What Is a Financial Excellence Framework?

What does a financial excellence framework include, and how can it help finance teams operate at a higher standard?

A financial excellence framework is a structured model that helps finance teams improve performance, decision-making, and strategic impact. By aligning people, processes, and technology, it drives consistency, accountability, and value creation across the finance function. Adopting a financial excellence framework is essential for teams aiming to lead transformation, not just track it.

Why does financial excellence matter for modern finance teams?

In today’s business environment, finance is expected to do more than close the books. It’s a strategic function, responsible for enabling growth, improving agility, and guiding enterprise-wide decisions. But without a structured approach, finance can become reactive—focused on backward-looking reports instead of forward-looking impact. A financial excellence framework provides the roadmap to elevate performance and align finance with the business.

What is a financial excellence framework?

A financial excellence framework is a strategic structure that helps finance functions operate with greater discipline, efficiency, and influence. It typically integrates best practices across key areas such as forecasting, budgeting, reporting, compliance, planning, and analytics.

More than just a checklist, the framework is designed to standardize critical finance processes, ensure data accuracy and integrity, foster continuous improvement, improve cross-functional alignment, and strengthen the strategic role of finance. By implementing a financial excellence framework, finance leaders ensure the team delivers timely insights, supports enterprise strategy, and meets the highest standards of operational performance.

What are the key components of a financial excellence framework?

While each organization may adapt the framework to its own context, most financial excellence frameworks include the following core pillars:

| Pillar | Focus |

| Process Standardization | Streamlined budgeting, forecasting, close, and reporting workflows |

| Technology Integration | Automation, cloud platforms, real-time data access |

| Talent Development | Upskilling, performance management, finance leadership training |

| Business Partnership | Cross-functional collaboration, strategic influence |

| Governance and Compliance | Risk controls, regulatory alignment, internal audit readiness |

| Continuous Improvement | KPIs, benchmarking, feedback loops, agile mindset |

Each of these pillars supports the foundation of financial excellence and contributes to building a finance function that is future-ready and transformation-focused.

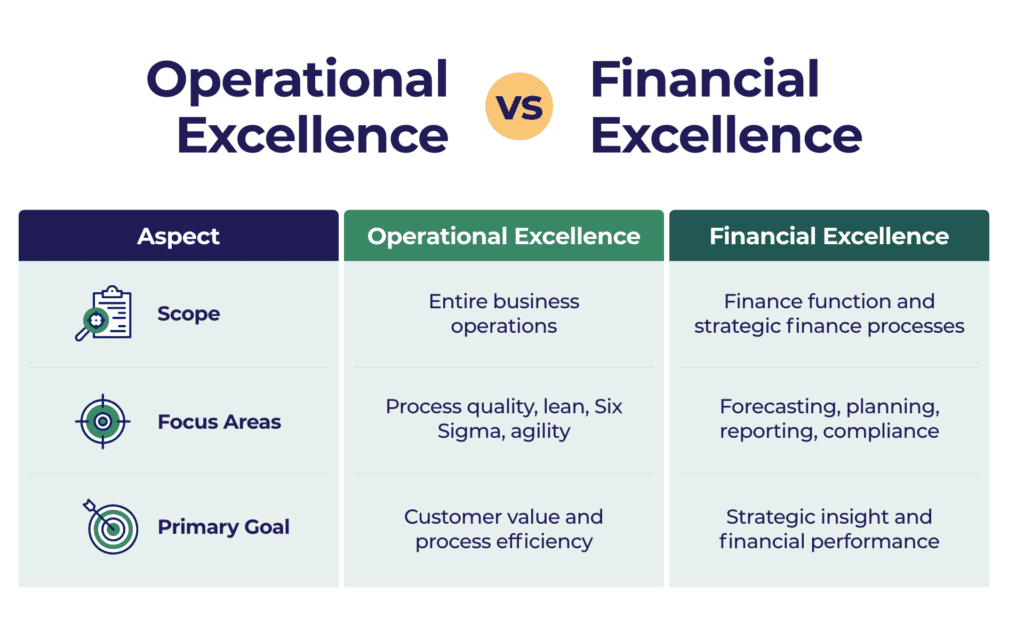

How is financial excellence different from operational excellence?

While both frameworks aim to drive efficiency and performance, financial excellence focuses specifically on the finance function—its processes, capabilities, and strategic influence. Operational excellence, on the other hand, typically covers broader business operations, including supply chain, manufacturing, or customer service.

Integrating both can unlock enterprise-wide transformation—but a dedicated financial excellence framework ensures the finance team leads from the front.

What are the benefits of adopting a financial excellence framework?

Finance teams that implement a financial excellence framework consistently outperform reactive or siloed teams. Key benefits include faster and more accurate planning cycles, improved decision-making through real-time insights, reduced manual workload and spreadsheet risk, greater alignment with business goals, higher performance from finance professionals, and stronger positioning as strategic business partners.

More importantly, financial excellence helps reposition finance from a compliance-focused function to one that delivers measurable value and supports long-term growth. Teams that embrace financial excellence are better equipped to lead transformation, drive efficiency, and support strategic priorities in uncertain markets.

How can my team implement a financial excellence framework?

Start with a clear assessment of your current capabilities. Identify which areas—whether it’s forecasting, business partnering, or compliance—need the most attention. Then, create a phased roadmap that aligns with business goals.

Effective implementation of a financial excellence framework includes engaging stakeholders, automating low-value tasks, defining real-world KPIs, investing in finance-specific training, and embedding strategic thinking into every process.

Financial excellence is not just about doing things better—it’s about doing the right things, faster, and with more clarity. GrowCFO Premium gives finance leaders the frameworks, training, and support to roll out financial excellence at scale and elevate their teams into high-performing strategic partners.

How can GrowCFO support your financial excellence journey?

GrowCFO Premium is designed for finance leaders who want to build lasting capability across people, processes, and technology. Our platform helps you put financial excellence into practice through hands-on resources, expert-led training, and a supportive peer network. Build the skills and systems your team needs to perform at the highest level

Achieve true financial excellence. Explore GrowCFO Premium.

Responses