Financial Planning & Analysis: Allocate Capital

Allocate Capital

A CFO plays a crucial role in allocating capital by strategically assessing investment opportunities and ensuring optimal distribution of financial resources to maximize shareholder value. They analyze financial data, forecast potential returns, and manage risks to support the company’s long-term growth and profitability.

Capital can be allocated in several ways. One approach is to invest in growth initiatives such as R&D, new product development, or market expansion. Another is to allocate capital towards efficiency improvements or cost-saving measures. Examples of capital allocation strategies used by many companies include:

- Investment: Enhancing business operations, making company acquisitions, or pursuing other strategic priorities.

- Returns: Issuing shareholder dividends, buying back company stock, or paying down debt.

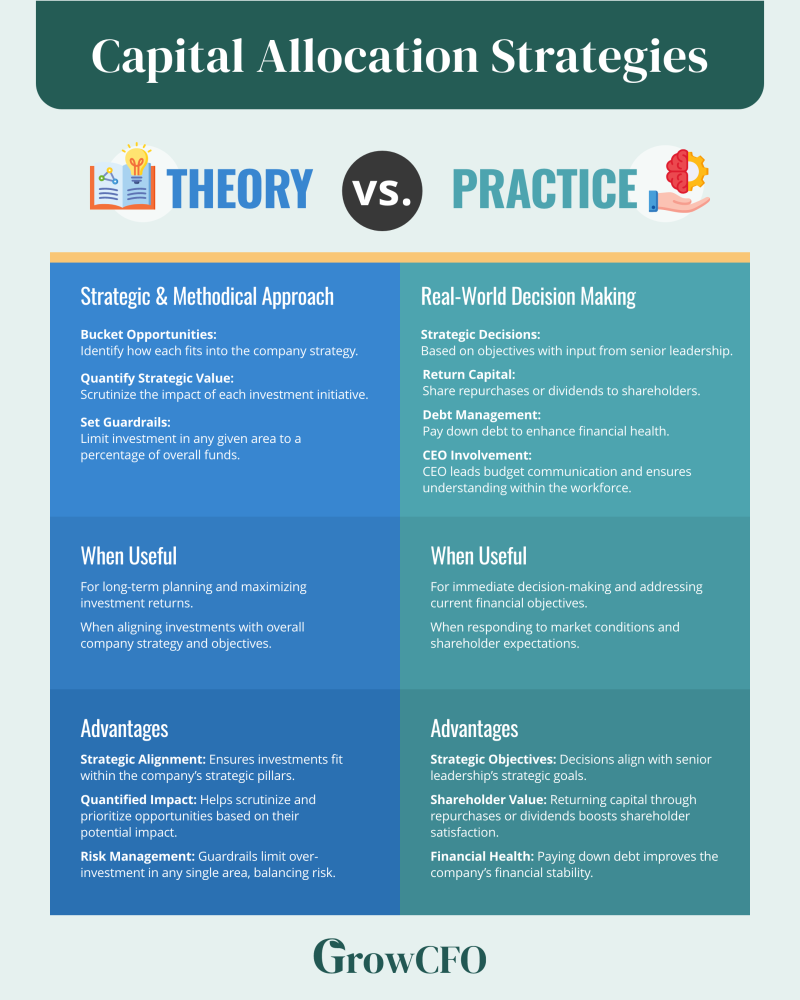

Allocation Strategy: Theory versus Practice

There are two ways to approach capital allocation: in theory and in practice.

In Theory: Capital allocations should be made using valuation methodology and return on investment calculations. This requires framing your recommendations with consideration to the wider context by:

- Bucketing opportunities across each strategic pillar to identify how they fit into the company strategy.

- Quantifying the strategic value within each requested investment initiative to scrutinize the likely impact of each opportunity.

- Setting guardrails for each strategic bucket, such as limiting investment within any given area to a percentage of overall available funds

- Most decisions are based on strategic objectives with key input from senior leadership teams.

- CFOs may return capital to shareholders through share repurchases or dividends.

- CFOs may also pay down debt.

- The CEO needs to be involved throughout the process and should lead in communicating the budget to the business.

- The CEO must have a strong understanding of what is driving the budget and be capable of discussing it with the workforce.

Understanding and effectively implementing capital allocation strategies is crucial for CFOs to drive long-term growth, maximize shareholder value, and ensure financial stability.

Join our upcoming Future CFO preview event to enhance your leadership skills across various CFO functions. Gain valuable insights and strategies to navigate challenges and elevate your role in driving operational excellence:

Responses