How Big Should Your Finance Team Be as You Grow?

Overview

GrowCFO research suggests that most finance leaders create an annual budget for their finance team based upon what they inherited when they first started to lead the department. As the demands grow, finance leaders create individual investment cases to hire incremental staff or to replace leavers with more experienced individuals. During this journey, you may implement the occasional new system and slightly tweak the structure of your team.

However, this top-down approach means that you are unlikely to ever secure the appropriate budget to effectively deliver each of your finance function requirements on an ongoing basis.

Finance leaders should dedicate time towards redesigning your dream finance function from scratch based upon your overall objectives and required outputs. This involves creating a bottom-up budget for your finance team based upon its purpose and value to your company. You can then compare this to your current recurring budget and create an investment case based upon any variances.

Market research – Large Enterprise

Finance leaders may benefit from benchmarking your finance function’s annual cost against other similar companies.

For multi-billion-dollar large enterprise companies with thousands of employees, market research suggests the following:

- The average cost of running a finance function is 1.4% of annual revenues.

- Well-run companies can reduce this cost down to around 0.6% – 0.7% of revenues.

However, the vast majority of businesses are much smaller than this and you are very unlikely to achieve these ratios in a small or medium-sized company.

Market research – SMB and Mid-Market

GrowCFO has researched hundreds of Small and Medium-sized Businesses (“SMBs”), Mid-Market Companies and Large Enterprises to determine the average number of people in their finance function.

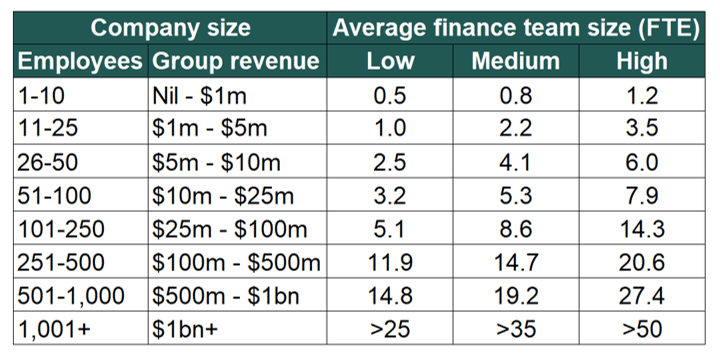

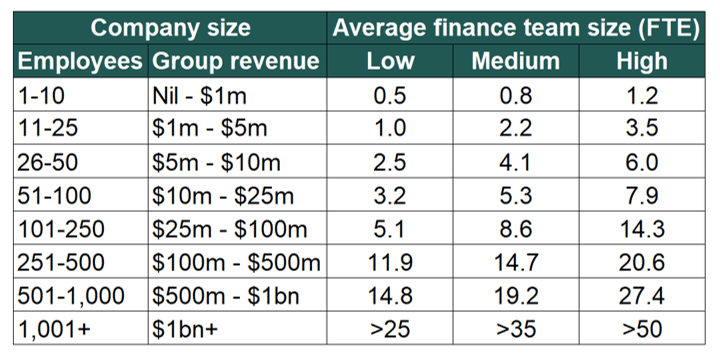

For each company in our sampled population, we have quantified the number of employees, the company’s group revenue and the size of their finance function. Here are the results of our research:

We have presented the average finance team employee headcount size by calculating the number of Full Time Equivalents (FTE) across three levels of finance function requirements: Low, Medium and High. These three categories are based upon the following ten consideration factors:

- Group structure: The complexity of the group structure, number of divisions, level of centralization, divisional autonomy, hierarchical layers and individual finance teams.

- Number of entities: The number of statutory entities within the group and their individual statutory requirements, for example bookkeeping, documentation, reporting and other legal considerations.

- International: The level of exposure to multiple international locations and the challenges of doing business in each overseas territory, such as overseas subsidiaries, office locations, places of employment, local rules, cross-border transactions and other territory-specific challenges.

- Level of complexity: The complexity of the business activities, accounting and reporting requirements based upon the nature of the company, its industry sector and future strategy.

- Nature of transactions: The nature of the company’s transactions such as the volume of repeat transactions, complexity of contracts, challenging activities, transaction values and currencies.

- Investor relations: The frequency and nature of investor relation requirements driven by the company’s ownership structure, level of public interest, type of investor and board structure.

- Fundraising and M&A: The demands placed on the finance function to lead or support multiple fundraising rounds, buy-side acquisitions of other companies, shareholder liquidity events, other M&A activity and exit strategies.

- Regulatory requirements: The company’s exposure to regulatory requirements based upon its industry sector, trading activities, ownership structure, geographies and other relevant factors.

- Technology: The level of technology sophistication across the business and its ability to automate business processes, streamline data processing and simplify reporting to reduce the burden of manual demands on the finance function.

- Outsourcing: The number of finance function activities that are outsourced to a third-party provider, thereby reducing the corresponding workload of the in-house finance team.

Finance leaders should review these ten factors to determine how your company ranks against each of them based upon a Low, Medium and High ratings classification. You can then use the above table to benchmark the size of your finance team.

Note that these ten consideration factors represent those that were identified during GrowCFO’s research project. However, every company is individually unique and you should determine which other factors may also apply to your business. For any given company, there may be additional requirements or specific reasons why your finance team needs to be bigger or smaller than the average size presented within the above table.

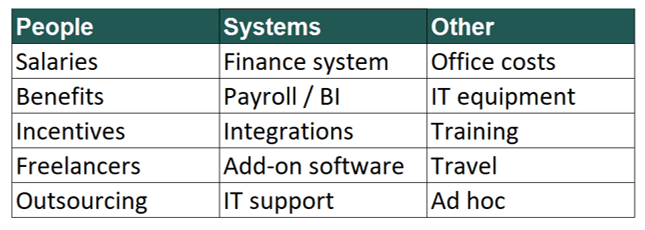

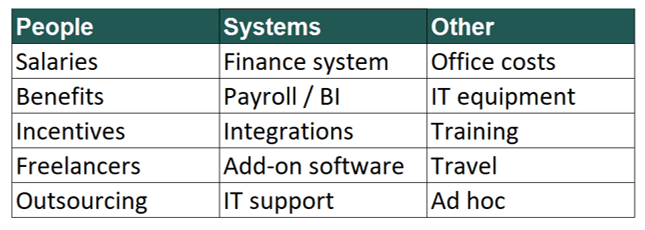

The cost of running a finance function

There are many different costs associated with running a finance function, which we have broken down into People, Systems and Other. The following table presents the most significant recurring costs identified within our GrowCFO survey:

Our GrowCFO market research suggests that the following six finance function activities typically take up the most time within a finance function across an annual cycle:

- Budgeting

- Closing the books

- Board packs

- Forecasting

- Reporting

- Audits

GrowCFO’s finance leader survey suggests that you can significantly reduce the cost of running your finance function by focusing on simplifying, streamlining and automating these six activities.

Why most finance teams are underinvested

As a finance leader, you are likely to be the one who is constantly scrutinizing other people’s expenditure levels and monitoring budgets. Given your perception as being the person who controls company spending, it can feel hypocritical to further invest in your own team.

This results in most finance leaders being under pressure to minimize the cost of your finance team. Most finance leaders feel uncomfortable towards asking for more resource when denying additional funding to other departments.

Additionally, too many finance teams are seen as cost centers rather than drivers of growth and value creation. This incorrect perception makes it harder to justify further investment compared to other departments such as your Product team and Sales & Marketing.

Summary

Too many finance functions are based upon inherited teams, fixed structures and ongoing roles. Most annual headcount movements are in reaction to employees leaving the company or other urgent requirements.

Finance leaders should constantly be redesigning your finance function from bottom-up based upon your overall team objectives and required outputs. You must clearly articulate the growth and value that your team drives across the business to avoid you being seen as a back-office support function.

And remember: your optimal finance function blueprint may be very different to what you currently have in place!

Develop your team

In addition to growing the size of your finance team, finance leaders should invest in the development of your team members to maximize their performance.

GrowCFO has surveyed hundreds of finance leaders to identify the top ten online training courses that would have the biggest impact on developing your teams. Our Finance Team Training Courses should be relevant to all your finance team members. Register now to demonstrate your commitment towards developing your team members and helping them to enjoy a successful career.

Responses