Who Are the Key Stakeholders for a CFO?

Who are the key external and internal stakeholders a CFO must engage with to drive business success?

A CFO’s effectiveness depends on their ability to understand and manage both external and internal stakeholders. These stakeholders include investors, board members, department leaders, employees, customers, and regulators — each with different priorities and expectations. Successful CFOs balance financial oversight with strategic communication across stakeholder groups to drive alignment, trust, and long-term growth.

Why Do External and Internal Stakeholders Matter to CFOs?

CFOs sit at the center of strategic decision-making and financial accountability. To succeed in this role, they must actively manage the expectations, needs, and influence of both external and internal stakeholders. Why?

Because these relationships shape:

- Investor confidence and capital access

- Team productivity and cross-functional alignment

- Strategic agility and operational resilience

- Brand reputation and customer loyalty

- Regulatory compliance and risk mitigation

A CFO who fails to engage the right stakeholders — or doesn’t adapt their approach to each — risks misalignment, inefficiency, and missed opportunities.

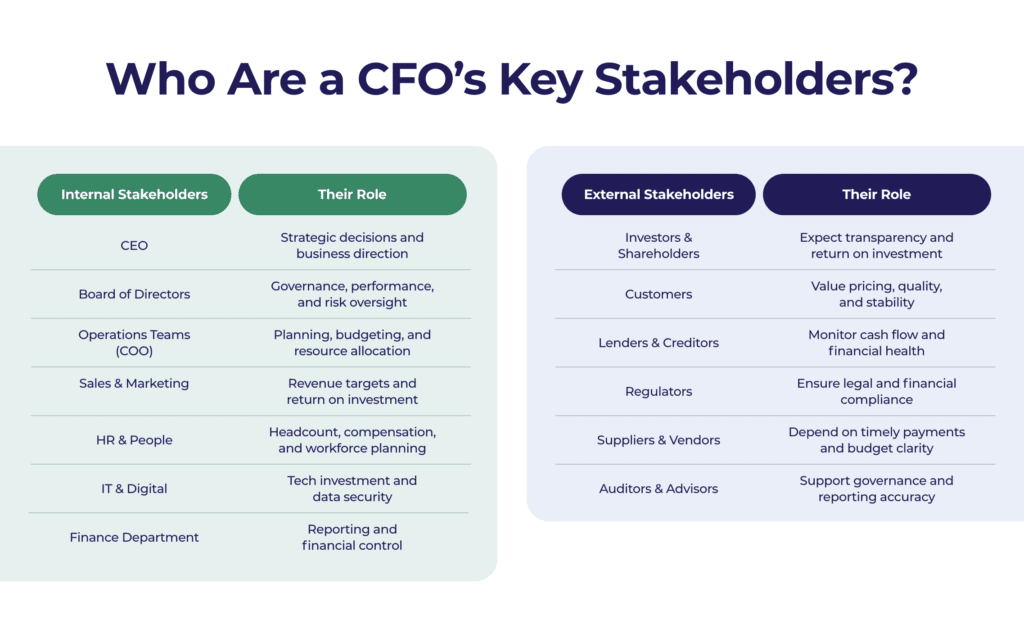

Who Are the CFO’s Internal Stakeholders?

Internal stakeholders are individuals or teams within the organization whose performance or decision-making is influenced by finance. CFOs must align with these roles daily to ensure clarity, control, and strategic progress.

Key internal stakeholders include:

- CEO – The CFO’s closest collaborator; drives strategic financial decisions

- Board of Directors – Oversees performance, governance, and risk

- COO & Operations Teams – Align on budgeting, planning, and resource allocation

- Sales & Marketing Leaders – Set revenue targets, cost efficiency, and ROI

- HR & People Teams – Collaborate on workforce planning and compensation

- IT & Digital Teams – Work together on technology investment and data security

- Finance Department – Ensures reporting accuracy and drives day-to-day execution

The more effectively CFOs can partner with internal stakeholders, the more influence they hold across the enterprise.

Who Are the CFO’s External Stakeholders?

External stakeholders influence the business from outside the organization. Managing these relationships with clarity and consistency is essential for long-term performance.

Key external stakeholders include:

- Investors & Shareholders – Expect transparency, returns, and capital efficiency

- Customers – Care about pricing, product quality, and financial stability

- Lenders & Creditors – Monitor debt, cash flow, and financial health

- Regulatory Authorities – Require compliance and timely financial disclosure

- Suppliers & Vendors – Need visibility on budgets, contracts, and payment cycles

Auditors & Advisors – Rely on collaboration for reporting accuracy and governance

Each external stakeholder group presents different risks and expectations. CFOs must tailor communications to maintain trust and influence outcomes.

How Can CFOs Balance External and Internal Stakeholder Needs?

Effective CFOs balance often competing demands — growth vs. cost control, agility vs. compliance, shareholder returns vs. employee well-being. Success comes down to how well they manage external and internal stakeholders and align them behind a shared vision.

| Stakeholder Focus | CFO Responsibility |

| Internal alignment | Facilitate transparency, planning, and execution |

| External communication | Present reliable data and insights |

| Risk management | Ensure compliance and operational resilience |

| Long-term vision | Translate numbers into strategy |

| Cultural leadership | Influence ethics, collaboration, and accountability |

Mastering the balance between external and internal stakeholders requires more than financial literacy — it takes executive presence, strategic communication, and leadership maturity. That’s where a structured CFO course or development program can make a measurable difference.

What Happens When CFOs Don’t Prioritize Stakeholder Relationships?

When CFOs neglect the needs of external and internal stakeholders, the consequences are tangible:

- Internal teams misalign on budgets and priorities

- Investors lose confidence due to unclear reporting

- Regulators impose penalties for non-compliance

- Vendors and suppliers delay partnerships

- Customers question financial stability

CFOs who succeed in today’s volatile environment are proactive relationship-builders. A strong CFO doesn’t just report performance — they create the conditions for it through strategic engagement with both external and internal stakeholders.

Want to strengthen your stakeholder leadership?

Join our Future CFO Preview Event to explore how GrowCFO can help you lead with clarity, confidence, and influence across your stakeholder ecosystem.

Responses