How Can CFOs Lead Finance Transformation Using AI

The finance function is being redefined—faster than most of us imagined.

According to Coherent Solutions, AI adoption in financial institutions will jump to 85% by the end of 2025, up from just 45% in 2022. This isn’t just another wave of tech hype. This is a generational shift in how finance operates, how value is created, and what it means to be a CFO.

We’re moving from a world of data gathering to a world of data decisioning. From spreadsheets and silos to real-time intelligence and automated workflows.

At the heart of this change? AI agents.

What Are AI Agents—and Why Do They Matter?

AI agents are not just chatbots or passive algorithms. They are intelligent, task-focused digital workers that can analyse data, learn from interactions, make decisions, and automate finance workflows without human prompting.

Think of them as always-on assistants that can:

- Classify and prioritise your incoming invoices automatically

- Detect anomalies in P&L or balance sheet lines before month-end

- Surface opportunities to reduce revenue leakage or cut unnecessary spend

- Generate forecasts based on real-time variables, not static models

This isn’t about replacing people. It’s about amplifying them.

By deploying AI agents, CFOs can move their teams up the value chain—freeing them from routine tasks to focus on what matters most: partnering with the business, delivering insight, and shaping strategy.

The CFO’s New Mandate: Drive Transformation Through AI

The expectations on CFOs in 2025 are higher than ever:

- 💸 Deliver more value, with fewer resources

- ⏱️ Accelerate reporting and forecasting cycles

- 📊 Enable business decisions based on real-time, reliable data

- 🔐 Build resilience into finance processes amid constant volatility

AI is the only tool that simultaneously increases speed, accuracy, and strategic capacity. But only if you know how to use it.

The New Model for Business Partnering

AI is not just about automation—it’s about transformation.

By offloading manual, transactional work, your team gains the capacity to:

- Engage earlier in commercial planning cycles

- Build predictive models for pricing, margin, or demand

- Advise stakeholders on where to allocate capital for growth

- Improve risk visibility before issues become problems

This is how finance becomes the real-time nerve centre of the business.

📢 Join Our Upcoming Webinar: AI & Finance Transformation in 2025

We’re hosting a live session to help CFOs like you move from theory to action. We’ll showcase how leading finance teams are already deploying AI to accelerate performance and enhance their strategic impact.

What You’ll Learn

✅ Real-world case studies from early adopters

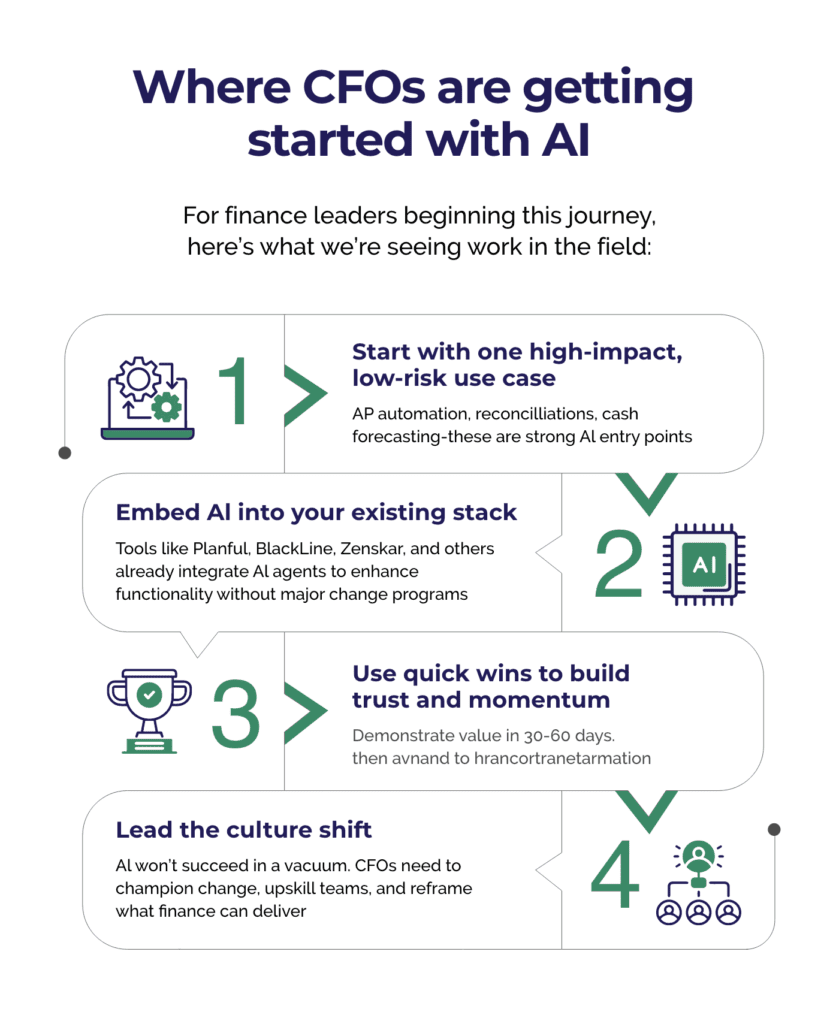

✅ How to deploy AI agents and automation tools for fast ROI

✅ The blueprint for transforming business partnering with AI

🗓 Date: 17 June 2025

🕒 Time: 4:00 PM BST

🎯 Format: 45-minute webinar + live Q&A with AI and finance experts

📌 Register now to reserve your seat — capacity is limited.

Final Thought

As a CFO in 2025, you’re not just a steward of capital. You’re a transformation architect. Those who embrace AI now will not only future-proof their function—but elevate their role as a strategic force across the organisation.

Where to Look for Market Insights

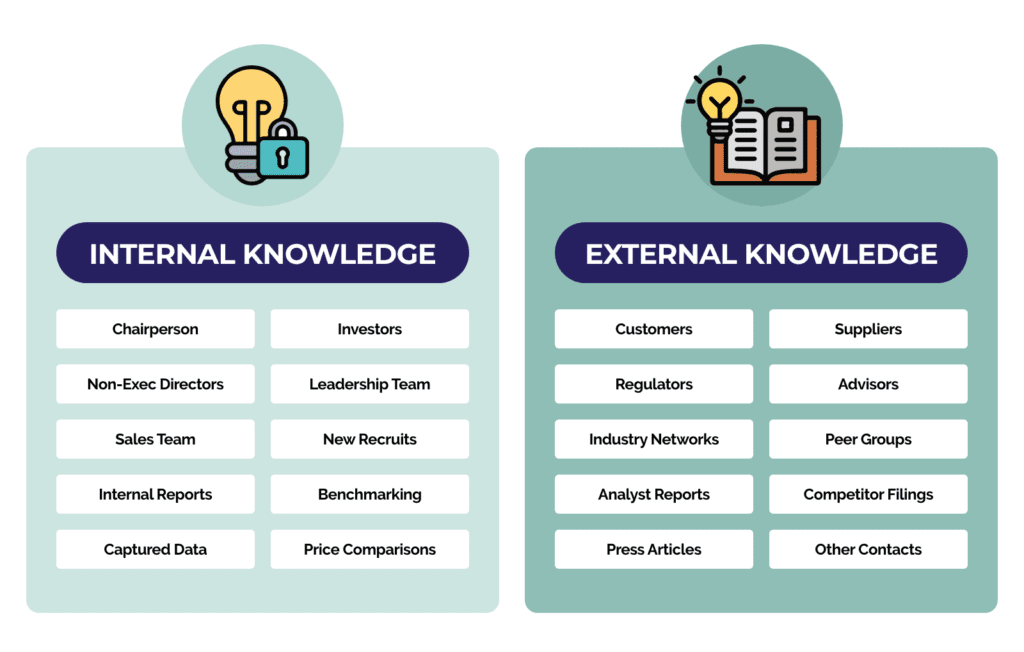

So, where do you find these insights?

You’re already surrounded by valuable information:

- Internal Teams: Sales and marketing can reveal frontline trends.

- Market Data: Industry reports, benchmarks, and competitive analysis.

- External Networks: Suppliers, partners, and trade groups.

Pulling these insights together gives you a more complete view — the kind that drives smarter decisions.

5 Ways to Develop Market Knowledge

Now that you know where to look, how do you turn those insights into action?

Here’s how CFOs can actively build market knowledge:

- Ask the Right Questions: Targeted questions uncover clearer insights.

- Use Multiple Sources: Combine data from reports, websites, and industry experts.

- Stay Current: Attend events, subscribe to industry bulletins, and connect with peers.

- Analyse Data: Benchmark pricing and metrics against competitors.

- Engage Internally: Discuss emerging risks and opportunities with department heads.

Consistent action is key.

By actively seeking market insights, you’re not just managing finance — you’re driving strategy.

The Power of Market Insight — And Why It Matters

Building market knowledge isn’t just about gathering data — it’s about knowing how to use it. From competitor strategies to emerging trends, the right insights reveal hidden risks and untapped opportunities.

If you’re ready to leverage market insights to elevate your strategic impact, the Future CFO Program can support your journey.

🔗 Register for the free preview event and discover how to lead with clarity, confidence, and a deeper understanding of the market.

Responses