What Are the Different Types of CFOs?

What are the different types of CFOs, and which one are you becoming?

There are several types of CFOs — each defined by how they think, lead, and create value. Some focus on financial control and precision. Others prioritise strategy, growth, or transformation. Understanding the different types of CFOs helps you identify where you are now, what your business needs, and how to evolve into a more impactful finance leader.

Why does it matter to know the different types of CFOs?

The CFO role is no longer one-size-fits-all. Companies need different strengths at different stages — from stabilisation and control to expansion and innovation. Likewise, finance professionals preparing for the CFO role must recognise their natural leadership style, and where they may need to grow to meet the demands of a broader, more strategic position.

This is especially important for finance leaders who want to progress beyond reporting and operations into high-impact, board-level influence.

What are the main types of CFOs?

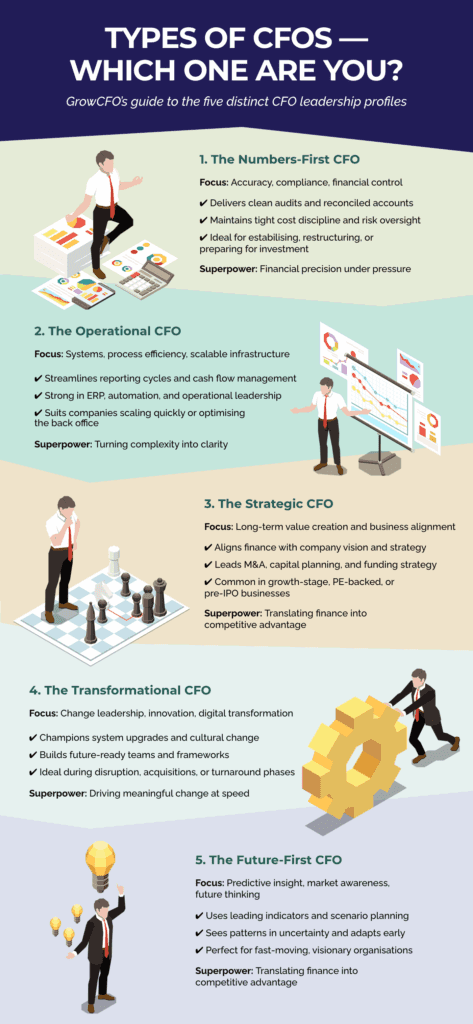

Based on industry patterns and our experience at GrowCFO, most CFOs tend to fall into one of the following five categories:

1. The Numbers-First CFO

Grounded in accounting, this CFO prioritises accuracy, compliance, and control. They excel in detail, reporting integrity, and risk mitigation.

- Delivers clean audits and reconciled accounts

- Maintains tight cost control and financial discipline

- Suited to businesses needing stability, turnaround, or investor readiness

2. The Operational CFO

Focused on internal processes, systems, and team efficiency. They often come from controller or operations roles and are excellent at building scalable finance infrastructure.

- Improves reporting cycles, cash flow management, and back-office efficiency

- Strong with ERP systems, shared services, and cross-functional execution

- Ideal for companies scaling quickly or consolidating operations

3. The Strategic CFO

Partners closely with the CEO to align finance with business direction. This CFO is deeply involved in business planning, capital allocation, and corporate development.

- Shapes long-term strategy and commercial decision-making

- Supports M&A, capital raises, and growth initiatives

- Often emerges in PE-backed, high-growth, or pre-IPO companies

- Example of strategic focus

4. The Transformational CFO

Leads change. Whether it’s digital transformation, restructuring, or a new business model, this CFO thrives during major shifts.

- Champions systems upgrades, automation, and data strategy

- Builds future-ready finance teams and cultures

- Key in moments of disruption, acquisition, or innovation

5. The Future-First CFO

Visionary and data-driven, this CFO sees beyond the numbers. They turn uncertainty into opportunity, use data to drive decisions, and position finance as a growth enabler.

- Leverages leading indicators and predictive analytics

- Anticipates change and builds scenario-based plans

- Ideal for dynamic, forward-looking organisations

Which type of CFO are you today — and who do you want to become?

It’s rare for any CFO to be just one type. The most effective finance leaders are adaptable, evolving their style as their business and career progress.

At GrowCFO, we help leaders move beyond their default mode and step into broader influence. For example:

- A Numbers-First CFO can learn to communicate more strategically

- An Operational CFO can grow into a commercial or investor-facing role

- A Transformational CFO can deepen technical rigour or governance oversight

That development doesn’t happen by accident. It starts with recognising your current profile, identifying what’s missing, and building the skills and confidence to lead at the next level.

How can you figure out what kind of CFO your business needs — or what kind you’re becoming?

Start by asking:

- What phase is the business in — stabilising, scaling, transforming?

- Are you being asked to drive change, or maintain control?

- Do you currently operate more internally (process, reporting) or externally (strategy, investors)?

- Where are you strongest — and where do you feel stretched?

If you’re unsure, you’re not alone. Most future CFOs haven’t had the space to reflect on this — or the guidance to develop across all four dimensions of modern CFO leadership: financial control, operational efficiency, strategic alignment, and change leadership.

That’s exactly what our Future CFO Preview Event is designed to help you explore.

Final thoughts on the types of CFOs

Knowing the different types of CFOs isn’t just a framework — it’s a roadmap. It helps you understand where you are, what your company needs, and where you’re headed.

If you’re serious about stepping into your first CFO role — or becoming a more well-rounded finance leader — now is the time to reflect, re-skill, and reposition.

Want to become a CFO?

Join our Future CFO Preview Event to learn how the GrowCFO Future CFO Programme helps ambitious finance professionals step into their first CFO role with confidence. Discover which type of CFO you are today, what skills you need next, and how to accelerate your journey to the top.

Reserve your place now.

Responses