How to Improve Finance Work-Life Balance

What are the most effective suggestions for work-life balance in finance, and how can business time management tips support a healthier career?

If you’re seeking suggestions for work-life balance in a high-pressure finance environment, you’re not alone. Long hours, constant deadlines, and high expectations can make it difficult to disconnect. But achieving balance isn’t just about working less—it’s about working smarter. By combining intentional time management, clear communication, and financial wellness practices, finance professionals can find greater fulfillment both at work and at home.

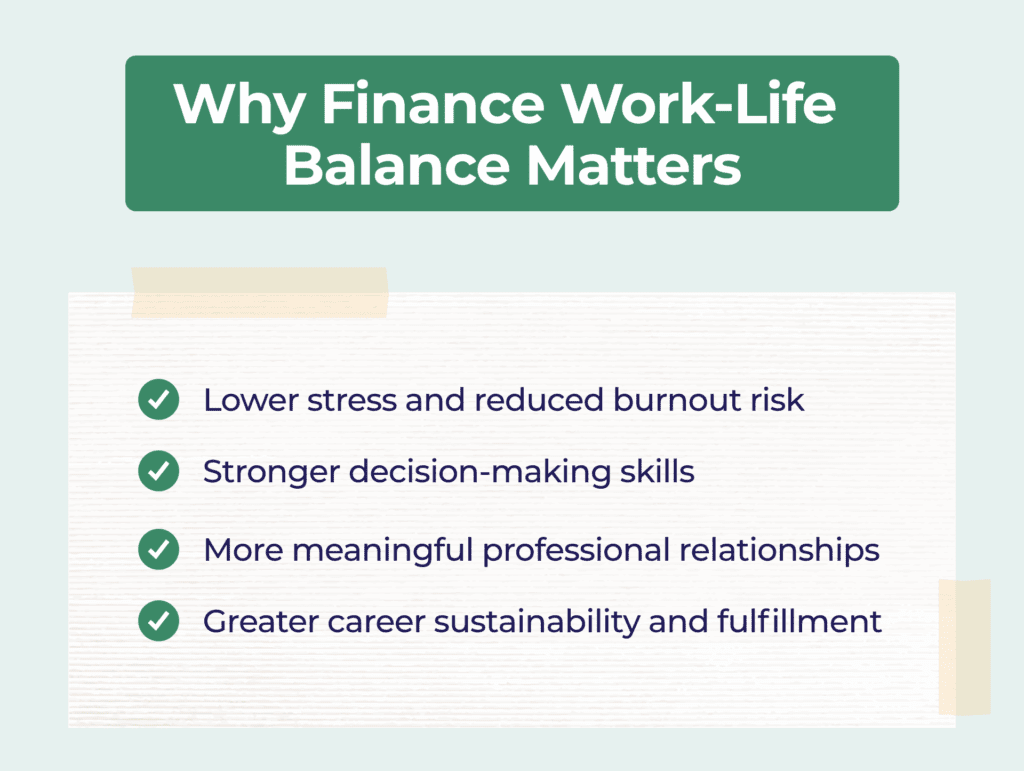

Why Finance Work-Life Balance Matters

According to experts from Smartsheet and LinkedIn, finance professionals who maintain strong boundaries, communicate proactively, and stay in control of their workload are more engaged, more resilient, and more likely to achieve long-term success.

Striking the right balance between financial well-being and personal time supports:

- Lower stress and burnout risk

- Stronger decision-making skills

- More meaningful professional relationships

- Greater career sustainability and fulfillment

Practical Suggestions for Work-Life Balance in Finance

Here are six impactful strategies tailored to the finance profession:

1. Set Clear Boundaries Between Work and Personal Life

Define when your workday begins and ends—and stick to it.

✅ Tip: Turn off email notifications during personal hours to protect your downtime.

2. Use Business Time Management Tips to Prioritize Work

Make use of prioritization frameworks like the Eisenhower Matrix to sort urgent from important.

✅ Example: Group similar tasks to minimize context switching and save mental energy.

3. Practice Effective Communication

Don’t suffer in silence. Speak up about workload, negotiate deadlines, and ask for help when needed.

✅ Why it matters: Clear communication builds trust, prevents burnout, and ensures mutual understanding with your team.

4. Focus on Continuous Learning and Efficiency

Skill development makes you more effective and confident at work.

✅ Tip: Automate repetitive tasks or learn shortcut tools in Excel or Power BI to save time.

5. Align Financial Well-Being With Work-Life Goals

Your career and finances are connected. Smart budgeting reduces money stress and gives you room to take personal time.

✅ Bonus: Many employers now offer financial wellness programs—take advantage of them!

6. Take Advantage of Flexible Work Options

Hybrid work, compressed hours, or remote-first setups can reduce commute time and increase your control over your day.

✅ Ask HR: Are there flexible policies or wellbeing benefits you haven’t tapped into?

Finance Work-Life Balance: Productivity Habits That Actually Work

| Work-Life Challenge | Strategic Shift | Actionable Solution | Why It Works |

| Workdays bleeding into personal time | Establish boundaries like a CFO closes books | Set fixed “end of day” routines—turn off notifications, close your laptop, update tomorrow’s top 3 priorities | Creates a mental and physical signal to disconnect from work mode [Smartsheet] |

| Task overload and decision fatigue | Prioritize by impact, not urgency | Use Eisenhower Matrix or “Must, Should, Could” lists to structure your to-do list | Prevents reaction-based work and enables strategic focus [Bernard Marr] |

| Constant interruptions during deep work | Design “focus blocks” like financial sprints | Block 90-minute windows for uninterrupted work and batch shallow tasks | Enhances concentration and productivity, especially for analysis/reporting tasks [PersonaTalent] |

| Lack of personal time for growth or rest | Make self-care and hobbies non-negotiable appointments | Calendar recurring non-work time: gym, reading, family dinners—treat it like a board meeting | Reinforces the idea that rest is part of peak performance [LinkedIn Advice] |

| Burnout from digital overload | Reduce screen fatigue with analog pauses | Schedule tech-free breaks or walk meetings—especially mid-afternoon | Refreshes mental clarity and reduces cognitive drain [Smartsheet] |

✅ Pro Tip: Track your energy, not just time. High-performance finance leaders manage their focus zones, not just hours on the clock.

The Intersection of Financial Wellness and Work-Life Harmony

Work-life balance isn’t just about hours—it’s also about peace of mind. Managing your money wisely can reduce stress and help you make better career decisions. Likewise, improving your work habits and managing your time creates more space for personal fulfillment.

Together, these practices:

- Boost your confidence and productivity

- Help you navigate tough transitions

- Enable you to show up as your best self—in and out of the office

Final Thought

Strong performance doesn’t require sacrifice. With the right tools, mindset, and support, finance professionals can build rewarding careers without burning out. Apply these business time management tips, implement key suggestions for work life balance, and discover how harmony can be a competitive advantage in your career.

Ready to Take Control of Your Work-Life Balance?

GrowCFO’s mentoring program connects you with experienced CFOs and finance leaders who can help you redefine success—on your own terms. Get tailored support to develop sustainable habits, reduce stress, and thrive in your role.Explore a more balanced approach to leadership — start here.