What Are The Steps To Becoming A CFO?

How do you become a CFO?

To become a CFO, you need a combination of education, technical finance expertise, leadership capability, and strategic insight. While the path can vary, most successful CFOs build their careers through deliberate progression in finance roles, formal qualifications, and experience driving business performance. If you’re asking “how to become a CFO,” start by investing in your foundational finance skills while developing leadership acumen and commercial thinking.

What educational background do you need to become a CFO?

One of the first steps in learning how to become a CFO is understanding the educational expectations. Most CFOs hold at least a bachelor’s degree in finance, accounting, economics, or business. Many also pursue advanced qualifications to gain leadership and strategic depth.

Typical educational milestones:

- Bachelor’s Degree: A must-have, usually in finance, accounting, economics, or business

- Master’s Degree or MBA: Common among CFOs, offering leadership development and strategic finance training

- Professional Certifications: Designations like CPA, CFA, or FMVA® enhance credibility and financial expertise

💡 Tip: Supplement your learning with online short courses in business risk, compliance, or strategic management to accelerate your journey.

What experience is required to become a CFO?

Understanding how to become a CFO means knowing which roles prepare you best. While there’s no fixed ladder, CFOs typically build their career through increasingly senior finance positions.

Common stepping stones:

- Financial Analyst

- Finance Manager

- Financial Controller

- Director of Finance

To stand out as a future CFO candidate, you should:

- Build a track record managing budgets, teams, and cross-functional initiatives

- Lead on forecasting, financial planning, and risk assessments

- Demonstrate strategic decision-making and commercial awareness

These are the kinds of milestones GrowCFO’s Future CFO Program is designed to help you navigate.

What skills should a future CFO develop?

If you’re serious about how to become a CFO, technical expertise alone won’t cut it. You need a balanced skill set that includes leadership, strategic foresight, and data fluency.

| Skill Type | Examples |

| Technical Skills | Financial reporting, budgeting, compliance, risk management |

| Strategic Thinking | Capital allocation, business modelling, scenario planning |

| Leadership | Team management, stakeholder influence, communication |

| Tech & Analytics | ERP systems, automation tools, data-driven forecasting |

These are the exact capabilities built into the GrowCFO Future CFO Program, which helps you shift from operational expert to strategic finance leader.

How long does it take to become a CFO?

When considering how to become a CFO, timing matters — and expectations should be realistic. Most CFOs reach the position after 15–20 years of progressive experience, though this varies based on industry, company size, and individual ambition.

Factors that influence your timeline:

- Size and growth stage of your organisation

- How early you step into leadership and strategy roles

- The breadth and depth of your finance expertise

You can accelerate this by:

- Volunteering for cross-functional transformation projects

- Building strong internal and external networks

- Making your CFO ambitions known to mentors and decision-makers

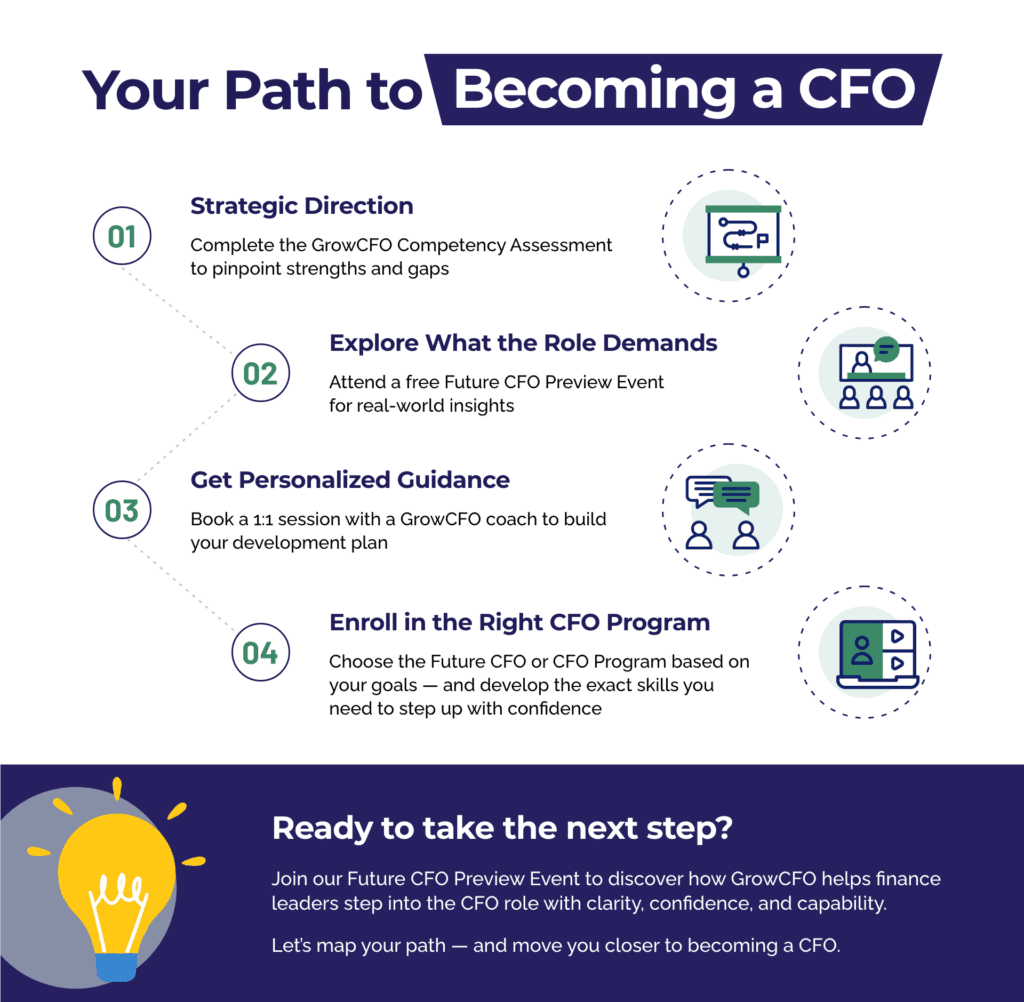

What are some practical steps to take right now?

If you’re ready to take control of how to become a CFO, here’s where to begin:

Complete a CFO Competency Assessment to identify your strengths and gaps

Attend a Future CFO Preview Event to understand what the role really demands

Book a 1:1 development call with a GrowCFO coach to map your personal growth plan

Enrol in the Future CFO Program or CFO Program — whichever aligns with your goals.

Ready to take the next step?

Join our Future CFO Preview Event to discover how GrowCFO helps finance leaders step into the CFO role with clarity, confidence, and capability.

Responses