The Hidden Cost of Fragmented Order-to-Cash: How to Protect Your Revenue

Table of Contents

Introduction

In today’s fast-paced business environment, efficient financial operations are crucial to success. Yet, many organizations lack a cohesive order-to-cash process, leading to significant revenue leakage. According to MGI Research, revenue leakage is responsible for 3-7% of top-line revenue loss for nearly half of all companies.

This article explores the indicators of a fragmented order-to-cash process, the repercussions of disjointed and manual processes, and effective strategies finance leaders can implement to address the issue and protect their organization’s financial well-being.

What is a Fragmented Order-to-Cash Process?

When discussing a fragmented order-to-cash process, we refer to a situation where the critical pieces of technology involved—the CRM, billing system, general ledger (GL), spreadsheets, etc.—are not seamlessly integrated. This fragmentation creates a bottleneck, hindering scalability and efficiency.

Maxio sits between the CRM and GL, offering a customizable billing and financial operations solution that brings together all of these essential technology components to ensure a cohesive order-to-cash process, eliminating bottlenecks and enhancing overall operational efficiency.

Signs Your Order-to-Cash Process is Fragmented

Several indicators suggest a fragmented order-to-cash process:

Heavy Dependence on Excel

Frequent reliance on spreadsheets to reconcile data from multiple sources is a sign of fragmentation. This dependency can lead to errors and inefficiencies.

CFO.com cites that the average FP&A employee reports spending more than half their time gathering data and administering spreadsheet-reliant processes. In these scenarios, this manual effort can slow down financial reporting, making it challenging to provide timely and accurate insights to stakeholders.

Inaccurate Invoices

Manual data entry and disjointed systems often result in inaccurate invoices.

Inaccurate invoices can lead to disputes, delayed payments, and even loss of trust. Correcting these errors often requires significant time and resources, further draining the company’s efficiency and profitability.

Missed Invoices

Even if invoices are accurate, in a fragmented system it’s common for some to fall through the cracks. Ensuring every billable event is invoiced without seamless integration becomes challenging, leading to potential revenue loss.

Missed invoices impact immediate revenue and strain customer relationships. Clients may become frustrated with inconsistent billing practices, which affects customer satisfaction and retention rates.

Long Days Sales Outstanding (DSO)

Fragmentation often leads to delays in invoice generation and payment collection. This delay affects cash flow and financial stability.

Extended DSOs can severely impact a company’s liquidity, limiting its ability to reinvest in growth opportunities. Managing cash flow becomes increasingly complex, affecting operational stability and long-term planning.

Multiple Sources of Truth

Fragmented processes often lead to inconsistent data across systems. When different departments use different data sources, aligning on key metrics like churn and ARR becomes difficult, leading to misinformed decision-making.

This inconsistency can create confusion and inefficiency as teams struggle to reconcile conflicting data. Inaccurate or incomplete information can have far-reaching negative consequences, from impacting strategic decision-making to causing delays in locating the right data. This can undermine the credibility of finance teams in front of key stakeholders.

The Consequences of a Fragmented Order-to-Cash Process

The repercussions of a fragmented order-to-cash process reach far beyond the previously mentioned revenue leakage, impacting an organization’s overall financial health. Other consequences include:

Loss of Investor/Board Confidence

Inaccurate financial reporting undermines stakeholder trust and can jeopardize funding opportunities. When financial statements are riddled with errors or inconsistencies, investors and board members may question management’s competency and the company’s overall stability. This loss of confidence can result in decreased investment, higher borrowing costs, and a more challenging path to securing future funding rounds.

Failed M&A and Valuation Haircuts

Poor financial health and unreliable revenue data can result in unfavorable terms during mergers and acquisitions. Potential buyers or partners rely on accurate financial data to assess a business’s value and health. When this data is compromised, it can lead to reduced valuations, stringent deal terms, or even the collapse of potential deals.

Failed Financial Audits

Discrepancies stemming from a fragmented order-to-cash process are challenging to reconcile and often result in audit findings highlighting material weaknesses or significant deficiencies. These outcomes harm the company’s reputation, potentially leading to regulatory penalties, increased scrutiny, and a loss of market confidence.

Best Practices to Address and Prevent Fragmentation

To mitigate the risks associated with a fragmented order-to-cash process, finance leaders should implement the following best practices:

- Invest in Integrated Technology: Ensure that your CRM, billing system, and GL are fully integrated to provide a single source of truth. An integrated financial operations platform like Maxio eliminates the need for manual data transfers and reduces the risk of errors. It also provides a comprehensive view of financial data, enabling better decision-making and improved accuracy in reporting.

- Automate Processes: According to Accenture, an impressive 80% of financial operations can be automated. By automating operations like invoicing and revenue recognition, companies can drastically enhance efficiency by accelerating these processes while ensuring consistency and accuracy. Furthermore, ScienceSoft highlights that automation can boost finance team productivity by up to five times and cut data processing costs by up to 90%.

- Regular Audits and Reconciliation: Conduct regular audits and reconciliations of financial data to identify and address discrepancies early. Regular audits help detect anomalies and discrepancies that could indicate larger issues. Implementing a routine reconciliation process ensures that all financial data is aligned and accurate, providing a solid foundation for financial reporting.

- Training and Development: Continuously train your finance team on best practices and the latest technology to keep them adept and proactive. Ongoing training programs ensure that your team is up-to-date with the latest tools and techniques, enabling them to handle complex financial processes efficiently.

By implementing these best practices, organizations can create a cohesive and efficient order-to-cash process.

Why Maxio Stands Out to Help

Solutions like those offered by Maxio deliver the comprehensive experience necessary to achieve this integration and automation. Leveraging Maxio, finance leaders can streamline operations, significantly reduce errors, and improve overall accuracy and efficiency, ensuring the financial health and growth of their organizations.

A fragmented order-to-cash process is a hidden threat to the financial health of many SaaS organizations. Finance leaders can protect their revenue and drive sustainable growth by understanding the signs, consequences, and best practices to address this issue.

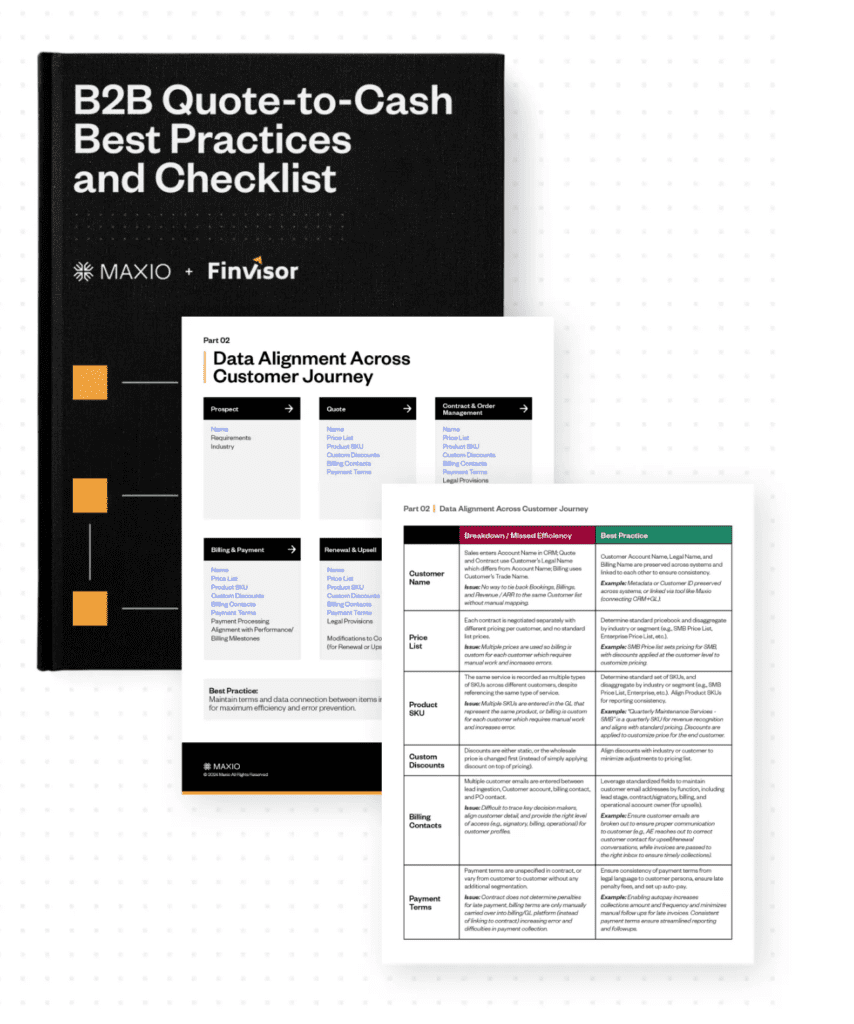

Access actionable steps to enhance your financial operations and safeguard your revenue with Maxio’s Quote-to-Cash Best Practices and Checklist. Download it today.

Responses