How Are Finance Teams Using AI?

In what ways are modern finance teams leveraging AI across their operations?

Finance teams are using AI to automate workflows, generate forecasts, analyze risks, and deliver real-time insights that support smarter strategic decisions. The impact of AI in finance goes beyond speed — it improves accuracy, reduces manual work, and enables finance leaders to move from reactive reporting to proactive value creation. As adoption accelerates, forward-looking teams are embedding AI into their everyday operations.

What are the main ways finance teams are using AI today?

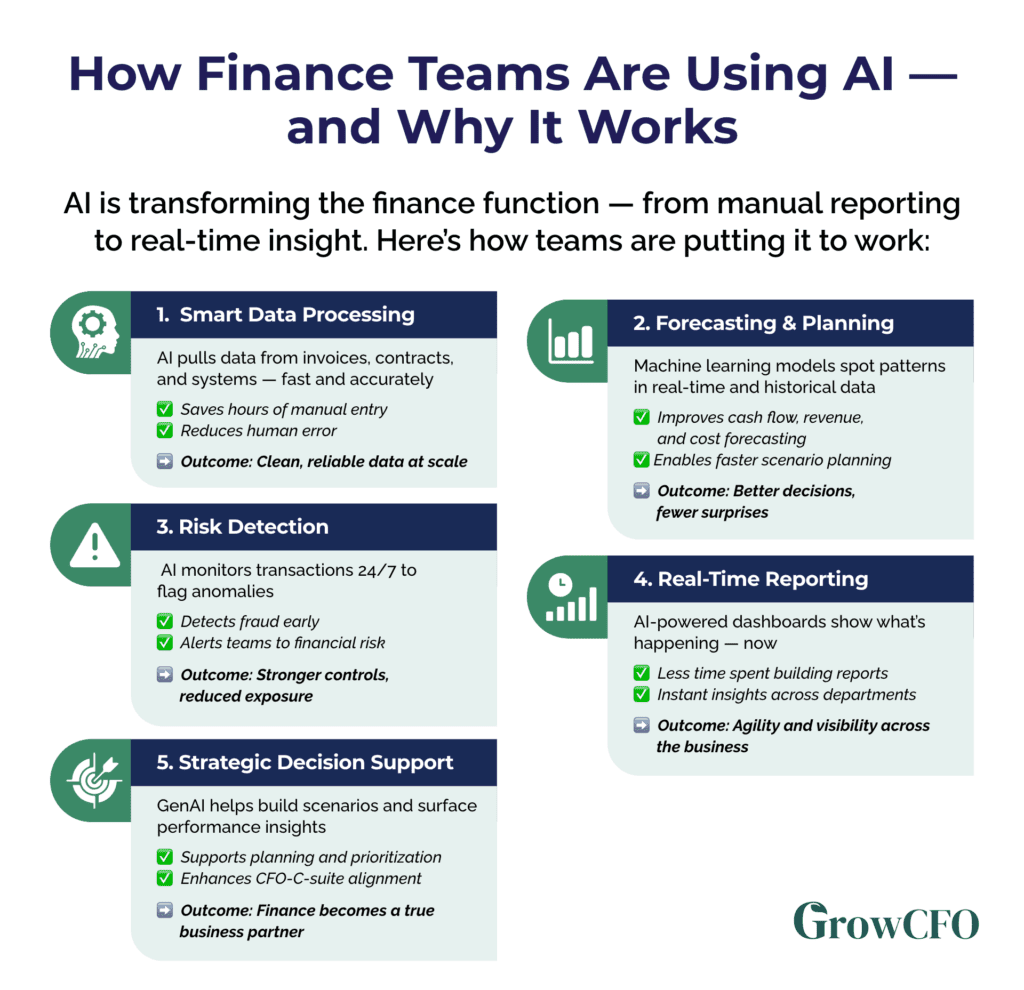

AI in finance is being applied across almost every core function — from month-end close to strategic forecasting. According to global finance leaders, AI enables a shift away from manual, rules-based workflows toward intelligent, insight-driven processes. Key applications include:

1. Data entry and processing: AI tools can automatically extract and validate financial data from invoices, contracts, and systems, saving time and reducing errors.

2. Forecasting and planning: Machine learning models predict trends based on historical and real-time data, improving the accuracy of cash flow, revenue, and expense forecasts.

3. Risk management and anomaly detection: AI monitors transactions to flag irregularities, identify potential fraud, and detect early signs of financial risk.

4. Real-time reporting and dashboards: AI-powered analytics platforms give finance teams faster, clearer visibility across the business.

5. Strategic decision support: Tools like GenAI help finance teams create scenarios, analyze performance drivers, and generate recommendations — making them more effective partners to the C-suite.

How is AI changing the role of the finance team?

Traditionally, finance functions have operated on structured processes, backward-looking data, and linear rules. AI in finance introduces a dynamic, predictive layer that allows teams to respond faster and with more confidence. This evolution shifts the finance role from “record keeper” to “strategic advisor.” Instead of simply closing the books or tracking KPIs, finance teams can: – Simulate multiple business outcomes – Detect risks before they escalate – Optimize capital allocation – Provide proactive guidance to business units AI enhances the judgment of finance professionals — it doesn’t replace it. By offloading routine work and surfacing insights faster, AI allows teams to focus on the value-added thinking that drives growth.

What are the benefits of AI in finance?

Finance AI offers a compelling return on investment across multiple areas:

| Benefit | Impact |

| Efficiency | Reduce time spent on manual data tasks and reporting |

| Accuracy | Minimize human error and improve data integrity |

| Speed | Make real-time decisions with up-to-date financial insights |

| Cost savings | Eliminate redundant work and reduce FTE overhead |

| Scalability | Automate repeatable tasks across global or high-volume teams |

| Strategic alignment | Provide deeper, faster insights to drive business performance |

In fact, AI-driven automation is projected to save the financial services industry over $447 billion annually by removing inefficiencies and duplicated work. More importantly, 70% of CFOs now see AI as the most critical technology for improving decision-making in the finance function.

What tools are finance teams using to adopt AI?

There’s a growing ecosystem of AI tools designed specifically for finance. These include: – Power BI + AI integrations for data visualization and forecasting – OCR and NLP tools to automate document processing – Predictive analytics platforms for scenario modeling – GenAI assistants for report writing, insight summaries, and variance analysis – Custom automation workflows built in tools like Power Automate, UiPath, or Alteryx The key is not the tool itself — but how it’s used. High-performing teams focus on embedding AI into existing processes, not creating new ones from scratch.

How can finance teams build capability in AI?

The biggest barrier to adopting AI in finance isn’t technology — it’s skills. Many teams lack the confidence or knowledge to get started. That’s why structured, finance-specific upskilling is essential. Here’s a simple roadmap:

1. Start with awareness – Educate your team on what AI in finance can (and can’t) do.

2. Pick a pilot use case – Choose a process like reporting or reconciliations to automate.

3. Measure results – Use small wins to build momentum and buy-in.

4. Upskill the team – Invest in training focused on finance-specific AI tools and workflows. 5. Scale with purpose – Expand automation across departments based on value and readiness.

How can GrowCFO help finance teams adopt AI?

Our Premium AI Adoption Program gives finance teams practical, CPE-accredited training on making AI a daily habit and building an AI-powered finance function. It is part of GrowCFO Premium, which also includes 100+ on-demand courses, 30+ live workshops, and an AI-powered learning plan to develop the right skills for your role.

Start with GrowCFO Premium and learn how to apply AI in finance to improve workflows and decision-making.

Responses