The approval trap: why tighter controls are making you lose control

Table of Contents

There’s a dangerous lie we tell ourselves in finance: that more layers of approval equals more control. We build complex hierarchies and rigid thresholds, believing we’re protecting the business. But for most scaling businesses, the opposite is true. The more you tighten the grip, the more the process slips through your fingers. This results in ‘documented bottlenecks’ rather than actual oversight.

It’s time to admit that if your finance team spends more time chasing signatures than honing the process, you’ve not built governance, you’ve created an approval trap.

The paradox nobody talks about

Here’s what actually happens when finance teams try to strengthen spend control:

They add approval layers. They tighten thresholds. They increase oversight.

And spend control gets worse.

Not because the controls themselves are flawed, but because the process can’t scale. What worked for 50 people breaks at 150. What felt manageable with £2M in annual spend becomes chaos at £10M.

Meanwhile, the business draws a different conclusion: finance slows everything down.

The irony? None of this actually improves control. It just creates better-documented bottlenecks.

What finance leaders get wrong about bottlenecks

Most finance teams assume bottlenecks exist because they’re not being strict enough.

The real problem is usually simpler: decisions don’t know where to go.

This isn’t unusual. In many scaling organizations, approvals don’t slow down because people are being overly cautious — they slow down because the process has no structure. Requests disappear into inboxes. Approvers don’t know what’s waiting for them. Finance can’t see where delays are actually happening.

Sound familiar?

The questions that reveal the cracks

If you’re a finance leader, ask yourself:

- Can you describe your delegation of authority in under 60 seconds without checking a document?

- If someone joins your team tomorrow, will they know exactly what they can approve?

- When a manager submits a request, do they know how long it should take?

If the answer to any of these is “not really” – you don’t have a control problem. You have a clarity problem.

And clarity problems always look like bottlenecks.

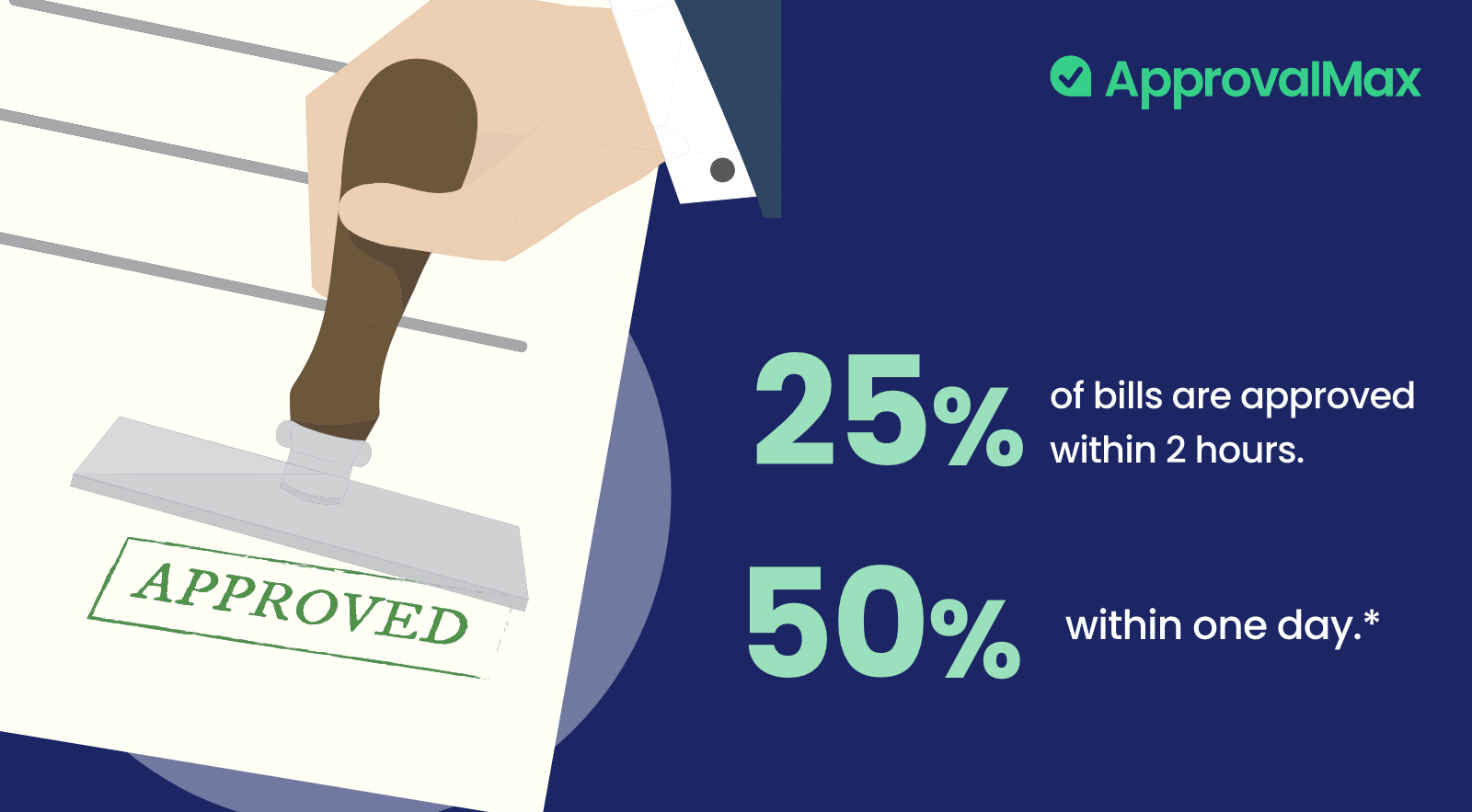

Approval timing statistics (25% within 2 hours, 50% within 1 day): ApprovalMax Homepage

What actually removes bottlenecks (without weakening control)

ApprovalMax processes over 12 million bills annually across 17,000 businesses.* When they analyzed approval patterns, they found something telling:

25% of bills are approved within 2 hours. 50% within one day.*

These aren’t companies with looser controls – they’re companies with clearer controls.

The difference shows up in four specific practices:

1. Delegation that doesn't require interpretation

illumin (the journey advertising platform) cut their approval time by 50%* by doing one thing: removing ambiguity about who approves what.

Not by speeding up decisions. By making it obvious where decisions should go.

When your approval matrix requires judgment calls about who should approve something, you’ve built delay into the system. Every request becomes a routing puzzle that someone in finance has to solve.

2. Visibility that replaces chasing

Green Cross Health, one of New Zealand’s largest healthcare providers, reduced approval times by 96%* – from hours to five minutes.

The change wasn’t faster approvers. It was eliminating the need for finance to chase approvals in the first place. When approvers can see what’s waiting, they don’t need reminders. When finance can see where delays are happening, they can address patterns instead of individual incidents.

3. Exceptions that surface early, not late

The best approval processes don’t prevent exceptions – they surface them.

When a request falls outside normal parameters, it should trigger a flag, not disappear into inbox archaeology. This is where finance adds genuine value: not in approving routine spend, but in applying judgment to the genuine edge cases.

4. Accountability without policing

BMI Group (a Canadian building materials company) saved two full-time equivalents per month* – not by hiring more people to chase approvals, but by making delays visible to the people who owned them.

When budget holders can see their own approval bottlenecks, they fix them. Finance stops being the project manager of spend and becomes a strategic partner instead.

The shift that matters

There’s a fundamental difference between two types of finance teams:

Reactive finance teams spend their time:

- Chasing approvers

- Explaining delays

- Defending process

- Being worked around

Strategic finance teams spend their time:

- Identifying spending patterns

- Highlighting trade-offs

- Enabling decisions

- Being sought out

The gap between these two isn’t about headcount or sophistication. It’s about whether your approval process works with how the business operates, or against it.

A question worth sitting with

If your finance team feels like the bottleneck, ask yourself this:

Is the problem really about saying ‘no’ – or about making it clear when ‘yes’ is obvious?

The companies with the strongest spend control aren’t the ones with the most approval layers. They’re the ones where routine decisions move quickly, exceptions surface clearly, and finance has time to focus on the decisions that actually matter.

That’s not less control. It’s smarter control.

Sources

* ApprovalMax platform statistics (12M+ bills, 17,000+ businesses): ApprovalMax Homepage

* Approval timing statistics (25% within 2 hours, 50% within 1 day): ApprovalMax Homepage

* illumin 50% approval time reduction: ApprovalMax Customer Stories – illumin

* Green Cross Health 96% approval time reduction: ApprovalMax Customer Stories – Green Cross Health

* BMI Group 2 FTE per month savings: ApprovalMax Customer Stories – BMI Group

This article was written in partnership with ApprovalMax, whose approval automation platform processes 16 million+ documents annually for businesses using Xero, QuickBooks, and NetSuite.

Responses