Fundraising and M&A

Most companies encounter significant fundraising, acquisition and shareholder liquidity events at some point during their business life cycle. These represent key milestones for any business and have the potential to significantly impact your company’s overall success.

Fundraising generates significant capital to fast track your company’s growth trajectory and deliver your business plan. Acquisitions provide companies with new instant access to new technologies, products, skills, customers, and potential deal synergies. Shareholder transactions can result in liquidity events and exit processes, creating a return on investment for your investors.

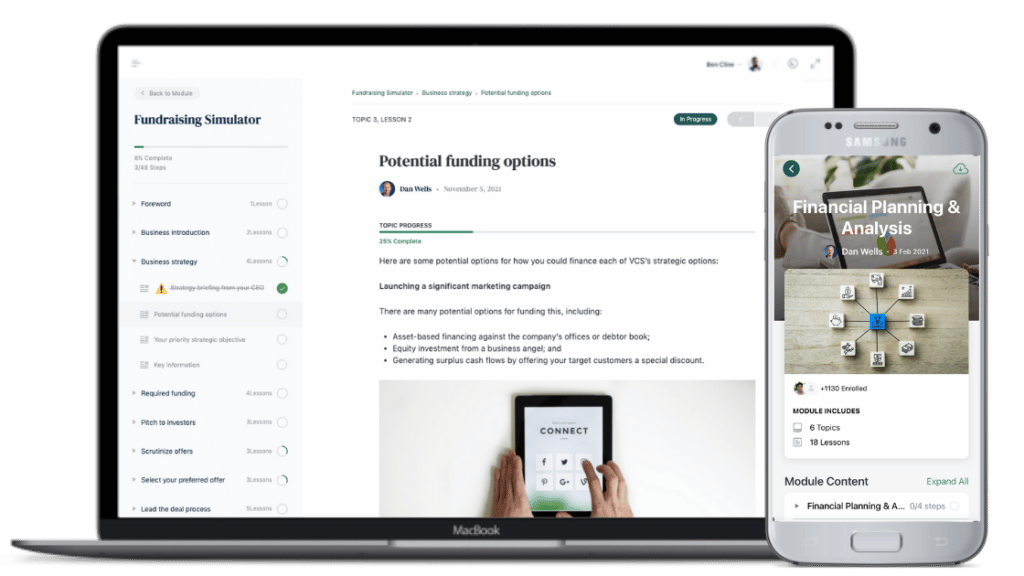

Fundraising Simulator

Over two-thirds of aspiring and first-time finance leaders have little or no fundraising experience. This can easily derail your career progression and leave you feeling unprepared when leading your first ever fundraise.

GrowCFO’s Fundraising Virtual Simulator provides you with essential first-hand CFO experience of leading and delivering an entire fundraising process from initial brainstorming through to deal completion.

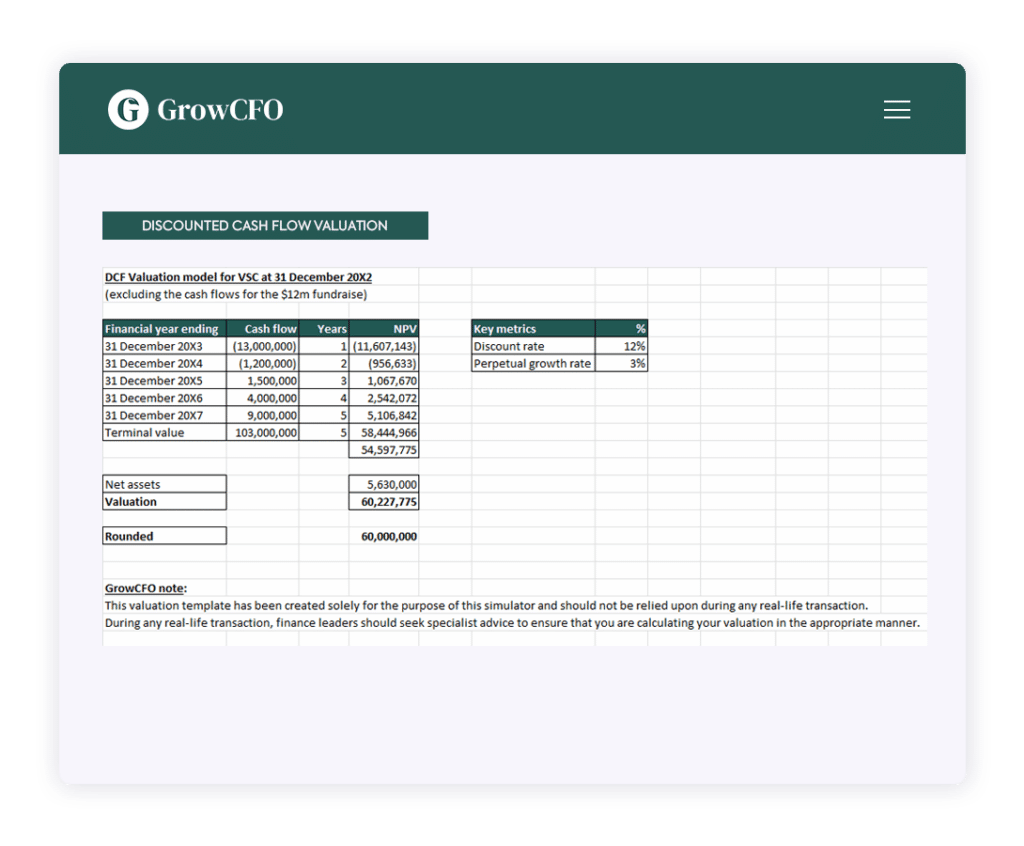

Our simulator is based on a real-life $12 million fundraise comprising equity and convertible debt for a high growth company with a pre-money valuation of $60 million.

We have designed our simulator to help prepare you to confidently lead a range of fundraising deals so that you can thrive throughout the process and feel empowered to obtain the best available deal for your company.

Business Valuation Model

The business valuation model provides a popular methodology to estimate the value of an organization. It allows you to input your financial data and market assumptions to generate a potential valuation range, enabling you to estimate the value of the business. Furthermore, this tool can help CFOs prepare for future fundraising opportunities. Additionally, it enables CFOs to determine the appropriateness of your valuation methodology when it comes to the consideration of future M&A activity.

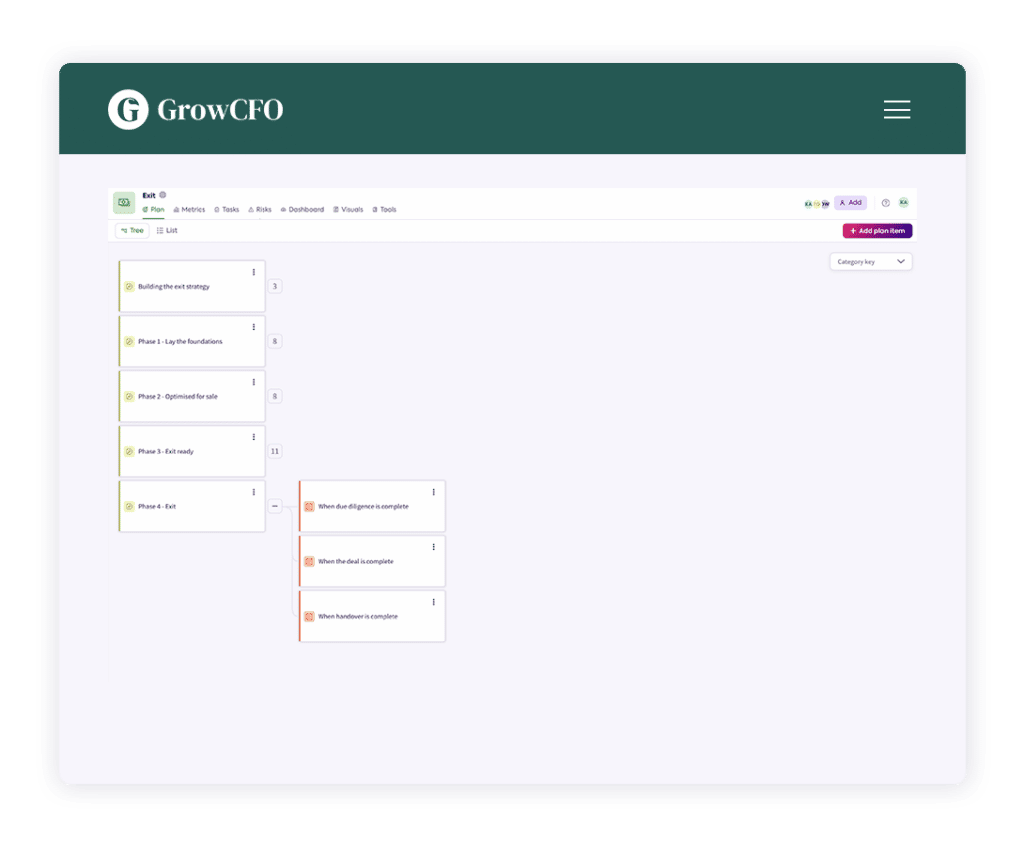

Shareholder Exit Planning

Shareholder exit planning allows you to assess the organization’s financial health and develop strategies that can keep the business running in the short and long term. This type of tool also helps CFOs take into account factors such as deal processes, market trends, and compliance regulations when planning for a shareholder exit. Furthermore, the plan allows you to work with other departments to ensure that stakeholders are well-prepared during an exit event.