Why Finance Leaders are Ditching Traditional ERP for Post-Modern Systems

Table of Contents

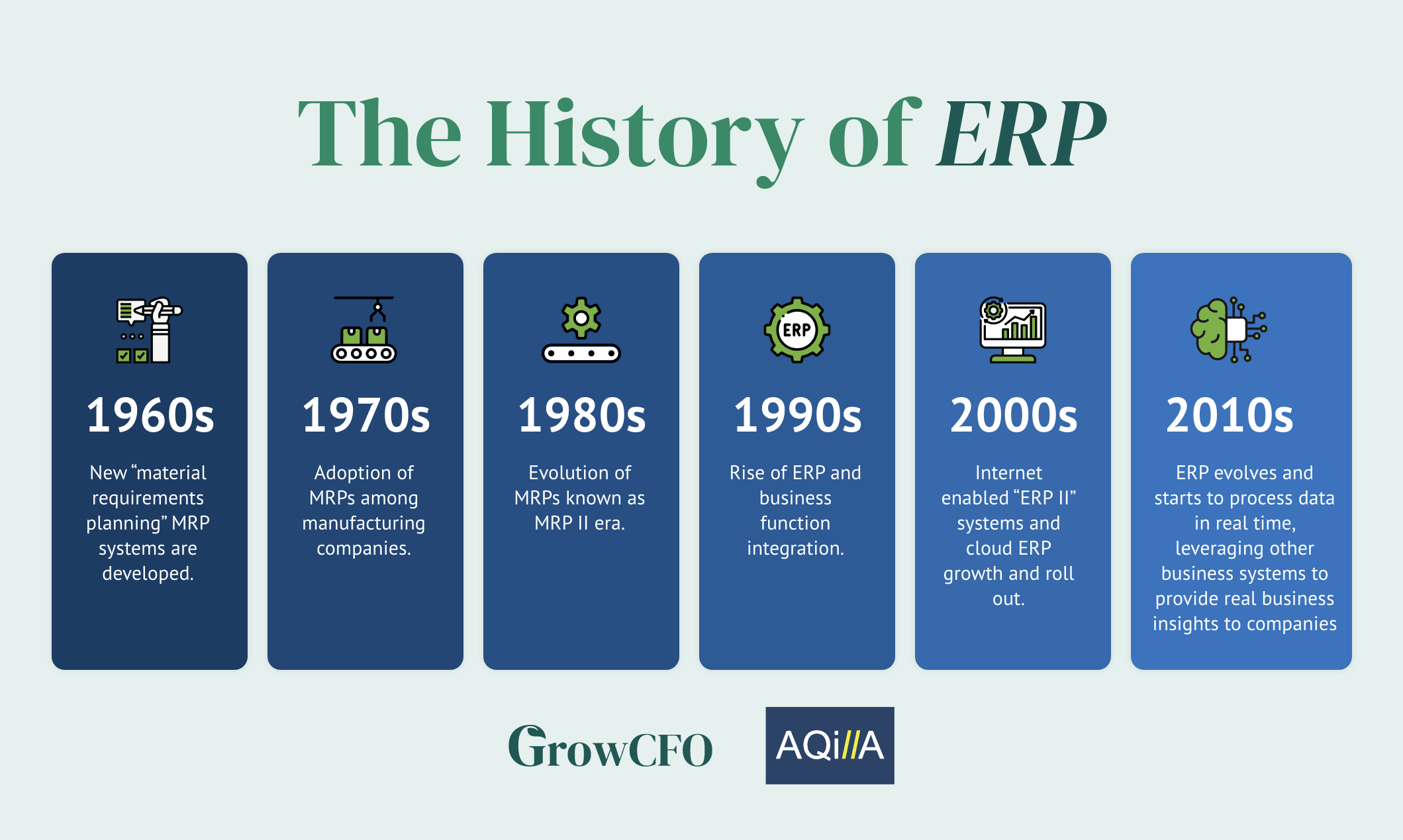

A History of ERP

The term Enterprise Resource Planning (ERP) was developed by Gartner in 1990, defined as “the ability to deliver an integrated suite of business applications” that includes processes such as finance, HR, distribution, manufacturing, service, and the supply chain. Throughout the 1990s and 2000s, ERP systems became incredibly popular, with numerous corporations around the world implementing them. However, the rapid rate of technological progression at the beginning of the 21st century left many ERP systems outdated and systems became too expensive, lacked flexibility to embrace new technologies, and had lengthy, disruptive implementations. The situation was exacerbated by numerous failed implementations criticized in the media during that time.

Since 2010, we have witnessed the rise of Postmodern ERP systems. Another phrase coined by Gartner; Postmodern ERP describes a more flexible technology infrastructure with a strategy that involves using the best applications possible in each area of an organization while ensuring adequate integration with each other when necessary. These systems may be hosted either on-premises or in the cloud, based on the organization’s needs.

Think of a postmodern ERP system like a sports team coach who selects the best players for each position to create a winning team. Similarly, postmodern ERP systems choose the most suitable applications for each business function—finance, HR, supply-chain management—and integrate them to work seamlessly together. These separate systems are connected via APIs (Application Programming Interfaces), enabling the creation of a cohesive system unique to an organization’s needs. Postmodern ERP allows best-in-class technology to be leveraged across the organization which then benefits from data sharing between systems via the integration. It also ensures that future upgrades or replacements of one piece of software don’t disrupt the rest of the business and reduces the risk of disruption when a company uses a single “mega-vendor” and wants to make changes to their systems.

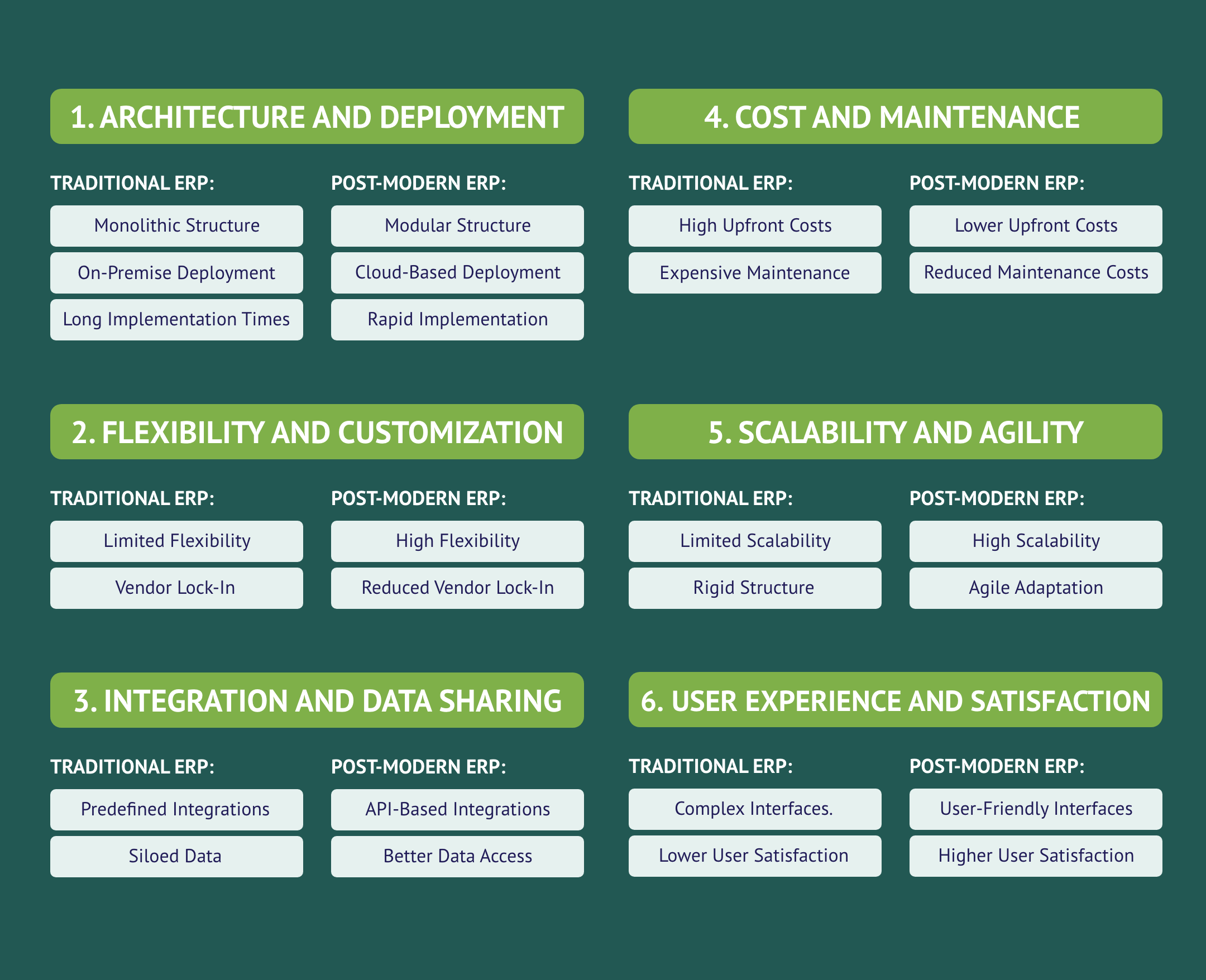

So what are the main differences between traditional and post-modern ERP systems?

Architecture, Deployment and Ongoing Management

Traditional ERP systems are typically built as a single, integrated suite of applications from one vendor. Systems are often deployed on-premises, requiring significant expensive hardware and ongoing maintenance. Implementations of traditional ERPs can be lengthy and complex, sometimes taking several years to fully deploy with limited ongoing flexibility. Customizations are possible but can be costly and complex due to the tightly integrated nature of the suite. Businesses often become dependent on a single vendor for all updates, support, and future developments, leading to vendor lock-in with high upfront costs due to significant initial investments in hardware, software licenses, and implementation services. Ongoing maintenance and updates can also be costly and resource intensive.

In contrast, post-modern ERP systems adopt a more flexible, best-of-breed approach, where different modules from various vendors are integrated. These systems are often cloud-based, reducing the need for extensive on-premises hardware and allowing for quicker updates and scalability and generally involving lower upfront costs, primarily due to cloud-based deployment and subscription-based pricing models. Regular updates and maintenance are handled by the service provider, which reduces the burden on internal IT teams and lowers overall maintenance costs. Implementation of post-modern ERP systems is typically faster, focusing on incremental, bite-sized projects providing ongoing high flexibility. Companies can choose the best applications for each function, such as finance, HR, and supply chain, and integrate them as needed. The modular nature of post-modern ERPs allows businesses to replace or upgrade individual components without affecting the entire system, reducing vendor lock-in.

Integration, Data Sharing, Scalability and Agility

Traditional ERP systems come with predefined integrations where modules within the system are pre-integrated, but there are often limits to customization. Moreover, while the data is integrated within the suite, it can be harder to share with external systems or new applications, leading to siloed data. These systems also have limited scalability. Scaling up or down can be challenging and often requires significant investment and time. The rigid structure of traditional ERPs means that adapting to new business needs or market changes can be slow and cumbersome.

In contrast, post-modern ERP systems use API-based integrations, allowing for more flexible and extensive data sharing across different systems. Real-time data analytics and integration with other business applications enhance decision-making processes, providing better data access and insights. They offer high scalability, easily adjustable to match the changing needs of the organization, with flexible pricing models. These systems are more agile, allowing businesses to quickly adopt new technologies and respond to market changes efficiently.

User Experience and Satisfaction

The user interfaces of traditional ERP systems are often complex and less user-friendly, requiring extensive training for users. This complexity can lead to lower user satisfaction due to the inflexibility and difficulty in use whereas post-modern ERP systems are designed with modern, intuitive interfaces to enhance user experience. They achieve higher user satisfaction rates due to their ease of use and adaptability to specific business needs, making them more user-friendly and accessible.

Examples of Traditional ERP Systems:

- SAP: A comprehensive suite covering various business processes, widely adopted across industries but known for its complexity and high implementation costs.

- Oracle: Another extensive ERP solution with integrated applications for finance, HR, and supply chain, often requiring significant customization and maintenance.

- Microsoft Dynamics: An on-premise ERP solution offering a wide range of functionalities, typically involving longer implementation times and higher upfront costs.

Examples of Post-Modern ERP Systems:

- Sage Intacct: A cloud-based financial management solution enhancing visibility and control over financial operations and streamlining complex financial processes with features like multi-entity management and real-time dashboards.

- AccountsIQ: Supports complex group accounting and offers advanced consolidation, business intelligence, and financial reporting tools for companies with diverse structures and international operations.

- Aqilla: A cloud-based ERP specifically designed for financial management, offering flexibility, real-time data access, and easy integration with other business applications.

To illustrate the difference between traditional and post-modern ERP systems, this graph shows ease of implementation time relative to size and complexity of requirements:

Postmodern ERP: The Statistics

The shift from traditional ERP systems to post-modern ERP solutions is backed by compelling statistics:

- Increased Adoption of Cloud-Based ERPs:

- According to Gartner, by 2024, more than 60% of all large organizations globally will have deployed at least one cloud-based ERP module.

- The cloud ERP market is expected to grow at a CAGR of 13.6% from 2020 to 2027, reaching $37.7 billion by 2027 (Allied Market Research).

- Improved Agility and Flexibility:

- A survey by Panorama Consulting Solutions found that 93% of companies that implemented post-modern ERP solutions reported improved flexibility in their business processes.

- Post-modern ERPs offer a 21% reduction in IT costs compared to traditional ERP systems due to their modular nature and reduced need for extensive customizations (Gartner).

- Better Integration and Real-Time Data:

- Over 80% of CFOs reported that post-modern ERP solutions provided better integration capabilities with other business applications and real-time data analytics, enhancing decision-making processes (PwC).

- Companies using post-modern ERP systems experienced a 22% improvement in business process efficiency, driven by better integration and real-time access to data (Forbes).

- User Satisfaction and Ease of Use:

- A survey by Software Advice revealed that 76% of users preferred post-modern ERP systems over traditional ones due to their user-friendly interfaces and ease of use.

- Post-modern ERP solutions have a 25% higher user satisfaction rate compared to traditional ERP systems (Nucleus Research).

- Cost Efficiency and ROI:

- Companies reported a 20-30% reduction in total cost of ownership (TCO) when switching to post-modern ERP solutions due to lower upfront costs and reduced maintenance expenses (Accenture).

- The ROI on post-modern ERP implementations is typically achieved within 2 years, compared to 3-5 years for traditional ERP systems (Deloitte).

These statistics underscore the trend towards post-modern ERP solutions and highlight the tangible benefits that finance leaders and CFOs can expect when making the switch.

Embarking on a complete digital transformation via one single vendor can be expensive and disruptive for years. Before undertaking such a project, ask if it adds value to your customers’ experience or your bottom line. If not, reconsider why you are pursuing it. For those needing to improve technology, taking 90-day, bite-sized projects through continuous, incremental improvement is smarter. It ensures each business unit accesses best-in-class, innovative software to drive greater efficiency and effectiveness.

Position your business to be agile enough to adopt new technology, supporting your growth ambitions and reducing the need for frequent changes as you outgrow legacy solutions. While there is no one-size-fits-all answer, implementing an IT infrastructure that provides agility to navigate future unknowns while generating operational efficiency supports this approach. Postmodern ERP aligns with this strategy, making it a compelling choice for finance leaders seeking to future-proof their organizations.

To learn more about leading a finance transformation project, check out Aqilla’s most recent white paper:

As a reminder, all GrowCFO community members are able to access a special 20% discount rate with Aqilla.

If you would like to learn more about Aqilla, please reach out to Chris Tredwell, Chief Revenue Officer at Aqilla on chris.tredwell@aqilla.com

Responses