How CFOs are Leveraging AI Adoption to Reposition Their Organizations for Growth

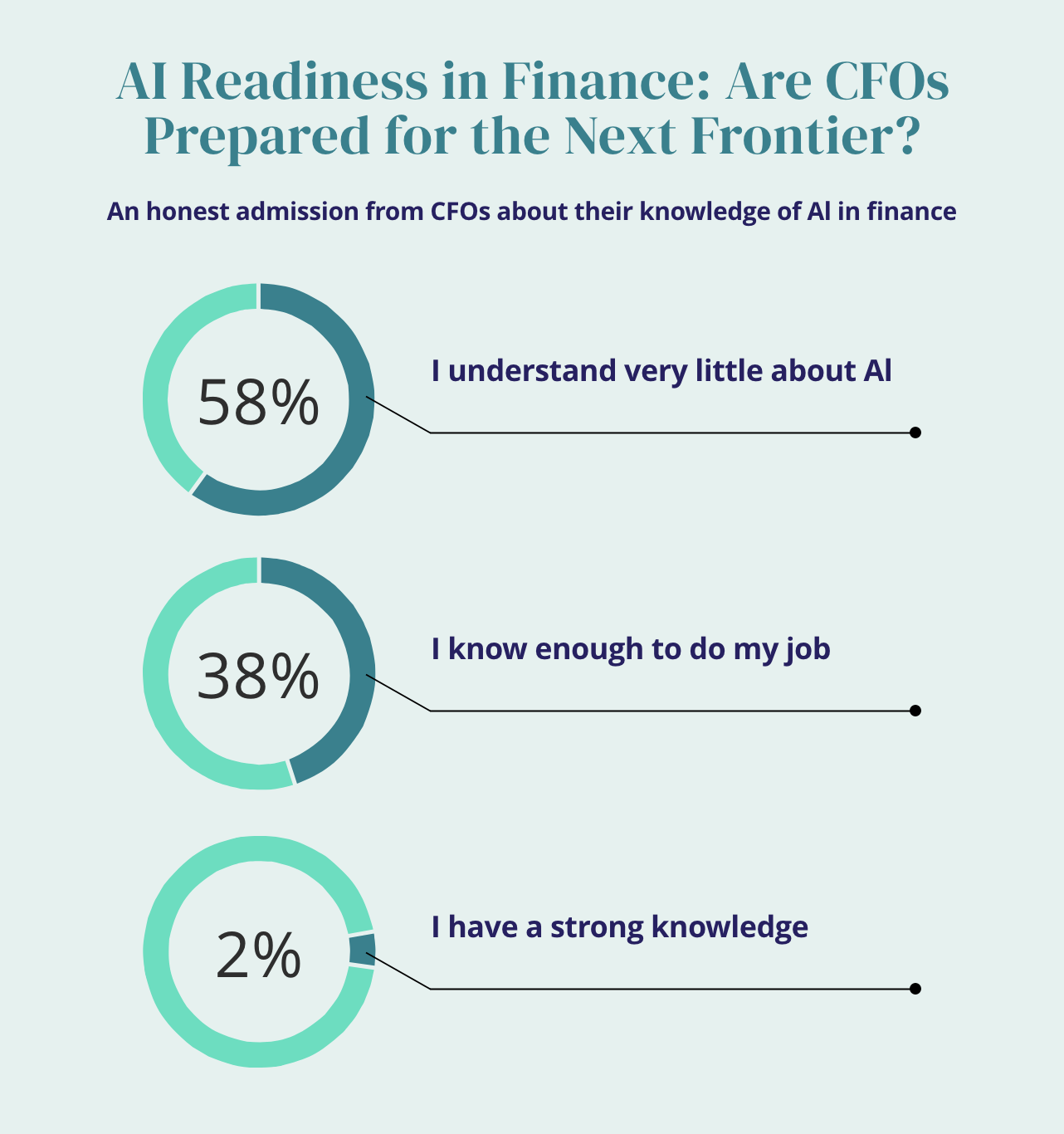

A recent SAP Concur report revealed that 90% of CFOs feel unprepared for the AI revolution, putting their organizations at risk in an increasingly data-driven environment essential for sustainable growth. Although many CFOs are pushing forward with AI deployment, their understanding remains limited—58% of finance leaders admit they know very little about AI in finance.

As the business environment evolves, it is vital for CFOs to view AI not merely as a tool but as a transformative force that can enhance operational efficiency and guide strategic direction. Embracing this shift is crucial for maintaining competitiveness and fostering growth.

Increasing Adoption of AI in Finance

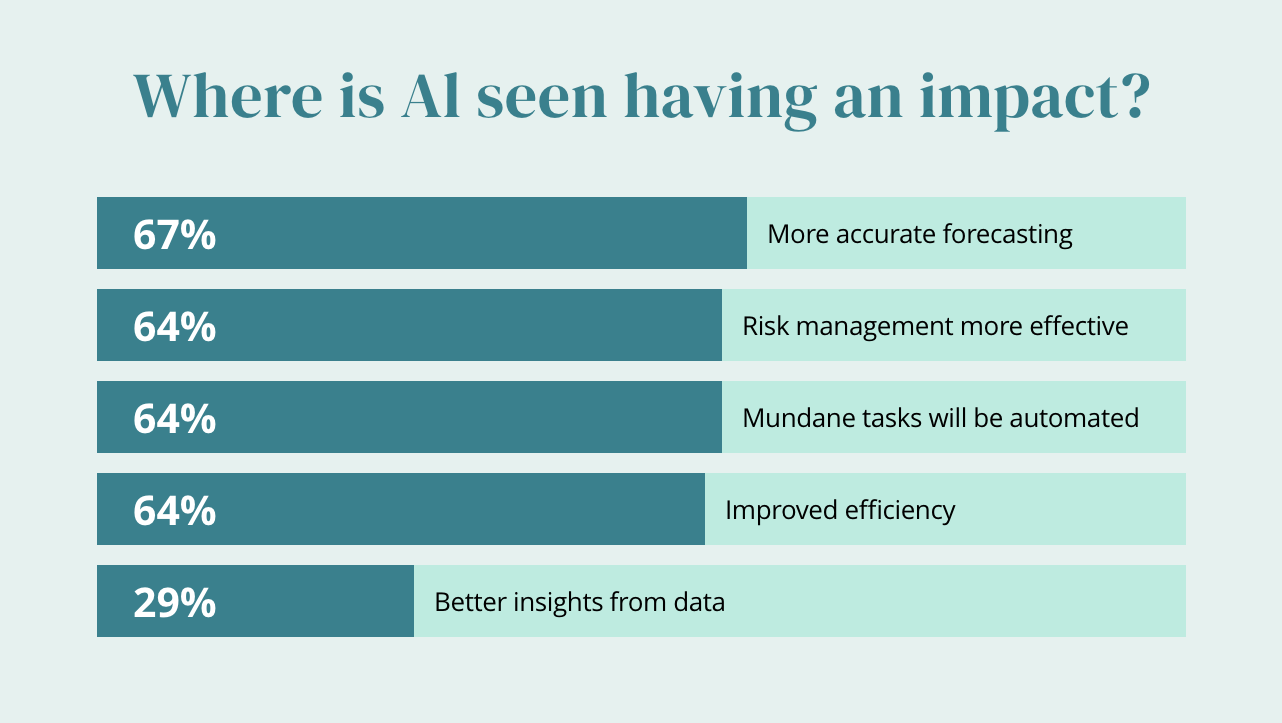

AI adoption in finance is on the rise, particularly in areas like financial planning and forecasting, risk management, and automating routine tasks. While these advancements are already transforming the industry, the next big leap will be AI’s ability to generate actionable insights from data. However, as AI becomes increasingly sophisticated, it could raise questions about the evolving role of CFOs and FP&A teams in an AI-driven future.

With AI’s growing role in finance, it’s clear that these advancements are particularly significant for CFOs aiming to drive organizational growth. By leveraging cutting-edge AI tools, CFOs can unlock several benefits:

- Smarter Decision-Making: AI delivers more accurate forecasting, empowering CFOs to make quicker, more precise strategic decisions.

- Enhanced Operational Efficiency: Automation reduces the time spent on routine tasks, allowing teams to focus on high-value activities that impact growth.

- Stronger Risk Management: Predictive analytics and advanced modeling help CFOs identify potential risks and respond proactively before they escalate.

Integrating AI into financial operations doesn’t just streamline processes—it fundamentally shifts how CFOs shape the future of their organizations. With AI, they can craft financial strategies backed by real-time intelligence, adapt to market changes with agility, and foster resilience in a constantly evolving business environment. Ultimately, adopting AI is more than an investment in technology; it’s an investment in staying competitive and ensuring sustained growth in an era of rapid transformation.

Shift in AI Investment Trends

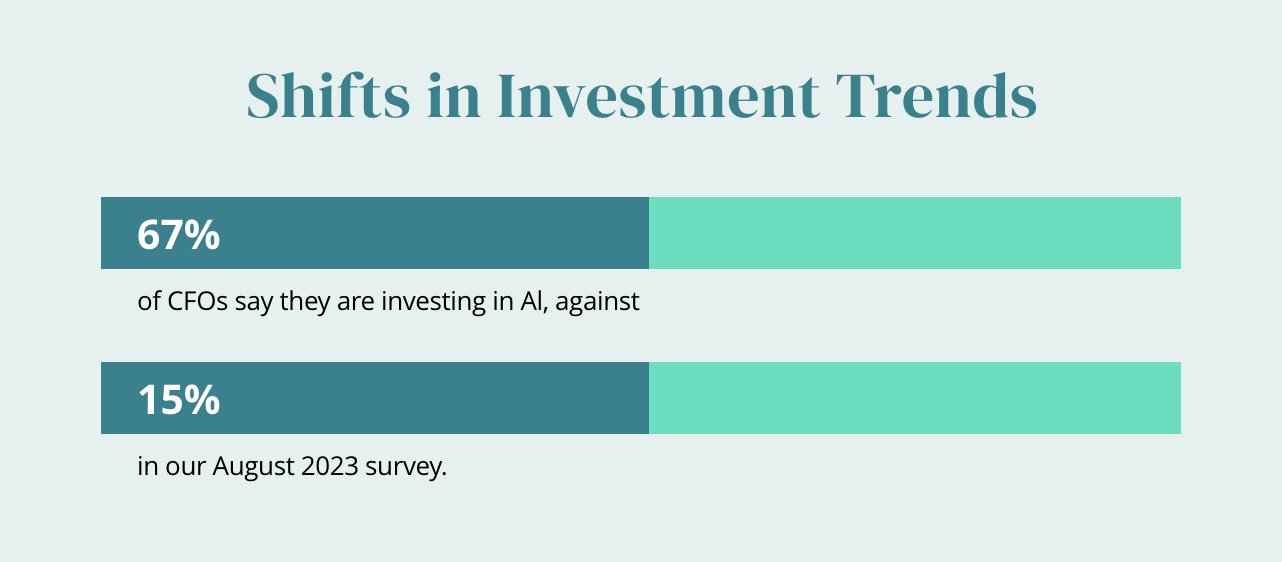

The substantial increase in AI investment among CFOs—from 15% to 67%*—marks a pivotal change in the financial sector.

This growing commitment reflects a proactive approach to harnessing technology for both operational enhancements and strategic advancements. This trend highlights AI’s essential role in evolving financial leadership and steering organizations toward sustainable growth in a rapidly changing environment.

Challenges in Cost Control

Despite the emphasis on growth, many CFOs still identify cost control as a significant challenge, underscoring the need for effective budgeting and resource allocation. This situation emphasizes the importance of leveraging AI to enhance forecasting accuracy and address software limitations that complicate cost management. By adopting advanced AI solutions, CFOs can:

- Refine their budgeting practices

- Gain deeper insights into financial data

- Develop more agile strategies

This balance between growth and efficiency drives CFOs to explore innovative solutions that align resources with organizational goals. To find out more about how cost control can impact growth, download the CFO insights report here.

Prioritizing User Experience

Moreover, CFOs must prioritize user experience in cost control tools, as poor usability can undermine digital transformation efforts. Difficult-to-navigate financial technologies can hinder adoption and diminish the effectiveness of these tools in enhancing operational efficiency. A strong focus on user experience streamlines processes and fosters a culture of innovation, empowering finance teams to embrace digital transformation fully. Ultimately, prioritizing usability is essential for maximizing the value of technology investments and achieving sustainable growth.

Building the Foundation for AI Success in Finance

The webinar, From Data to Decisions: Building the Foundation for AI Success in Finance, featuring Cassie Petrie, Managing Director SMB EMEA, SAP Concur, and Paul Humphris, Head of Payroll, Travel & Expenses, Rolls Royce, offers actionable insights on integrating AI into financial systems. Cassie and Paul highlighted the importance of building a strong foundation for AI adoption by prioritizing data governance and aligning AI initiatives with overarching organizational goals. Their strategic advice is invaluable for CFOs navigating today’s complex financial landscape.

The discussion underscored the urgent need for CFOs to harness AI not just to tackle current challenges but to drive sustainable, long-term success. With many CFOs acknowledging a gap in their AI readiness, the stakes are high. By leveraging AI as a transformative tool, CFOs can redefine organizational growth, improve operational efficiency, and enhance decision-making—all while addressing user experience and critical sustainability goals.

Achieving this requires integrating advanced AI solutions, implementing user-friendly technologies, and aligning financial strategies with ESG commitments. These steps empower CFOs to stay competitive, adapt to rapid change, and position their organizations at the forefront of the financial evolution.

For a deeper exploration of AI in finance —including cost control, data analysis, and HR/IT integration—download the, CFO Insights Report: Repositioning for Growth.