Importance of CRM Data for Finance Teams

2023 has been a year of momental change, particularly with the launch of AI. More than ever, business success hinges on making informed decisions and adapting quickly to changing market dynamics, and the CFO has a pivotal role by bringing financial acumen and data-driven insights to the executive table.

This article explores how finance teams can directly contribute to commercial success, and highlights the importance of CRM data, and provides a few simple ways to get started.

Data, Data, Data…

Harnessing the power of data is vital for achieving rapid growth. McKinsey estimates that B2B SMEs that capture and understand data driven insights create above market growth rates, by a whopping 22% on average.

Growing 22% faster than the market average is material, even transformative. To move in this direction, it is critical to identify insights across historical data, present insights and future projections.

Data Sources: Past, Present & Future

Historical financial data is important, but the best finance teams and CFOs take a more holistic view of their businesses. They are able to accurately report the past, drive growth in the present, and even predict the future.

Historical data: Historical data is readily accessible, and accounting systems like Xero or QuickBooks accurately capture this information, but to form a full picture, it is critical to track key business metrics.

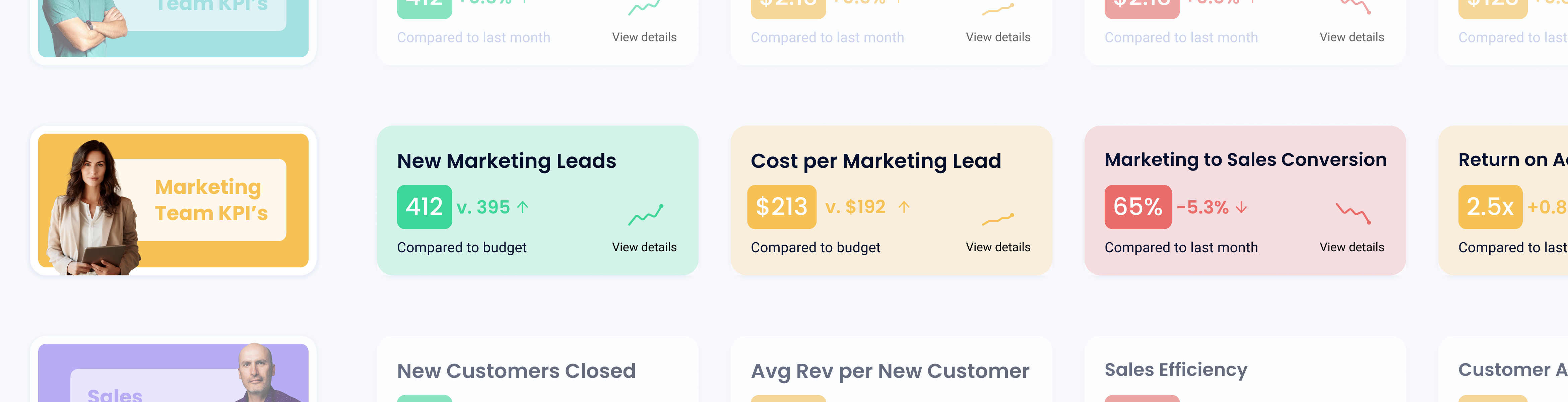

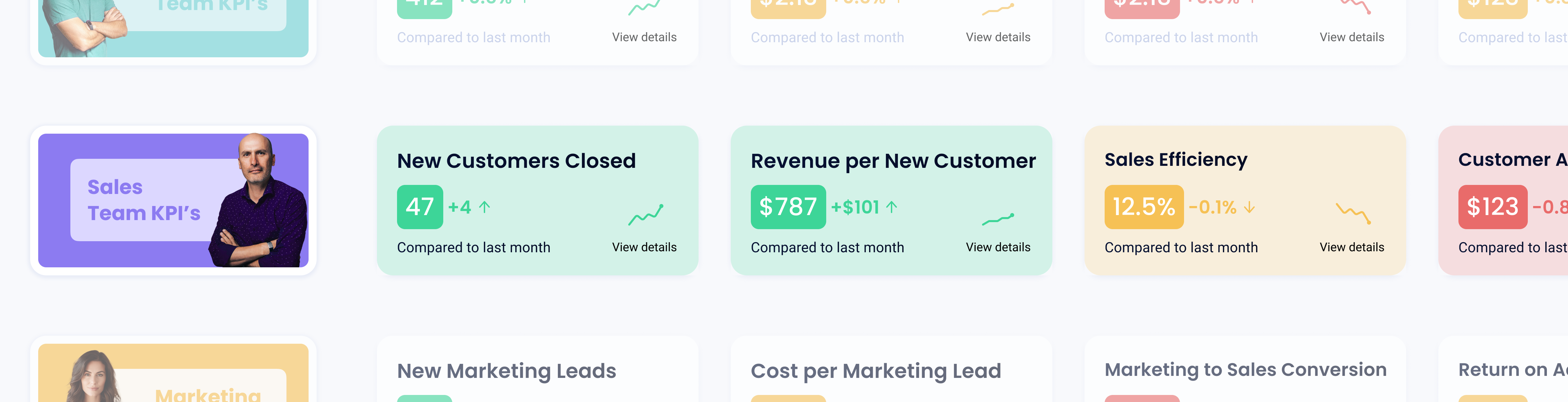

We have found that 3 to 5 KPIs per department is ideal, and no more than 15 for the whole company. In combination, these should reveal business performance. Examples are provided in Image 1 for the Sales, Marketing and Customer Success teams. Even if these teams are not fully formed, someone will be responsible for these aspects of the business so we would advocate that tracking them is important for all businesses.

The data in Image 1 is compiled from 2 sources: the accounting system (say Xero or QuickBooks) and the CRM platform (Hubspot, Salesforce and Pipedrive). The financial data is the source of truth, and the CRM data is carefully overlaid on top of it.

The Present: Understanding current performance requires tracking actual results against a measure of expectations. This can be a budget, forecast, or even just a target. Each month, current performance should be compared with both historical performance and targets.

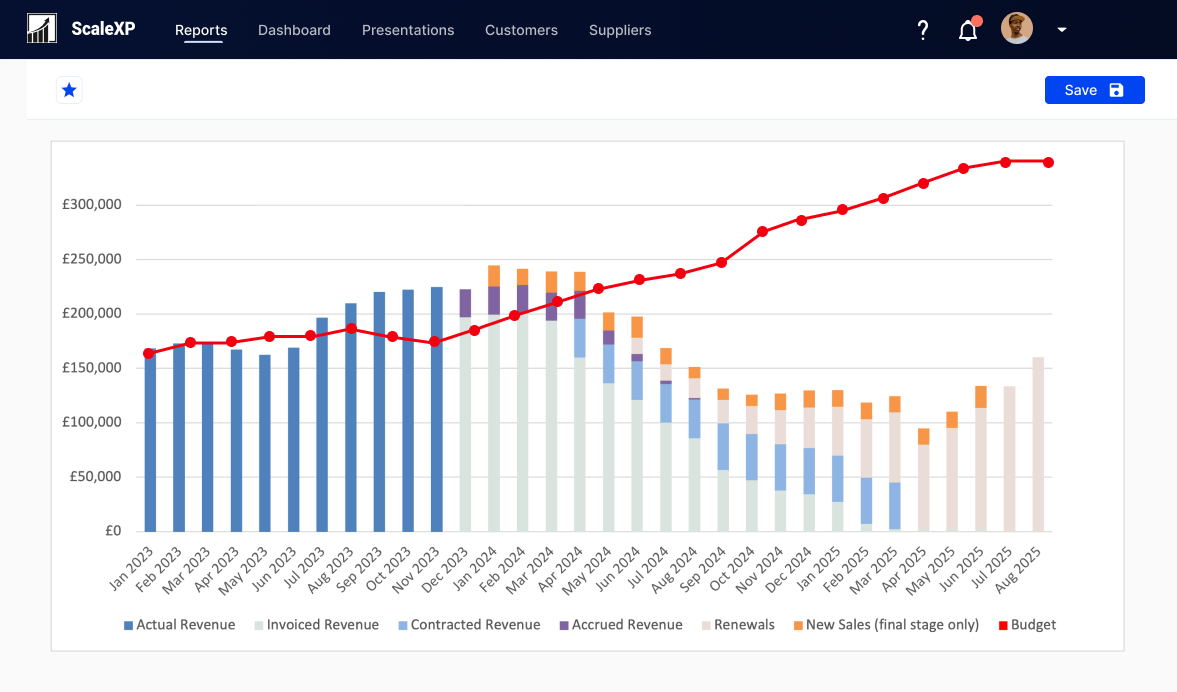

Image 2 provides an example. This data is also derived (only) from the accounting and CRM data. With the right processes in place, this type of summary can be provided monthly, automatically as soon as the month is closed.

Many companies have dirty or incomplete CRM data. The metrics in Image 1 and 2 are selected to use only data which is consistently clean, specifically Deals Closed Won. Other parts of the sales funnel and the CRM data is not included in metrics as it is less likely to be clean.

And The Future: Future data is all about identifying and understanding trends early. Is your sales team on track to make their targets? What is the gap to the sales forecast next month and in 3 months?

The simplest way to understand future performance is to add a couple of metrics to the list above. New sales is the most important. The ideal outcome is automated monthly tracking several months into the future against a forecast or budget. Our favourite view is shown in image 3. The image below is small but it shows a forecast 18 months into the future, integrating all accounting and CRM data. Image 3 can be automated from accounting and CRM data.

Importance of CRM Data

The metrics above show that just two data sources (accounting + CRM) can transform a finance team’s ability to provide robust and meaningful insights. By consistently providing this information, CFOs establish themselves as crucial strategic members of the executive team, providing analysis on performance, highlighting gaps and opportunities.

How CFOs Can Start Using CRM Data

As a CFO, you may be less familiar with the data in the CRM platform and how it can be used. If you are interested in learning more, here are a couple of ways to get started:

- Hubspot has a great series of free videos in its ‘HubSpot Academy’. They aren’t designed specifically for finance teams but provide a useful overview of the functionality and data in the CRM platform. It is worth looking through the titles and watching 1 or 2 that catch your interest.

- The ScaleXP platform integrates accounting and CRM data for finance teams. It is affordably priced at £250 – £400 per month (compared to other marketplace offerings, which typically end up costing around £4k per month or £40k per annum).

- ScaleXP also provides free monthly training sessions for finance teams on how to use CRM data. Each session is ‘Lunch and Learn’ with a clear topic. The new course will be in January. To register, click here.

If you would like to learn more about ScaleXP or request a demo, click here.

Responses