Most Finance Leaders Are Capable of Being CFO

Few Are Operating Like One.

You’ve delivered the numbers. You’re trusted internally. Your forecasts are solid.

But then it happens.

The CEO challenges your assumptions mid-meeting. A non-exec asks why capital allocation hasn’t shifted. Strategy is debated and you hesitate for half a second too long.

That hesitation is the gap.

And in 2026, that gap matters more than ever. Why 2026 Is Different

Technical finance capability is no longer impressive.

It’s assumed.

Boards are facing:

- Higher capital scrutiny

- Persistent volatility

- AI-driven operational redesign

- Tighter funding environments

- Greater expectation of finance-led strategic clarity

The question is no longer:

“Is this person a strong finance operator?”

It’s:

“Can this person lead this business?”

Competence is table stakes. Ownership is the differentiator.

A Practical Plan to Step Into 2026 Ready

Instead of vague development goals, follow this structured progression.

1. Research the role you want

Study real CFO job descriptions. Talk to current CFOs. Identify patterns in expectations.

Ask: What are they accountable for that I am not yet owning?

Write this down clearly.

2. Map your current capability

Use a structured benchmark rather than instinct.

The GrowCFO CFO Competency Assessment is designed to help you identify strengths and development areas across leadership, strategy, commerciality, and technical domains.

You need clarity before action.

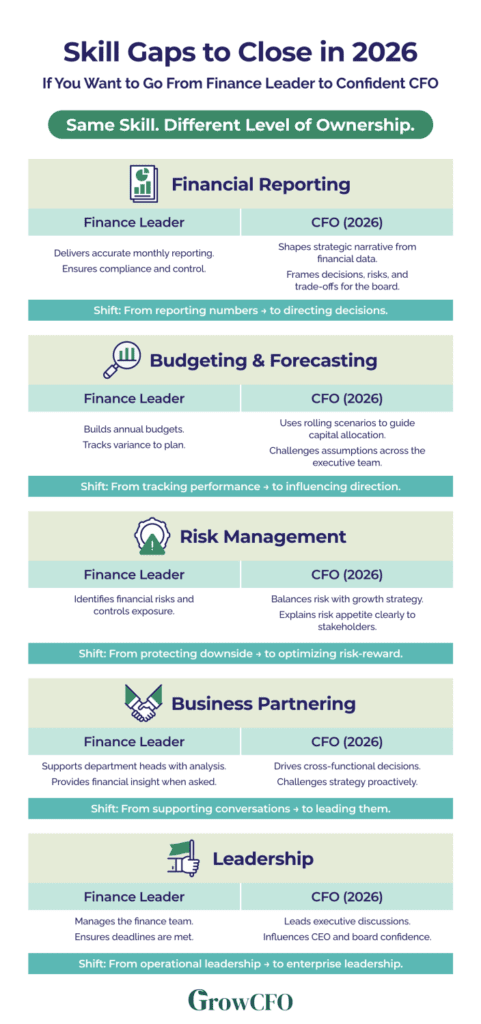

3. Choose three skill gaps

Do not try to fix everything.

Example:

- Board communication

- Strategic scenario modeling

- Executive presence

These become your 2026 development priorities.

Build deliberate learning around those gaps

This is where most leaders drift.

Instead of passive learning, choose targeted skill-building environments, for example:

- Simulation-based practice

- Peer discussion groups

- Board-level scenario exercises

- Mentored feedback environments

Within the GrowCFO community, finance leaders consistently tell us that clarity around strengths and gaps changes everything.

During our Future CFO Preview Event, participants receive a guided tour of the CFO Competency Framework and the GrowCFO platform, including simulators and the virtual boardroom environment.

Many leave with greater confidence simply because they can see the path, not just the ambition.

Clarity reduces hesitation. Structure reduces doubt.

Mini FAQ

Do I need to be a CFO already?

No. Many attendees are future or aspiring CFOs preparing for the step up.

Is this only about technical finance skills?

No. It covers leadership, strategic thinking, board interaction, and confidence.

Is there any commitment required?

No. It is a free preview workshop designed for learning and clarity.

Responses