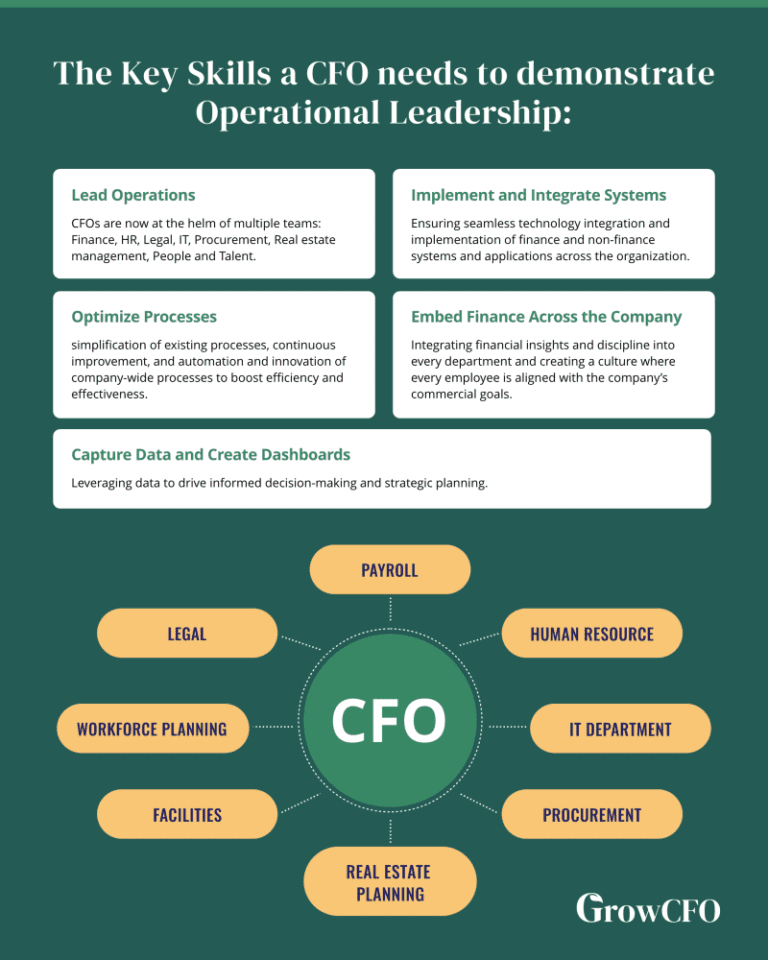

The Modern CFO is the New Operational Driver

Gone are the days when CFOs were solely focused on numbers. Today’s CFOs are overseeing a wide range of operational responsibilities, leading diverse teams, managing complex systems and driving organizational change – so what are the key skills required?

The Future of CFO Leadership:

As businesses grow more complex, the CFO’s role will continue to evolve, offering exciting opportunities for those ready to embrace these challenges. With the right mindset and approach, CFOs can drive profound organizational change and foster a culture of continuous improvement.

Interested in mastering these essential skills and more?

Join our Future CFO Program preview event, designed for finance professionals aspiring to become CFOs within the next 3-5 years. Don’t miss out on this opportunity to elevate your career and lead with confidence!

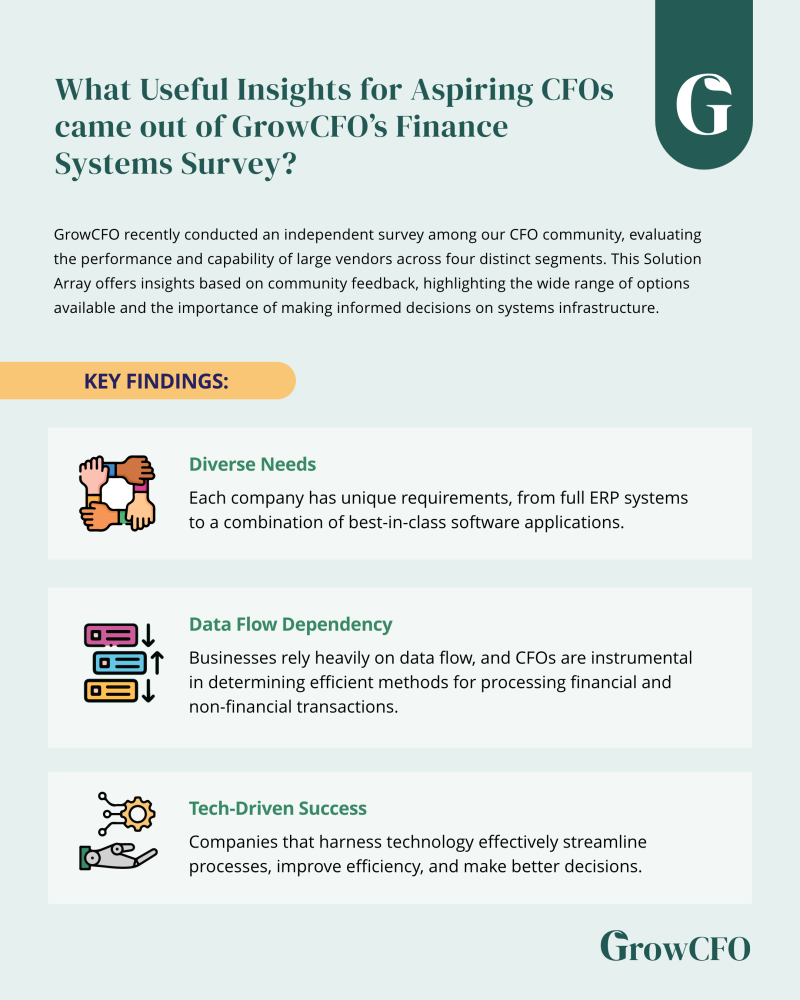

Unlocking the CFO's Strategic Role in System Integration

How do modern CFOs drive success through technology and navigate the complexities of digital transformation? By leading the charge in integrating market-leading solutions.

The Importance of System Integration:

In today’s fast-paced business environment, the ability to adapt to new technology and processes is critical for success. Digital transformation is essential not just for operational efficiency but also for enhancing the experience of stakeholders, customers, and staff. Modern CFOs play a pivotal role in implementing and integrating systems, making strategic decisions that impact the entire organization.

During the survey, 52% of finance leaders indicated plans to introduce more integrations in the next few years. This trend underscores the growing recognition of technology’s role in achieving business goals and the preference for integrating multiple solutions from different providers rather than relying on a single vendor.

Managing Implementation Risks:

The CFO must navigate financial and operational risks associated with new systems. Financial risks include potential cost increases or revenue decreases, while operational risks cover disruptions to business operations or IT systems. Developing a robust risk management plan in collaboration with the executive team is vital to mitigate these risks.

Future of Finance Functions:

As the finance function evolves to become more analytical and less transactional, eliminating cumbersome processes is key. Automation and system integrations are popular methods for achieving this transformation, allowing finance teams to focus on strategic analysis rather than routine tasks.

Ready to master these essential skills and more?

Register for our Future CFO Program preview event, designed for finance professionals aspiring to become CFOs within the next 3-5 years. Elevate your career and lead your organization through successful digital transformation.

Responses