How can finance functions add more value to a business?

In what ways can the finance function of a business go beyond basic reporting to drive greater business value?

The finance function of business goes far beyond bookkeeping and compliance—it plays a critical role in strategic decision-making and performance enhancement. By actively allocating funds through cash flow, operational, and master budgets, finance leaders can guide growth, improve resource utilization, and empower every department to deliver more impact. When optimized, the finance function becomes a proactive business partner that shapes future success.

What Is the Role of the Finance Function in Today’s Businesses?

Traditionally, the finance function of a business was focused on accounting, compliance, and reporting. But modern finance teams are expected to be strategic collaborators—empowering data-driven decisions, supporting growth, and managing risk.

At its core, the finance function is responsible for allocating funds to various departments and initiatives. This includes creating master budgets (company-wide financial plans), cash flow budgets (to ensure liquidity), and operational budgets (for department-level resource planning). These processes ensure that financial resources are used efficiently, aligned with business goals, and that potential issues are flagged before they become critical.

How Does a Strong Finance Function Drive Business Performance?

A high-performing finance function delivers value in several key ways:

1. Strategic Resource Allocation

Finance doesn’t just manage money—it deploys it to where it delivers the most return. This means assessing projects not only for cost, but for strategic alignment and ROI potential. Businesses with strong finance capabilities make faster, smarter funding decisions.

2. Real-Time Visibility and Insight

By integrating financial data with operational metrics, finance teams provide executives with real-time dashboards and actionable insights. This empowers leaders to act on opportunities faster—and respond to risks before they escalate.

3. Scenario Planning and Forecasting

Finance leaders increasingly use scenario modeling, stress-testing, and rolling forecasts to help companies stay agile. This enables organizations to adapt to changing market conditions with confidence—especially during economic uncertainty.

4. Partnering with the Business

Modern finance teams collaborate closely with marketing, sales, operations, and HR. By speaking the language of each function and embedding finance professionals into cross-functional teams, finance becomes a strategic partner—not just a gatekeeper.

What Are the Tangible Ways Finance Functions Add Value?

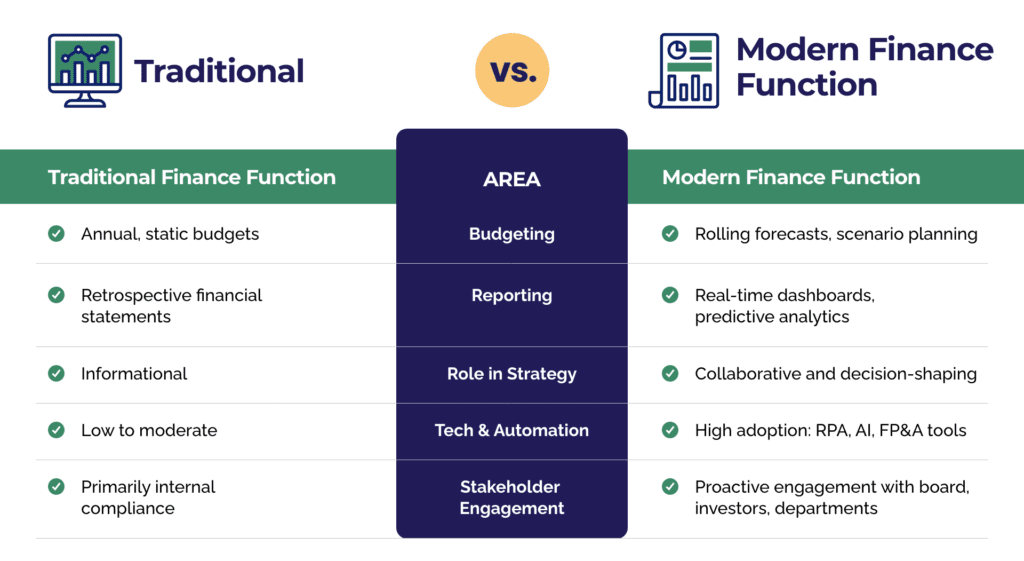

Let’s compare a traditional finance function with a modern strategic finance function:

As the table illustrates, the modern finance function of business is dynamic, tech-enabled, and deeply integrated across the organization.

What Skills Should Finance Leaders Develop to Add More Value?

To fully unlock the strategic potential of the finance function, finance professionals must evolve their skill sets. This includes:

- Data storytelling: Presenting complex financial data in a compelling, decision-ready format

- Technology fluency: Understanding and leveraging automation, AI, and cloud platforms

- Cross-functional collaboration: Working effectively with non-finance stakeholders

- Governance and risk management: Embedding controls while enabling innovation

- Strategic thinking: Linking numbers to long-term business goals

Finance leaders who develop these capabilities become not just stewards of capital, but trusted business advisors.

How Can CFOs Transform the Finance Function?

According to EY and other experts, transformation starts at the top. CFOs must champion a vision where finance is seen as a growth enabler. That means:

- Driving digital transformation in finance systems

- Building a team with both analytical and interpersonal strengths

- Embedding finance talent across the organization

- Leading with a performance mindset—not just compliance

When CFOs lead this transformation, the business unlocks faster growth, better resilience, and sharper competitive advantage.

Why Does This Matter More Than Ever?

In today’s volatile environment, the difference between thriving and surviving often comes down to financial agility. Companies can no longer afford a finance function that simply reports the past—they need one that helps shape the future.

From identifying new revenue streams to optimizing working capital and navigating economic shocks, finance teams must step forward as proactive leaders of performance and growth.

Ready to Transform Your Finance Function?

GrowCFO’s “Strategic Finance Leadership” module helps CFOs and senior finance professionals rethink the role of finance in business. Through on-demand content, real-world case studies, and practical frameworks, you’ll learn how to:

- Align finance with enterprise strategy

- Lead budgeting, forecasting, and scenario planning with impact

- Elevate boardroom communication and stakeholder trust

- Build high-performing finance teams

The finance function of business isn’t just about managing money—it’s about driving value. When equipped with the right tools, mindset, and leadership, finance becomes one of the most powerful levers for business success.

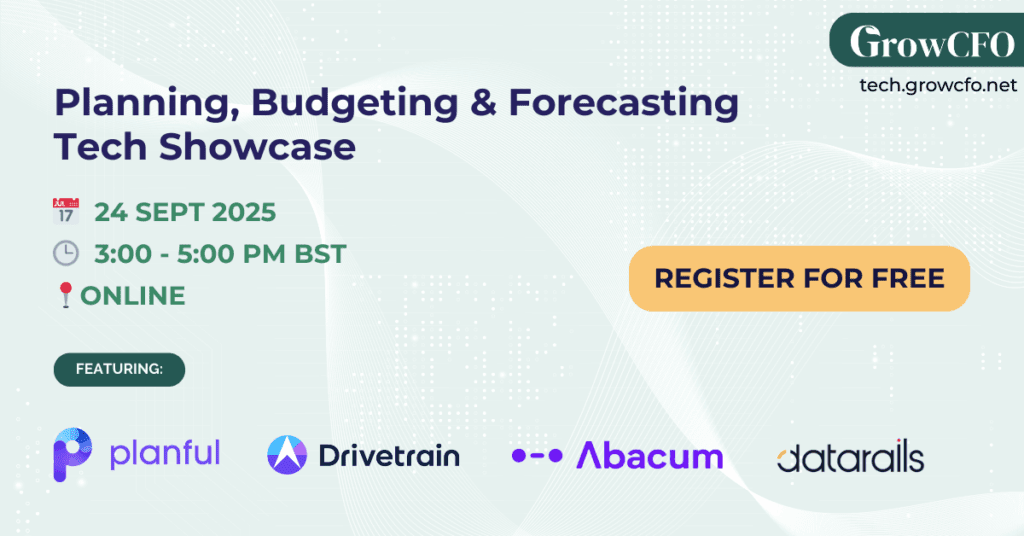

Join the CFO Preview Event

Take the next step toward becoming the leader your business — and your team — needs.

Responses