How to Implement AI in Finance Processes

What are the best ways to introduce artificial intelligence into finance operations and workflows?

Implementing artificial intelligence in finance starts with integrating AI into core finance processes like reporting, forecasting, compliance, and accounts management. From using cloud-based ERP systems to piloting AI tools for automation and risk mitigation, finance leaders can gradually embed finance AI to streamline operations, reduce costs, and enhance decision-making. When introduced thoughtfully, AI for financial services becomes a powerful driver of growth, agility, and innovation.

Why Use Artificial Intelligence in Finance?

The finance function is primed for transformation. Manual processes, large data volumes, and regulatory demands make it an ideal candidate for intelligent automation. Artificial intelligence in finance enables faster reporting, better forecasting, and more accurate risk analysis.

As EY and SAP highlight, AI in finance isn’t just about efficiency—it unlocks new ways to manage performance, ensure compliance, and deliver real-time insights. For finance teams aiming to shift from back-office functions to strategic enablers, AI is no longer optional—it’s essential.

What Finance Processes Benefit Most from AI?

Whether you’re in banking, corporate finance, or shared services, here are the finance processes where AI has the biggest impact:

| Process | AI Benefits |

| Accounts Payable/Receivable | Automates invoice processing, improves accuracy, reduces late payments |

| Financial Reporting | Accelerates close cycles and improves real-time visibility |

| Forecasting & Budgeting | Uses machine learning to detect patterns and forecast with greater precision |

| Fraud Detection | AI flags suspicious transactions with high accuracy using anomaly detection |

| Regulatory Compliance | Monitors transactions and ensures adherence to complex financial regulations |

| Credit Evaluation & Risk | Enhances risk models using non-traditional data and predictive analytics |

| Customer Service | AI-powered chatbots and virtual assistants help answer queries and reduce delays |

How to Get Started with Finance AI

Introducing AI for financial services doesn’t mean overhauling your entire infrastructure overnight. Start small and scale gradually. Here’s a roadmap:

1. Lay the Foundation with a Cloud-Based ERP

Modern ERPs like SAP S/4HANA or Workday Financial Management now embed AI directly into finance workflows. This allows teams to automate repetitive tasks, improve data accuracy, and generate predictive insights in real time.

✅ Why it matters: Cloud-based ERPs serve as the digital backbone of AI in finance.

2. Launch Pilot Programs

Begin with focused pilot projects in areas like invoice automation or financial forecasting. This allows you to test ROI, get buy-in, and refine your approach.

✅ Tip: Choose processes with high manual load and measurable outcomes.

3. Ensure Ethical and Transparent AI Use

Develop a company-wide AI policy to address concerns about job displacement and data privacy. Include clear communication and employee training to build trust.

✅ Why it matters: Transparent AI use fosters adoption and long-term success.

4. Integrate Robotic Process Automation (RPA)

RPA can handle high-volume, rules-based tasks—like data entry or reconciliation—freeing up human teams to focus on more strategic work.

✅ Example: Banks use RPA to reduce operational costs and improve debt management workflows.

5. Use AI for Enhanced Risk and Compliance

AI tools can scan massive datasets to detect anomalies and ensure that organizations stay ahead of evolving regulations.

✅ Why it matters: Compliance is no longer reactive—it can now be predictive.

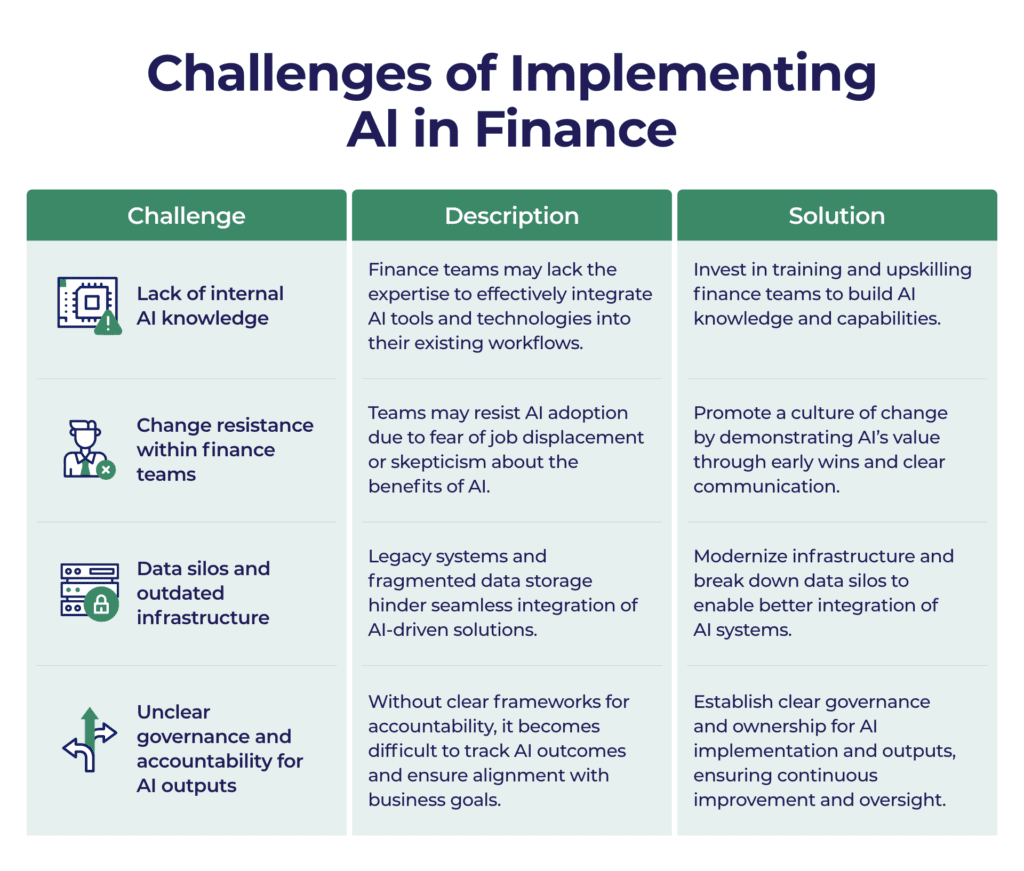

What Are the Challenges of Implementing AI in Finance?

Even with powerful tools, adoption can be slowed by:

- Lack of internal AI knowledge

- Change resistance within finance teams

- Data silos and outdated infrastructure

- Unclear governance and accountability for AI outputs

To overcome these, finance leaders must combine tech implementation with cultural change and capability building.

What Does the Future Look Like for Finance AI?

AI is reshaping not only how finance teams work, but how they think. As Workday and Centime suggest, tomorrow’s finance function will be:

- Proactive rather than reactive

- Insight-driven rather than report-driven

- Strategic rather than transactional

As AI becomes embedded in day-to-day operations, finance processes will evolve into powerful levers for enterprise transformation.

Final Thought

Implementing artificial intelligence in finance is no longer a future plan—it’s a present imperative. With the right systems, strategy, and mindset, finance teams can lead the charge in innovation, resilience, and value creation. From forecasting to compliance, AI is reshaping every part of finance processes—and the time to act is now.

Ready to Learn More About AI in Finance?

GrowCFO Premium offers deep-dive content, expert-led training, and implementation frameworks to help finance teams lead in the digital era. Explore our premium learning hub for forward-thinking finance leaders.