How Do I Become A Finance Business Partner?

What is the finance business partner career path and how can professionals transition into this role?

The finance business partner career path requires a combination of technical expertise, business acumen, and interpersonal skills. To become a finance business partner, professionals typically build a foundation in finance or accounting, gain experience in analysis and reporting, and then develop soft skills such as communication, collaboration, and influencing. By combining data-driven insights with strong business understanding, you can position yourself as a trusted advisor to leadership teams.

What is a finance business partner career path?

A finance business partner career path often begins with traditional finance roles such as financial analyst, management accountant, or FP&A professional.

These positions provide the technical grounding in financial modeling, budgeting, reporting, and compliance that is essential for credibility. Over time, the role shifts toward collaboration and strategy, where finance professionals use insights to influence business decisions and drive long-term performance.

What qualifications do you need to become a finance business partner?

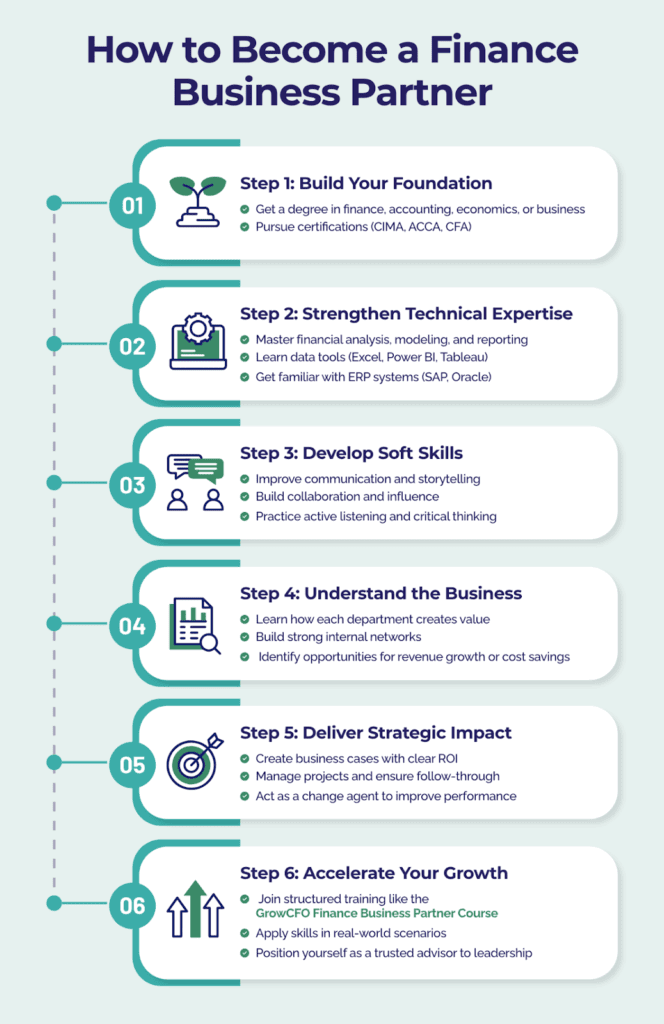

Most finance business partners start with a degree in finance, accounting, economics, or business. Professional certifications such as CIMA, ACCA, or CFA are valuable for demonstrating expertise and building credibility.

These qualifications provide the technical foundation needed for a finance business partner career path. However, education alone is not enough, success also requires developing strong communication, problem-solving, and leadership skills.

What technical skills are essential for finance business partners?

Technical skills form the backbone of the finance business partner career path. You will need to:

- Conduct financial analysis and modeling for forecasting, budgeting, and scenario planning

- Use data analytics tools like Excel, Power BI, and Tableau to extract and interpret insights

- Apply accounting knowledge to ensure accuracy and compliance

- Navigate ERP systems such as SAP or Oracle to manage integrated financial data

These technical capabilities ensure that finance business partners can produce reliable, data-driven insights that inform decision-making.

Why are soft skills just as important as technical expertise?

While technical skills open the door, soft skills are what make finance business partners truly effective. To succeed on the finance business partner career path, you need to:

- Collaborate across departments to align finance with strategic objectives

- Communicate financial insights in a way that is accessible to non-finance stakeholders

- Apply active listening and critical thinking to understand business challenges

- Build relationships and trust as a valued partner to senior leaders

- Demonstrate emotional intelligence to influence decisions and motivate change

These skills allow finance business partners to move from “number crunchers” to strategic advisors.

How do finance business partners add value to organizations?

The role goes beyond reporting results. Finance business partners analyze trends and patterns in data to identify opportunities for revenue growth, cost reduction, or efficiency improvements.

They also build business cases for new initiatives, challenge assumptions, and act as change agents. By applying both technical and interpersonal skills, they ensure that financial insights lead to real business outcomes.

What are the steps to build a finance business partner career path?

Becoming a finance business partner is a gradual process of growth and development. Key steps include:

- Become a student of the business: Understand how your organization creates value and what drives performance in each function.

- Develop technical expertise: Build strong skills in financial modeling, analytics, and reporting.

- Build an internal network: Form relationships with stakeholders across departments to strengthen influence.

- Learn to create business cases: Support recommendations with data and clear ROI analysis.

- Master communication and presentation: Deliver insights in a way that inspires action and clarity.

- Look for opportunities to improve processes: Position yourself as someone who drives positive change.

- Strengthen project management skills: Ensure financial insights translate into results.

- Stay accountable and consistent: Reliability builds trust and credibility with leadership.

How can finance professionals accelerate their path to business partnering?

While many finance professionals naturally evolve into business partnering roles, structured training accelerates the process. Programs like the GrowCFO Finance Business Partner Course are designed to develop both technical and soft skills. Through interactive modules and real-world scenarios, participants learn how to communicate effectively, influence decision-making, and align finance with business strategy.

The finance business partner career path combines technical expertise with strategic influence. To succeed, you must develop a balance of hard and soft skills, building your credibility through financial analysis while expanding your ability to collaborate, communicate, and challenge assumptions.

With the right training and mindset, finance professionals can transform into trusted advisors who shape the future of their organizations. For those ready to accelerate their journey, the GrowCFO Finance Business Partner Course provides a proven path to success.