in Finance

– Effective Interaction and Use Cases

– Integrating AI Chatbots into Daily Finance Work

Date: TBC

6 CREDITS

Workshops:

– Freeing Up Time

– Fixing What’s Broken

– Solving Hard Problems

Date: TBC

6 CREDITS

Workshops:

– Automation Fundamentals for Finance

– Exploring No-Code Tools and Techniques

– Creating Effective Financial Workflows

Date: TBC

6 CREDITS

Workshops:

– Design Your Stakeholder Semantic Model

– Build Dynamic Models in Power Query

– Create Time-aware Financial Metrics using DAX

– Variance Analysis with Power BI Visualisation

Date: TBC

8 CREDITS

Workshops:

– Build Financial Ratios and Dynamic Income Statement Measures

– Enhancing the Income Statement with formatting, Report page tool tips and drill-through

– Building a custom waterfall chart and dynamic visuals based on Field Parameters

– Securing, Sharing and publishing reports in the Power BI service

Date: TBC

8 CREDITS

Our Clients

Our live workshops have already delivered transformational learning outcomes to people in the following companies:

GrowCFO Live Workshop Policies

2. Course cohort group sizes are restricted to generate engagement.

3. Participants who keep their cameras turned off are removed from workshops.

What We Expect From Participants

Prioritize Your Growth Live participation is the key to unlocking full potential. Did you know that participating in live sessions boosts learning retention by 90%, compared to just 20% for passive watchers? At GrowCFO, we prioritize active learning that transforms how participants absorb and apply knowledge.

Engage to Excel: Engagement is everything when it comes to building lasting skills. Completing exercises with your camera on can increase skills application by 85%! At GrowCFO, we foster an engaging environment that empowers financial professionals to take their expertise to the next level.

Grow Beyond Limits: We expect you to embrace experiential learning, which can lead to a 40% boost in productivity and performance. GrowCFO is committed to guiding you through transformational growth in finance. Immerse

The Power of Experiential Learning

ExLF vs Video on Demand (VoD)

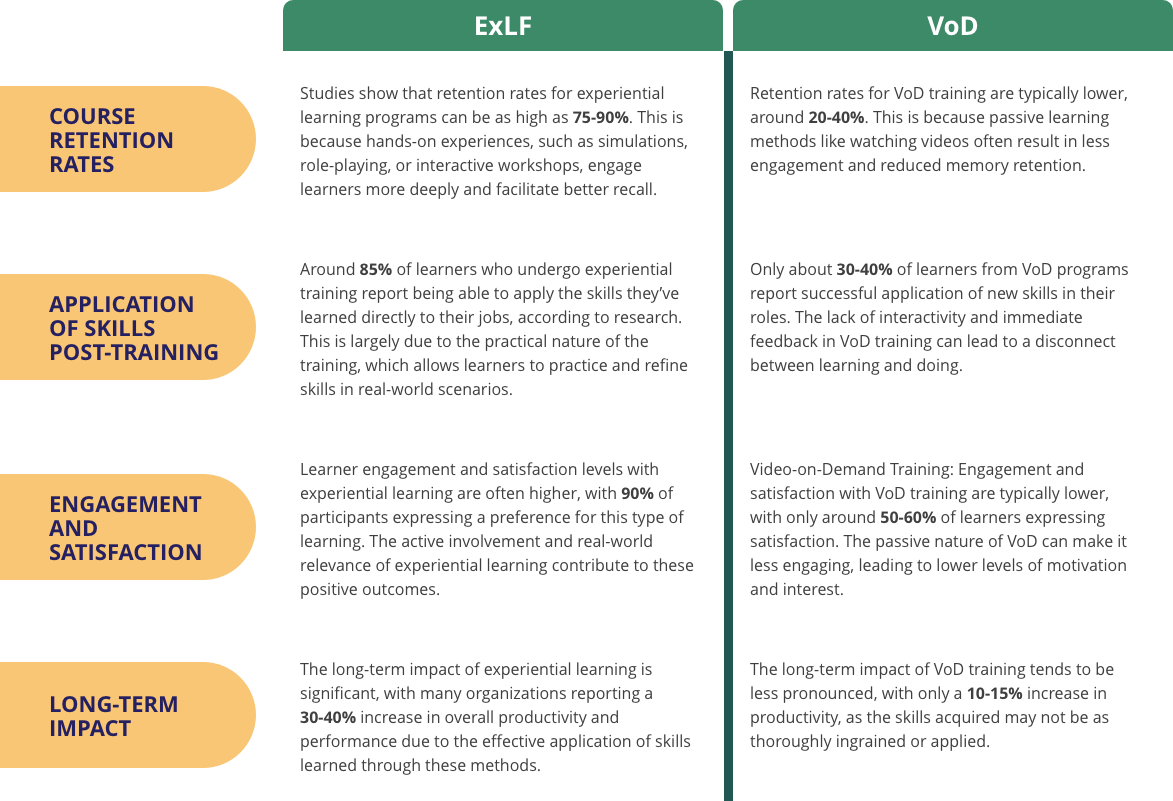

Experiential learning programs and video-on-demand (VoD) training methods both have their place in corporate learning and development. However, research shows that experiential learning generally leads to better retention of new skills and their application within roles post-training.

Here are some key statistics to illustrate the differences:

Frequently Asked Questions

We have delivered our ExLF courses to hundreds of companies around the world across all size categories and ownership types with fantastic feedback throughout. This includes large corporates (both group and divisional teams), PE-backed companies, investment firms, owner-managed businesses, venture capital, family offices, charities, utilities, other not-for-profits, and regulatory firms.