How to Be More Effective as a CFO in the Boardroom

What strategies can CFOs use to enhance their impact and influence in board meetings?

To be effective in the boardroom, the CFO role must evolve from financial reporter to strategic advisor. This means mastering communication, aligning insights with business priorities, and contributing meaningfully to governance and growth conversations. By understanding their finance role within broader board member roles, CFOs can shape decisions, influence outcomes, and build credibility with senior stakeholders.

Why Is the CFO Role So Critical in the Boardroom?

The boardroom is where strategic decisions are made—and the CFO holds the keys to the data, insights, and economic logic that underpin those decisions. But simply showing up with spreadsheets is no longer enough. Today’s CFO role requires presence, clarity, and strategic contribution.

As noted by leadership coach Alena Bennett, the most effective CFOs don’t just present numbers—they tell a compelling story. They communicate the “why” behind the figures and help the board navigate decisions with confidence.

When CFOs elevate their boardroom performance, they also elevate the overall effectiveness of the board.

How Can CFOs Deliver Maximum Impact in Board Meetings?

Here are three critical areas CFOs should master to excel in the boardroom, inspired by Bennett’s State, Script, Sequence framework and best practices from Tropic and HFTP:

1. State: Own the Room with the Right Mindset

Before the meeting even begins, the CFO must ground themselves in intention. Visualizing the meeting’s flow, anticipating questions, and focusing on calm, confident energy helps set the tone.

✅ Tip: Remind yourself—you’re the expert. Enter with authority, not anxiety.

2. Script: Communicate Clearly and Strategically

Avoid overwhelming the board with data. Instead, deliver a concise narrative that answers:

- What happened?

- Why does it matter?

- What should we do next?

This ensures your finance role supports board member roles in decision-making rather than distracting from them.

✅ Tip: Link each financial insight to a business outcome or strategic decision.

3. Sequence: Present with Logical Flow

Organize your message in a way that builds trust and momentum. Start with key wins or risks, follow with supporting data, and close with action-oriented recommendations.

✅ Tip: Use visuals like “Top 5 Spend Movements” or forecast dashboards to highlight trends without drowning in detail.

Practical Tactics to Strengthen Your Boardroom Contributions

CFOs can level up their boardroom effectiveness using the following strategies:

| Tactic | Why It Works |

| Targeted Variance Analysis | Focus on the “why” behind changes—not just the “what.” Identify specific suppliers or categories impacting costs. |

| Quantify Savings and Opportunities | Prove your value with concrete numbers. E.g. “$450K in savings this quarter, with $1.2M in pipeline opportunities.” |

| Forecast Future Obligations | Highlight upcoming commitments and renewals to avoid budget surprises and support resource planning. |

| Map Investments to Strategy | Show how financial decisions support strategic goals—answering the question, “Are we putting money where our priorities are?” |

| Strengthen Governance Reporting | Create a control scorecard that reflects financial discipline and builds board confidence. |

| Leverage Benchmarking Data | Compare vendor performance or costs against peers to support negotiation and budget justification. |

What Are the Dos and Don’ts for CFOs in the Boardroom?

Mastering board dynamics means knowing both what to do—and what to avoid.

✅ Dos:

- Communicate clearly and avoid jargon

- Be transparent about financial health, risks, and trade-offs

- Come prepared with data, context, and recommendations

- Stay strategic, focusing on key issues and outcomes

- Engage actively in discussions without dominating them

❌ Don’ts:

- Don’t overcomplicate presentations

- Don’t react defensively—be proactive and forward-thinking

- Don’t monopolize the conversation

- Don’t let bias cloud objectivity

- Don’t neglect soft skills—relationships matter just as much as reports

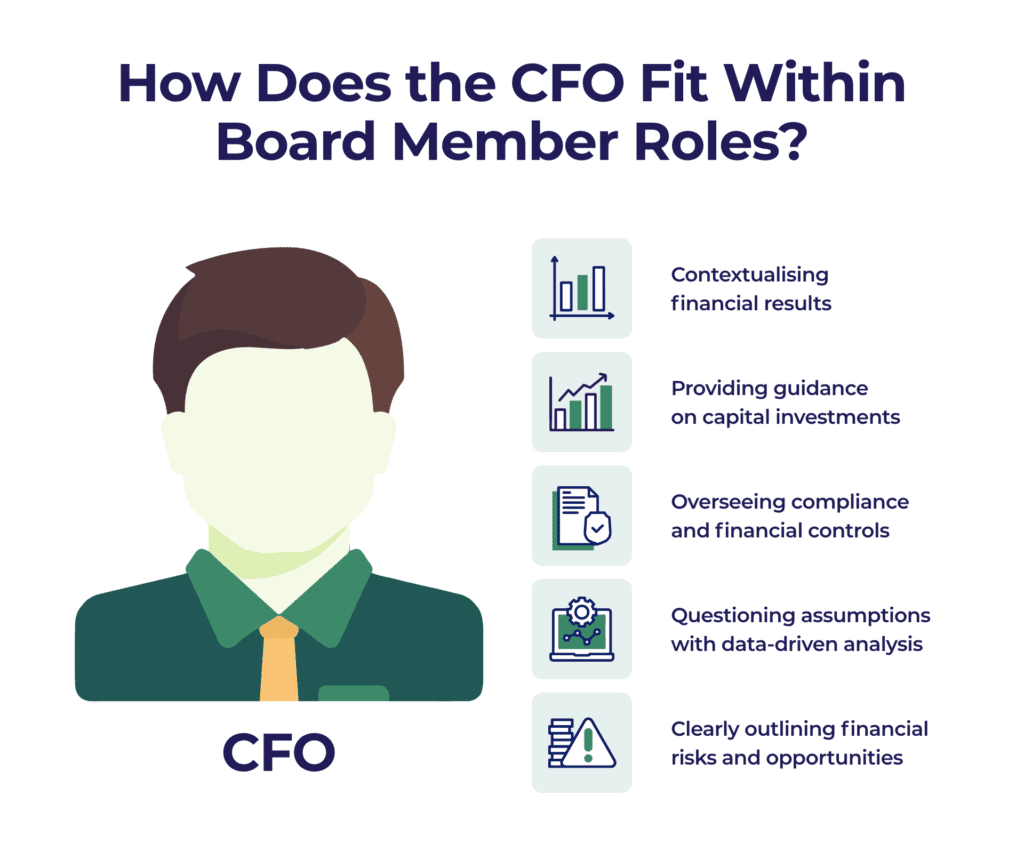

How Does the CFO Fit Within Board Member Roles?

Among all board member roles, the CFO is uniquely positioned to bridge operations with strategy. They act as the voice of financial truth and help ensure that decisions are grounded in economic logic.

The CFO’s role includes:

- Interpreting financial performance in context

- Advising on capital allocation and investments

- Ensuring regulatory compliance and fiscal governance

- Challenging assumptions with data-driven insights

- Representing financial risk and reward scenarios clearly

Done right, the finance role isn’t just informative—it’s transformative.

Ready to Strengthen Your CFO Role at the Board Level?

GrowCFO’s CFO Program includes focused content and mentoring to help you thrive in the boardroom. Learn how to lead strategic conversations, build boardroom presence, and influence at the highest level.

Final Thought

Being effective in the boardroom isn’t just about financial accuracy—it’s about strategic influence. By elevating your mindset, message, and presence, you can redefine the CFO role and shape the future of your organization as a trusted, impactful board member.

Secure your seat at our next Preview Event.