Short-Term Cash, Long-Term Value: How Finance Leaders Get Both

💥 68 % of CFOs say balancing short-term earnings with long-term value creation is their toughest challenge.*

Yet the quickest lever to ease that tension often hides in plain sight: the cash trapped inside Accounts Receivable (AR).

Source: GrowCFO Q2 Tech Innovation Report

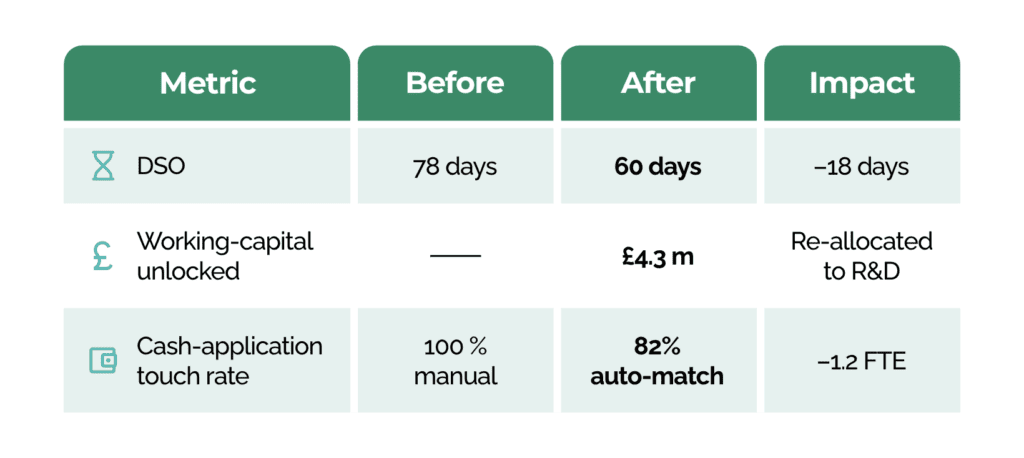

🚀 Mini Case Study – Atlas Machinery

Last year, UK heavy-equipment maker Atlas Machinery faced the same squeeze most mid-market CFOs feel: slowing demand, rising rates, and board pressure to fund R&D. Rather than tap new debt, the finance team deployed an AI-driven AR platform that automated dunning, predicted late payers, and matched bank receipts automatically.

Results after nine months:

“Freeing £4 million without new capital raised the team’s credibility overnight,” says CFO Julie Hughes. “It let us fund innovation and hit earnings guidance.”

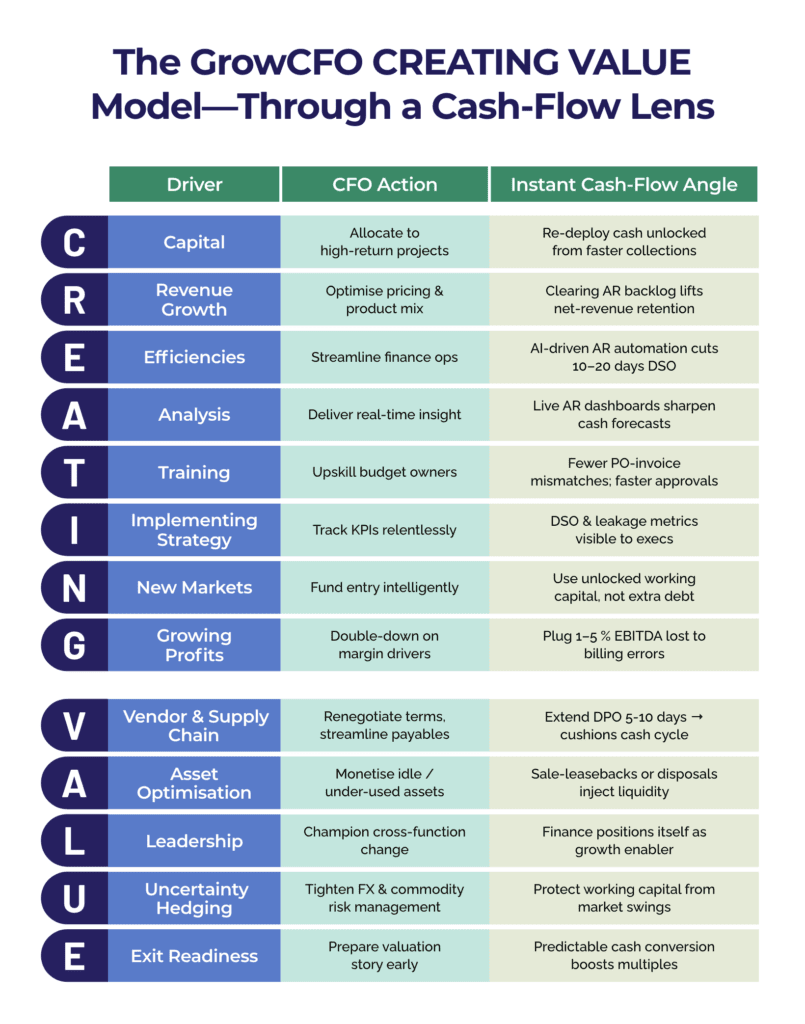

🔍 Quick-Win Spotlight: AR Automation

What the data shows

- 55 % of B2B invoices are paid late*

- 1–5 % of EBITDA quietly leaks via billing errors*

- 80 %+ of cash-application tasks can be auto-matched*

- 10–20 days DSO reduction is realistic in year one*

Interpretation: A medium-sized £100 m-revenue company reclaiming 15 DSO days can free £4-5 m in working capital—enough to self-fund a major product initiative without new financing.

🗓️ Your 30-Day AR Tune-Up Checklist

Week 1 – Map the Money Trail

- Segment customers by payment behaviour.

- Quantify cost of each extra DSO day (working-capital model).

Week 2 – Fix the Low-Hanging Fruit

3. Issue all invoices electronically within 48 hours of delivery.

4. Pre-empt disputes with a shared portal for POs, PODs and credits.

Week 3 – Automate & Prioritise

5. Deploy predictive dunning rules—escalate only the riskiest accounts.

6. Auto-match at least 70 % of bank receipts; re-route exceptions.

Week 4 – Instrument & Iterate

7. Surface live DSO, ageing, and leakage metrics on a CFO dashboard.

8. Review with Sales & Ops; lock in new SOPs before quarter-close.

Steps 3 & 4 are exactly what you’ll see live at Wednesday’s Tech Showcase—details below.

❓ “Ask Dan” Q&A

Q: When economic uncertainty is high, how do you justify new tech spend on AR automation?

A: Frame it as a working-capital swap, not a cost item. If the project frees £X in 12 months and costs 15 % of £X, your ROI story writes itself. It also shifts the board discussion from cap-ex approval to cash-conversion risk. Want to see the math and tools that make this real? Join the Showcase on 25 June.

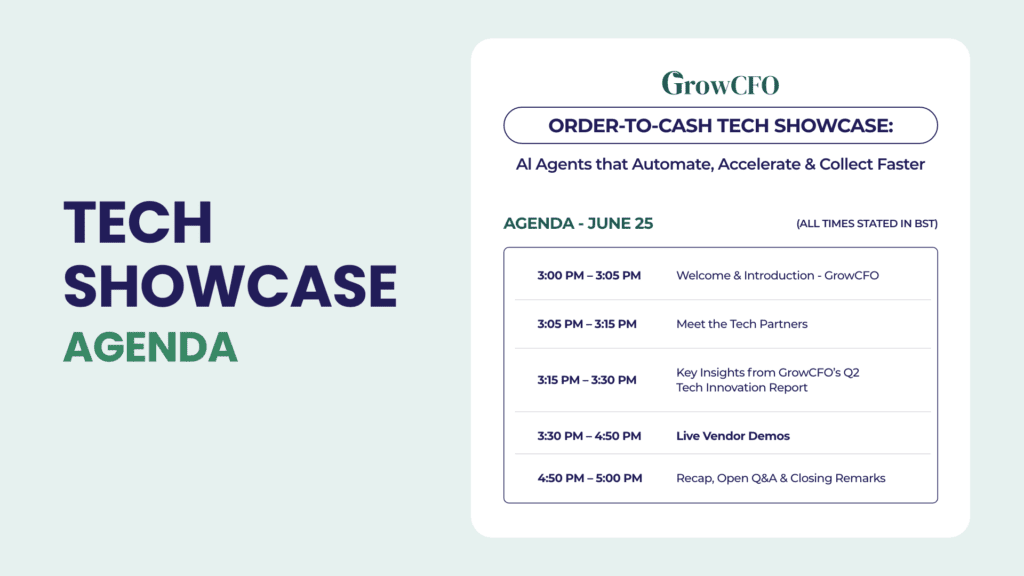

⏰ Tech Showcase Micro-Agenda (25 June, 15:00–17:30 BST)

Unlock trapped cash. Fund long-term growth.

Reserve your spot at the AR & Spend-Management Tech Showcase → http://tech.growcfo.net/?utm_source=LinkedIn&utm_medium=Dan%20Newsletter&utm_campaign=23rd%20June

Final Thought

Great CFOs don’t pick between today’s cash and tomorrow’s innovation—they unlock the cash that pays for tomorrow’s innovation.

See you on 25 June.

Responses