From CFO to Chief Value Officer: What It Means for FP&A

This quarter at GrowCFO, FP&A is the central theme — but it can’t be viewed in isolation. Technology alone won’t solve finance’s biggest challenges without first understanding the evolving role of the CFO.

The CFO role is undergoing a fundamental transformation. No longer confined to reporting the past, today’s CFO is expected to shape the future — not just of finance, but of the entire organisation.

Welcome to the era of the Chief Value Officer.

This new mandate extends beyond financial reporting. It’s about enabling better, faster decisions, driving performance, unlocking growth, and delivering value across all stakeholders. And at the heart of this shift lies FP&A.

The Rise of the Chief Value Officer

The Chief Value Officer’s mindset moves beyond cost control and compliance. It focuses on what truly drives value in the business — from customer retention and innovation velocity to carbon reduction — and aligns capital, strategy, and execution accordingly.

This transformation is being fuelled by powerful forces:

- Digital business models that reward agility and innovation

- ESG demands from investors and regulators

- AI and automation, which reduce manual tasks and enhance insight generation

- Boardroom expectations shifting from “What happened?” to “What should we do next?”

In this new environment, CFOs must do more than explain the numbers — they must illuminate the value behind them.

What This Means for FP&A

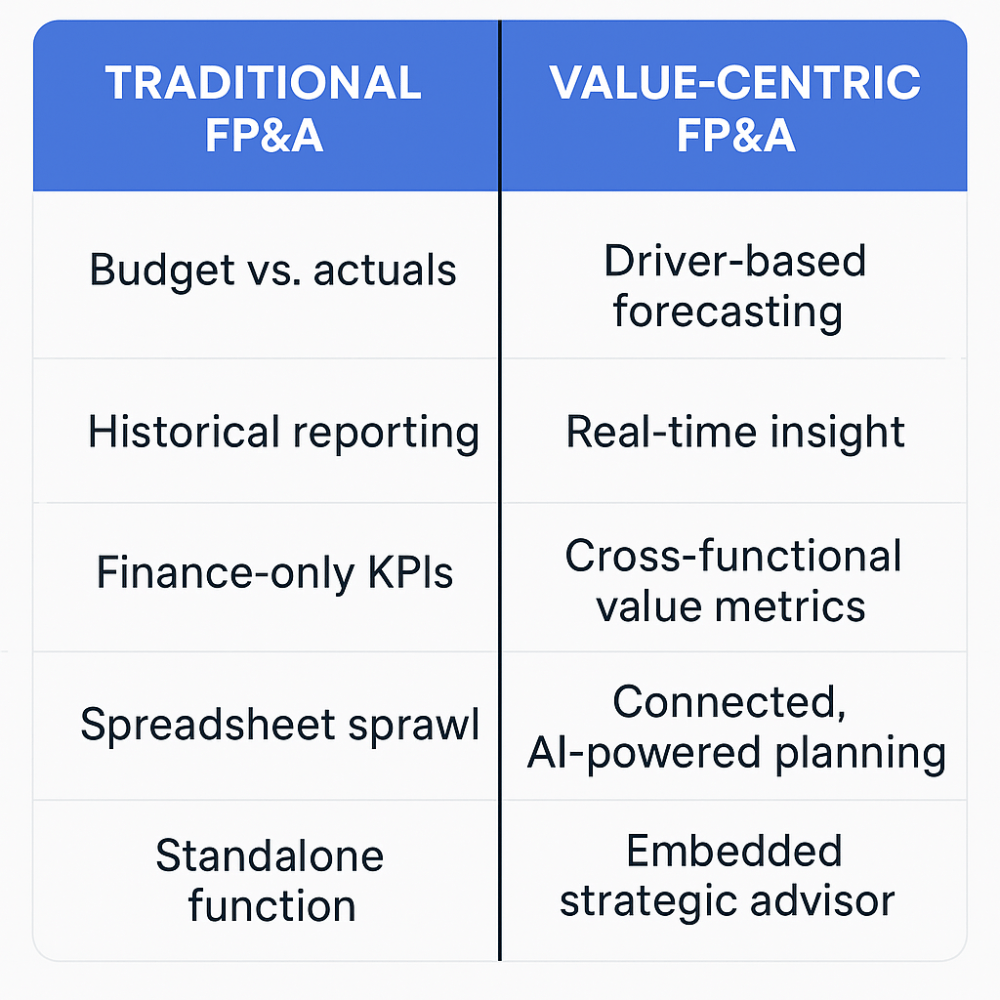

The implications for FP&A are significant. Traditional planning, budgeting, and forecasting no longer suffice. Expectations are rising quickly.

To meet these demands, FP&A must undergo three major shifts:

- Mindset shift – from gatekeeper to guide

- Skillset shift – from spreadsheet jockey to strategic storyteller

- Toolset shift – from Excel to intelligent planning platforms

The Systems to Support the Shift

Technology is no longer a nice-to-have — it’s essential.

Modern FP&A teams are investing in:

- Cloud-native platforms such as Pigment, Anaplan, Planful, or Causal to unify planning across functions

- AI and ML tools to automate forecasting, detect anomalies, and support real-time scenario planning

- Data integration layers like Acterys to eliminate silos and ensure one version of the truth

While many FP&A teams still rely on Excel, that’s increasingly like running a Formula 1 team with a clipboard and stopwatch.

Value-Based Metrics: What FP&A Should Track

To support the Chief Value Officer agenda, FP&A must guide the business in measuring what truly matters. This means going beyond the P&L to include KPIs such as:

- Customer lifetime value

- Net revenue retention

- Employee productivity per initiative

- ESG impact metrics

- ROI of strategic initiatives

These are more than metrics — they offer a lens into sustainable value creation.

Mini Case: Shifting to Strategic FP&A

A mid-market SaaS company recently restructured its FP&A function around value creation. Instead of quarterly variance reports, the team ran monthly “strategy sprints” involving cross-functional input. AI-based tools flagged early churn indicators, prompting timely customer success interventions.

The outcome? A 20% improvement in forecast accuracy and a 15% reduction in churn within six months. The FP&A team didn’t just report outcomes — they influenced them.

How to Get Started

For CFOs and FP&A leaders ready to embrace this shift, here are five practical steps:

- Assess FP&A maturity – Identify your biggest gaps: skills, systems, or structure

- Pilot value-based planning – Choose a strategic area (e.g. product development or retention) and start measuring real value drivers

- Upskill the team – Invest in business acumen, data literacy, and storytelling capabilities

- Upgrade the toolset – Implement platforms that enable real-time collaboration and predictive planning

- Partner across the business – Embed FP&A within value streams, not just departments

GrowCFO’s FP&A lead Catherine Marks is diving deeper into these topics in the upcoming webinar The Future of FP&A: Supporting the Chief Value Officer Transition on 23 July.

From Finance to Value Engineering

The journey from CFO to Chief Value Officer is more than a title change — it’s a redefinition of purpose. For FP&A teams, it’s a golden opportunity to lead.

No longer confined to the back office, FP&A is now a co-pilot in value creation, steering the business with clarity and confidence.

The question is no longer just, “Are we planning for performance?” but:

“Are we engineering value?”

Now is the time to rewire FP&A for the future.

P.S. Don’t forget to book your seat at the webinar.

Responses