What Is a Professional Finance Mentor?

What does a professional finance mentor do, and why are they important?

A finance mentor is an experienced finance professional who supports and guides someone with less experience in the sector. The goal of a finance mentor is to help the mentee grow their technical skills, leadership abilities, and career trajectory. In today’s competitive finance landscape, working with a professional finance mentor can accelerate development and unlock long-term strategic value.

What does a finance mentor do?

A finance mentor offers structured support to help another professional grow in their finance career. This can include offering strategic advice, industry knowledge, feedback on decisions, and insights from their own experience. The finance mentor relationship typically happens between a more senior individual—often with CFO or FD-level expertise—and a less experienced mentee who may be navigating early leadership, career transitions, or high-stakes decision-making.

In practice, this might look like monthly 1:1 meetings, regular check-ins, or a more informal advisory relationship. Finance mentors are not managers or therapists—they are sounding boards, strategic guides, and trusted allies in professional development.

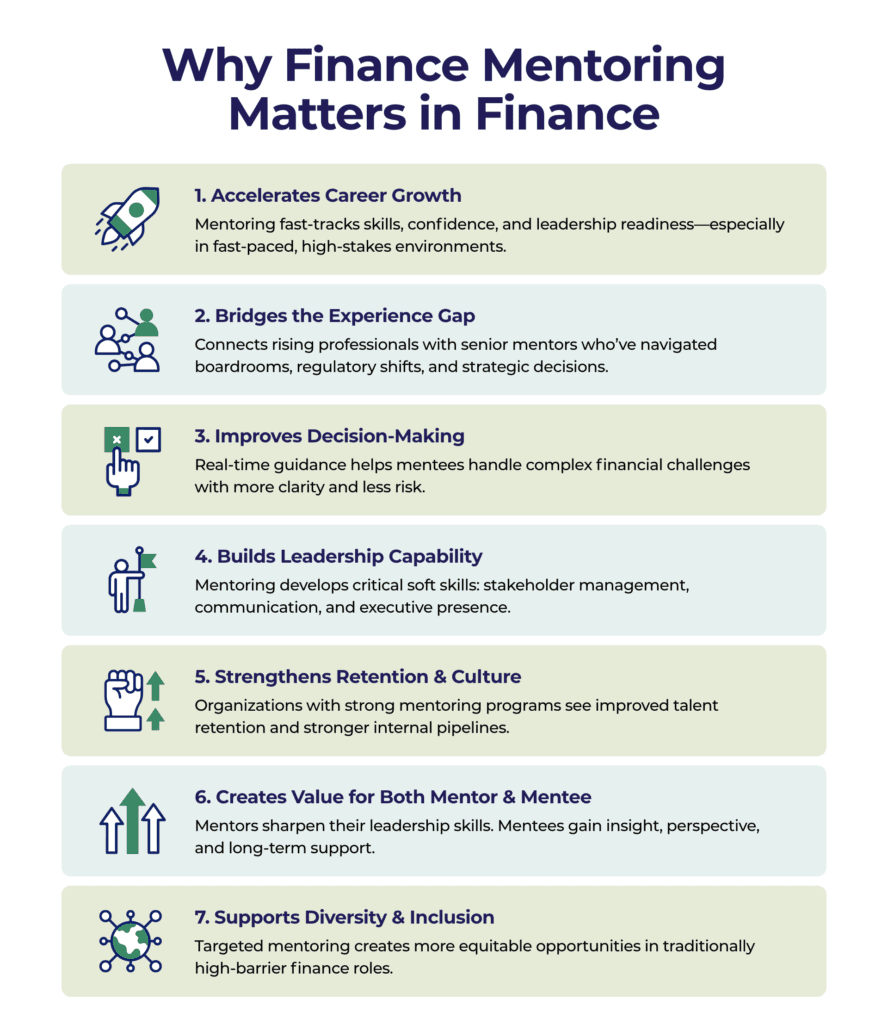

Why is finance mentoring important in the finance sector?

Mentoring has become increasingly vital in the finance world, where change, regulation, and high performance are constant. According to leading mentoring platforms, mentoring in finance involves a professional relationship designed to help the mentee develop key skills, industry knowledge, and career confidence. Finance mentor relationships offer benefits at both the individual and organizational level.

Mentees gain insight, improve decision-making, and build confidence. Mentors benefit from developing leadership and giving back to the industry. Organizations benefit from better retention, stronger leadership pipelines, and more informed decision-makers. In fast-paced financial environments, structured mentoring can be the difference between linear growth and exponential development.

What are the key traits of a successful finance mentor?

A great finance mentor doesn’t just know the numbers—they know the people, the politics, and the pressure of the role. Key traits include:

- Deep sector expertise in finance or accounting

- Experience navigating complex decisions and stakeholder dynamics

- Ability to listen, challenge constructively, and build trust

- Strategic mindset with strong communication skills

- Commitment to the mentee’s success over the long term

How is a finance mentor different from a coach or manager?

While coaching, management, and mentoring all support professional development, they serve different purposes. A manager focuses on performance within a specific role. A coach may work short-term on skills or behaviors.

A finance mentor, on the other hand, brings lived experience and long-term insight, helping mentees navigate career moves, board relationships, leadership dilemmas, and strategic growth. Coaching is often skills-based. Mentoring is wisdom-based.

What are the benefits of working with a finance mentor?

The benefits of finance mentoring extend far beyond career progression. Here’s what mentees often gain:

- Improved decision-making under pressure

- Guidance through complex career transitions

- Strategic insight not found in textbooks or training

- Broader perspective on financial leadership challenges

- Access to a trusted advisor who understands the stakes

- Increased confidence in board-level conversations

- Support in shaping long-term goals and executing them

Many professionals also report faster promotions, greater role clarity, and better relationships with senior stakeholders after structured mentoring.

Who needs a finance mentor?

You don’t need to be struggling to benefit from a finance mentor. In fact, many high-potential finance professionals seek mentoring at moments of growth, not crisis. This includes:

- New finance leaders stepping into FD or CFO roles

- Mid-career professionals aiming for the C-suite

- Senior managers preparing for strategic transformation

- Individuals navigating fast-scaling environments or board dynamics

If you’re facing high-impact decisions or increased responsibility, a finance mentor can help you move with more confidence and less guesswork.

What should you look for in a finance mentoring program?

Not all mentoring is equal. A high-quality finance mentor program should offer:

- Clear structure and cadence (e.g. monthly or biweekly sessions)

- Senior mentors with proven finance leadership experience

- Customization to your role, challenges, and goals

- Confidentiality and trust at its core

- Practical frameworks and strategic insight

Generic mentoring programs often fail to deliver at the executive level. If you’re preparing for a CFO role or already in senior leadership, you need mentorship that matches the complexity of your position.

Where can you find the right finance mentor?

At GrowCFO, our mentoring program is designed specifically for senior finance professionals. Each mentoring relationship is led by a former CFO or strategic finance leader. Our six-month package includes 6 x 90-minute sessions or 9 x 60-minute sessions, tailored to your needs. Topics may include stakeholder engagement, strategy development, board communication, and personal leadership growth. You’ll walk away with more than advice—you’ll gain clarity, confidence, and a strategic roadmap for your next chapter.

Learn more or apply here: GrowCFO Mentoring Program

Responses