How to Become a Strategic CFO

What does it take to evolve from a traditional finance leader into a strategic CFO?

To become a strategic CFO, finance leaders must move beyond reporting and compliance to actively influence business direction, profitability, and long-term growth. This involves mastering the strategic economics of the company, aligning finance with corporate strategy, and earning a trusted seat at the leadership table. The journey requires sharp analytical thinking, strong business acumen, and the ability to translate financial insights into actionable strategy.

What Does It Mean to Be a Strategic CFO?

A strategic CFO is more than a numbers expert—they’re a business architect who ensures that strategy choices align with the financial realities and economic drivers of the company. Unlike traditional CFOs focused on historical performance, strategic CFOs ask: “What would have to be true for this strategy to succeed financially?”

According to renowned strategist Roger Martin, the CFO’s unique contribution lies in applying logical rigor to strategy. By understanding the dynamic relationship between revenue, cost, and profit, CFOs can test assumptions and challenge ideas with credibility and clarity.

They ask:

- Will scale reduce costs enough to make this strategy viable?

- Are our pricing structures aligned with projected revenue models?

- Does our product breadth or geographic expansion add or dilute profit?

This financial perspective is not just useful—it’s essential to smart CFO strategy.

What Capabilities Define a Strategic CFO?

To fully transition into a strategic CFO, leaders must build and demonstrate the following key capabilities:

1. Mastery of Strategic Economics

This means understanding how different factors—pricing, scale, product mix, geography—affect both cost structures and revenue generation. Strategic CFOs can model future outcomes and steer the company toward sustainable profitability.

2. Logical and Analytical Rigor

Strategic CFOs challenge strategy with “What Would Have to Be True?” questions, helping leaders uncover blind spots, reduce risk, and make financially sound choices.

3. Business Partnership

Instead of being siloed in finance, strategic CFOs work hand-in-hand with marketing, operations, and product to align decisions with long-term business value.

4. Contextual Awareness

Strategic CFOs recognize that no two companies—or moments—are alike. They adjust their strategy orientation to match the company’s life stage, growth goals, and CEO expectations.

5. Leadership and Influence

Finally, a strategic CFO earns a consistent voice in high-level decision-making, becoming a go-to advisor for shaping and executing strategy.

What Role Does CFO Strategy Play in Business Success?

A company’s strategy is only as strong as its financial foundation. The CFO strategy acts as the connective tissue between vision and execution. This includes:

- Ensuring investments deliver long-term value

- Making capital allocation decisions that support growth

- Mitigating strategic and financial risks

- Driving efficiency while enabling innovation

- Aligning financial plans with enterprise-wide goals

In Deloitte’s view, the most impactful CFOs choose a strategy orientation—whether it’s Operator, Steward, Catalyst, or Strategist—based on their organization’s needs. The most effective CFOs can pivot between these modes, always reinforcing value creation.

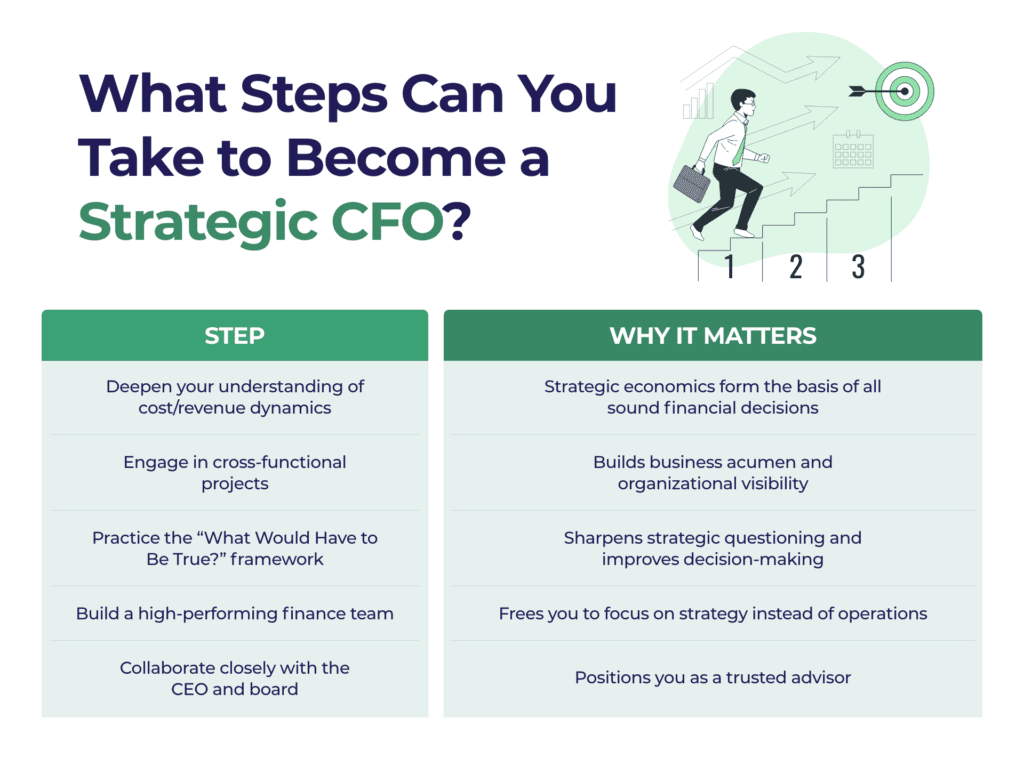

What Steps Can You Take to Become a Strategic CFO?

If you’re aiming to evolve into a more strategic role, consider these actionable steps:

What Are the Biggest Challenges Strategic CFOs Face?

Becoming a strategic CFO isn’t without challenges. Key obstacles include:

- Gaining access and influence in strategy discussions

- Shifting from a transactional to a forward-looking mindset

- Balancing financial discipline with innovation

- Developing communication skills to convey complex financial insights to non-finance stakeholders

Overcoming these challenges requires both intention and structured development.

Final Thought

To become a strategic CFO, you must go beyond financial stewardship and become a driver of business strategy. Master the economics of your company, ask sharper questions, and guide decisions that lead to sustainable growth. The CFO seat isn’t just about overseeing the past—it’s about shaping the future.

Ready to Become a Strategic CFO?

If you’re serious about transitioning into a strategic leadership role, GrowCFO’s CFO Program is built to help you do exactly that. Learn how to apply strategic economics, earn a seat at the strategy table, and lead transformation across your organization.

Join our next Preview Event.