Do I Need to Know All Finance Skills to Become a CFO?

Do you need to master every finance skill to become a successful CFO?

You don’t need to know every finance skill in depth to become a CFO, but you do need a strong foundation across core finance disciplines. Successful CFOs combine technical proficiency with strategic thinking, leadership, and the ability to translate financial insight into business impact. Developing key finance skills — while also honing soft skills and digital fluency — is essential for any aspiring finance leader.

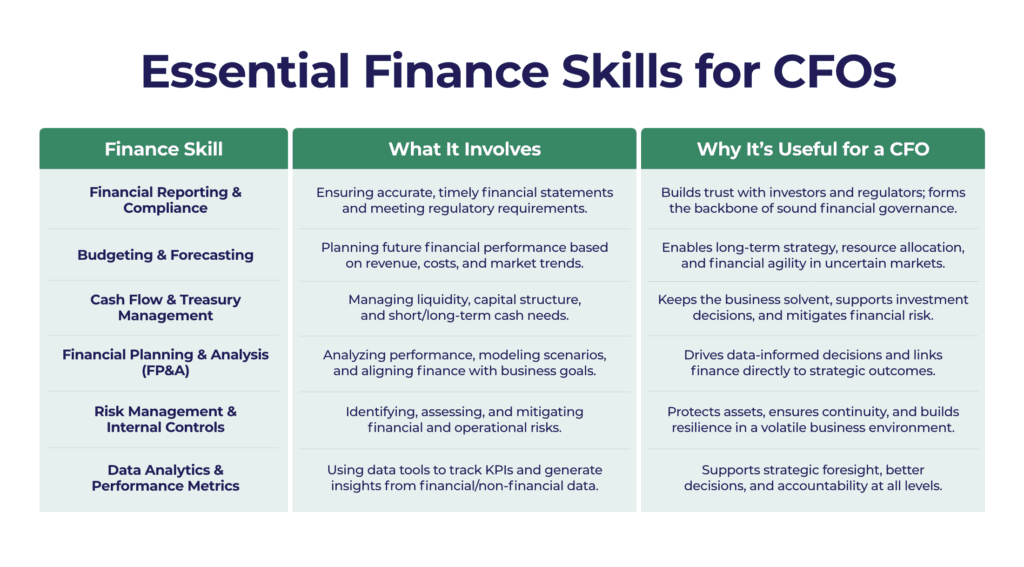

What are the essential finance skills every CFO should have?

CFOs are no longer just the stewards of financial reporting — they’re now strategic partners shaping business direction. While it’s unrealistic to expect deep mastery in every finance function, aspiring CFOs must understand and oversee a wide breadth of financial areas. According to ACCA, core finance skills include:

- Financial reporting and compliance

- Budgeting and forecasting

- Cash flow and treasury management

- Financial planning and analysis (FP&A)

- Risk management and internal controls

- Data analytics and performance measurement

These foundational skills help CFOs guide decisions, ensure financial health, and support long-term business strategy. You may not do each task yourself, but understanding how these functions work — and how to manage the people who do them — is crucial.

Is technical knowledge enough to become a CFO?

No. As CFO.University puts it, finance leaders must evolve beyond being “scorekeepers” to become strategic advisors. While technical proficiency is non-negotiable, soft skills and strategic competencies matter just as much — if not more — for CFO roles. These include:

| Technical Finance Skills | Strategic & Leadership Skills |

| Financial reporting | Business acumen |

| Budgeting | Communication & storytelling |

| Risk & compliance | Strategic planning |

| Treasury & cash flow | Change management & adaptability |

| Forecasting | Team leadership & cross-functional influence |

A standout CFO bridges both sides — translating financial data into business insight, managing stakeholders, and leading transformation across the organization.

What qualifications are needed to become a CFO?

CFOs need finance skills such as operational knowledge related to accounting, finance, and general business practices, and the ability to think strategically and see the big picture. Most companies look for:

- A bachelor’s degree in accounting, finance, or economics

- A professional qualification (e.g., ACCA, CPA, CIMA)

- Often, an MBA or master’s in finance or leadership

Because of the increasing impact of technology on finance, today’s CFOs must also be familiar with the software and digital tools required to run a modern finance and accounting operation — from ERP systems to data visualization and BI platforms.

Can I become a CFO without knowing every financial function in detail?

Absolutely. Leadership at the CFO level is more about knowing how to ask the right questions, interpret information, and make decisions based on insights — not executing every spreadsheet or accounting entry yourself.

GrowCFO often sees candidates struggle when they try to master everything instead of delegating or building strong teams. As long as you understand how each area contributes to the bigger picture and can manage or influence the right experts, you can succeed.

How can I develop the right mix of finance skills?

To accelerate your path to CFO, focus on breadth first, depth where it counts:

- Start with core technical fluency. If you’re weak in an area like forecasting or cash flow, upskill or shadow someone who’s strong in it.

- Step outside pure finance. Gain exposure to operations, sales, or technology to broaden your commercial perspective.

- Develop leadership and storytelling skills. Practice explaining financial outcomes in a compelling way to non-finance audiences.

- Stay digitally current. Learn to work with automation tools, analytics platforms, and AI-driven reporting tools.

What programs can help me become CFO-ready?

If you’re serious about becoming a CFO, GrowCFO offers practical programs tailored to your development path:

- The CFO Competency Assessment — identify your strengths and skill gaps

- The Future CFO Program — learn how to lead at board level, communicate with impact, and drive strategic change

Take the GrowCFO Competency Assessment to discover which finance skills you need to strengthen to progress to CFO.

Responses