Head of Finance vs CFO — What’s the Difference?

How is the role of Head of Finance different from that of a Chief Financial Officer (CFO)?

The key difference between Head of Finance and CFO lies in focus and seniority. While a Head of Finance manages the day-to-day financial operations and internal reporting, a CFO is responsible for strategic financial planning, investor relations, and shaping long-term business growth. If you’re comparing head of finance vs CFO, think operational execution vs strategic leadership.

What does a CFO do in the Head of Finance vs CFO structure?

A Chief Financial Officer (CFO) is the most senior financial leader in an organization. According to Forbes and EdStellar, CFOs oversee every aspect of a company’s financial health — from reporting and planning to capital structure and strategic investments. They provide financial advice to the CEO and board, manage external stakeholder relationships (e.g. investors and lenders), and drive financial strategy at the highest level.

Key responsibilities include:

- Strategic financial planning and budgeting

- Capital allocation and investment decisions

- Risk management and regulatory compliance

- Mergers, acquisitions, and financing decisions

- Investor relations and board-level reporting

In short, the CFO ensures the company’s financial direction aligns with its overall business objectives — a role that sets them apart in the head of finance vs CFO comparison.

What does a Head of Finance do compared to a CFO?

The Head of Finance (also sometimes called a Finance Director or VP of Finance) is typically more focused on operational finance. They oversee internal processes like budgeting, forecasting, payroll, and financial reporting — often managing the finance team directly.

Their responsibilities may include:

- Leading the day-to-day financial operations

- Ensuring accuracy in monthly and annual reporting

- Managing budgeting cycles and internal controls

- Ensuring tax, audit, and regulatory compliance

- Supporting departmental cost management and efficiency

While this role is vital for internal financial health, it generally does not include strategic external responsibilities like investor relations or capital markets work. In the head of finance vs CFO framework, the Head of Finance is the operational lead — but not the strategic face of finance.

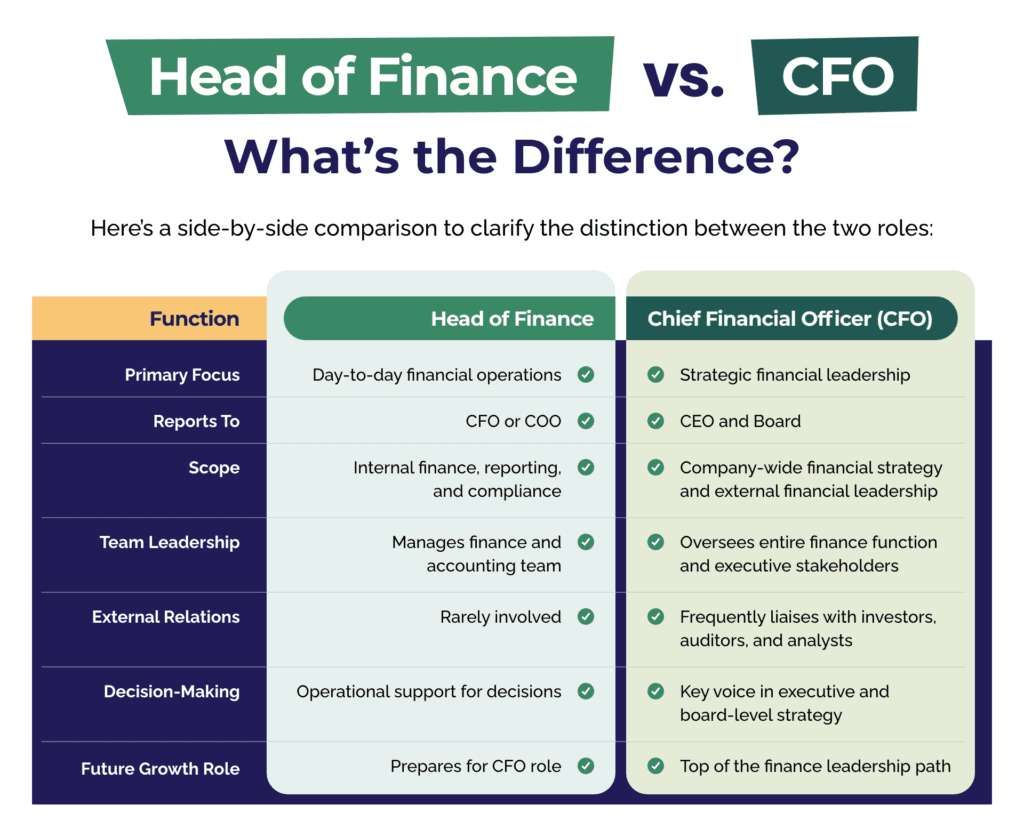

This table illustrates how the head of finance vs CFO distinction plays out in scope, visibility, and long-term career trajectory.

Can the same person perform both Head of Finance and CFO roles?

In smaller businesses, yes — often one person wears both hats. A Head of Finance may take on CFO-level duties, especially in startups or early-stage companies. However, as the company scales, separating these roles brings clear benefits:

- The CFO focuses on growth, fundraising, and long-term positioning

- The Head of Finance ensures internal efficiency, accuracy, and compliance

According to 360 Business Partners, having both roles allows companies to balance strategic foresight with operational excellence — a powerful combination for sustainable success. This is where the head of finance vs CFO structure becomes essential to scale.

Which role should I aim for — Head of Finance or CFO?

If you’re currently in a financial controller or finance manager role, becoming Head of Finance is often the next step. It gives you hands-on leadership experience while expanding your operational scope. From there, your progression to CFO depends on:

- Developing strategic thinking and board-level communication skills

- Building experience in investor relations or M&A

- Demonstrating financial leadership across the wider business

GrowCFO’s Future CFO Program is designed to help senior finance professionals bridge this exact gap — preparing you to evolve from operational leader to strategic CFO.

Why understanding Head of Finance vs CFO matters

Understanding the difference between Head of Finance vs CFO is key whether you’re mapping your career or structuring your finance team. One role ensures operational control and financial discipline. The other sets strategic direction and drives enterprise-wide value creation.

Both are essential — but only one has a seat at the top table.

Want to become a CFO?

Join our Future CFO Preview Event to learn how the GrowCFO Future CFO Program helps ambitious finance professionals step into their first CFO role with confidence. Explore the essential skills, common challenges, and how to position yourself for success at the top.

Reserve your place now.

Responses