What Are the Most In-Demand Skills for Finance Professionals?

Which finance skills are most needed in today’s evolving business environment?

The most in-demand skills for finance professionals in 2025 go beyond number-crunching. While technical capabilities like financial analysis and forecasting remain vital, employers also seek resilience, digital fluency, and strategic thinking. As the industry evolves, building the right mix of soft and technical finance skills in demand is essential for long-term career growth.

Why Are Finance Skills Evolving?

The finance profession is transforming rapidly due to digitization, automation, regulatory complexity, and increasing strategic involvement. Today’s finance professionals must do more than manage numbers—they must interpret, communicate, and influence decisions.

According to Forbes and ACARP, organizations now prioritize finance talent who can adapt to change, understand digital tools, and contribute to risk management and business strategy. In short, the finance skills needed today are broader and more dynamic than ever before.

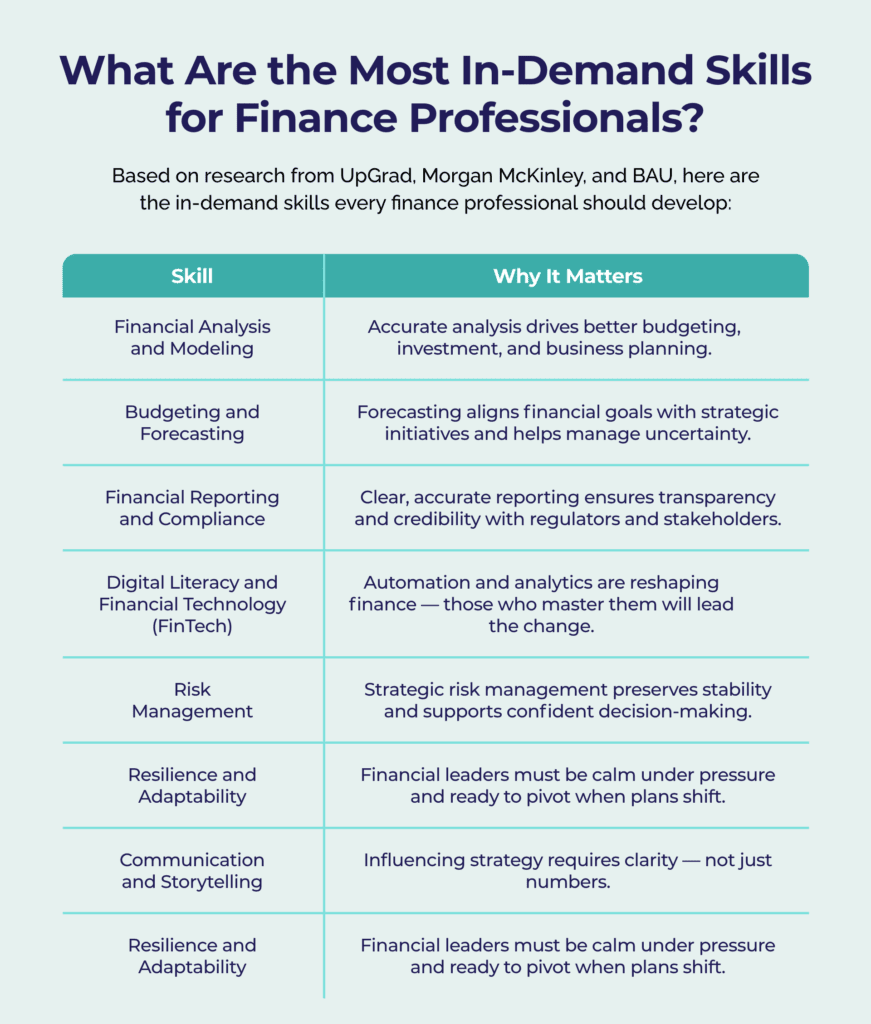

What Are the Most In-Demand Skills for Finance Professionals?

Based on research from UpGrad, Morgan McKinley, and BAU, here are the in-demand skills every finance professional should develop:

1. Financial Analysis and Modeling

Understanding and interpreting data to evaluate performance, identify trends, and inform decisions remains a foundational skill.

✅ Why it matters: Accurate analysis drives better budgeting, investment, and business planning.

2. Budgeting and Forecasting

Being able to project financial outcomes and build realistic financial plans is core to effective finance functions.

✅ Why it matters: Forecasting aligns financial goals with strategic initiatives and helps manage uncertainty.

3. Financial Reporting and Compliance

Knowledge of standards like IFRS, GAAP, and Basel III is crucial for staying compliant and building trust.

✅ Why it matters: Clear, accurate reporting ensures transparency and credibility with regulators and stakeholders.

4. Digital Literacy and Financial Technology (FinTech)

Fluency with ERP systems, RPA, AI, and data visualization tools like Power BI is increasingly vital.

✅ Why it matters: Automation and analytics are reshaping finance—those who master them will lead the change.

5. Risk Management

Identifying financial risks and putting mitigation strategies in place is essential in volatile markets.

✅ Why it matters: Strategic risk management preserves stability and supports confident decision-making.

6. Resilience and Adaptability

As highlighted by Reed and Forbes, resilience is among the most in-demand soft skills. In fast-paced finance roles, bouncing back from setbacks and thriving in uncertainty sets professionals apart.

✅ Why it matters: Financial leaders must be calm under pressure and ready to pivot when plans shift.

7. Communication and Storytelling

The ability to translate complex data into actionable insights for non-financial stakeholders is a must.

✅ Why it matters: Influencing strategy requires clarity—not just numbers.

8. Strategic Thinking and Commercial Awareness

Finance professionals who understand the bigger picture help shape business direction—not just track it.

✅ Why it matters: CFOs and finance teams are now expected to act as strategic partners.

Which Finance Skills Are Rising in 2025?

Emerging trends point to a growing need for these niche, future-facing finance skills in demand:

| Skill | Trend Driving Demand |

| ESG Reporting & Sustainability | Investor expectations and new regulations |

| Data Analytics & Visualization | Rise in AI-driven finance and digital transformation |

| Change Management | Organizational agility during transformation |

| Cybersecurity Risk Awareness | Rising threats to financial systems and data |

| Stakeholder Engagement | Boardroom communication and external reporting transparency |

How Can Finance Professionals Stay Competitive?

To stay ahead, professionals should:

- Upskill continuously with courses in forecasting, fintech, and leadership

- Build soft skills like resilience, influence, and emotional intelligence

- Get exposure to cross-functional projects, board reporting, and transformation initiatives

- Leverage networks like GrowCFO to stay connected and informed

Final Thought

The future of finance demands more than technical precision—it calls for strategic insight, digital agility, and human-centered leadership. By developing the most in-demand skills, finance professionals can lead with confidence, adapt with resilience, and unlock real impact in their roles.

Want to Build the Most In-Demand Finance Skills?

Explore the GrowCFO Premium platform—packed with on-demand courses, skills assessments, and leadership training designed for finance professionals who want to thrive in a fast-changing world. Start your growth journey here.

Responses