What Skills Do Finance Business Partners Need?

What are the most important finance business partner skills for success?

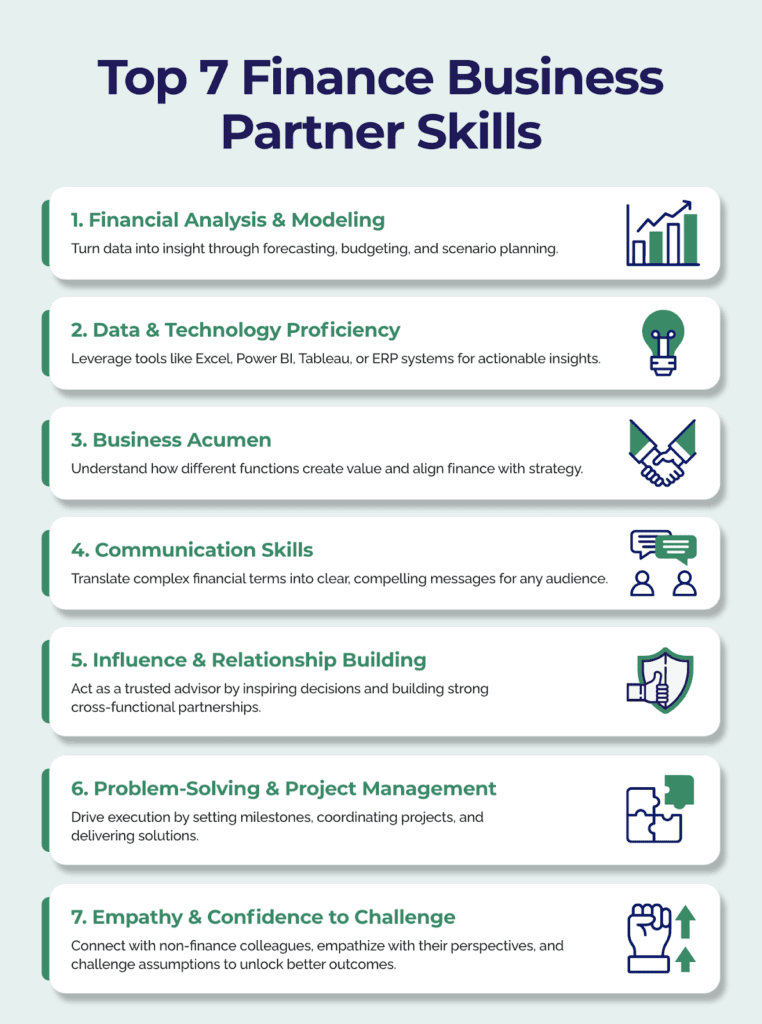

The most effective finance business partners combine technical expertise with strong interpersonal and strategic abilities. Key finance business partner skills include financial analysis, business acumen, empathy, communication, and the ability to influence decisions. By blending hard data skills with softer relationship-building capabilities, finance professionals can drive better outcomes and position themselves as trusted advisors to leadership teams.

Why are finance business partner skills critical for modern organizations?

Finance teams are traditionally strong in technical areas like financial reporting, analysis, and modeling. However, successful finance business partners go beyond numbers. They apply finance business partner skills to bridge the gap between financial insight and business strategy.

By doing so, they help leadership teams see the bigger picture, challenge assumptions, and make data-informed decisions that support long-term growth.

What technical finance business partner skills are essential?

While interpersonal skills often differentiate outstanding business partners, technical skills remain the foundation. Finance business partners need to:

- Perform financial analysis and modeling to support forecasting, budgeting, and scenario planning

- Leverage data analytics tools such as Excel, Power BI, or Tableau to extract actionable insights

- Apply accounting knowledge to ensure accuracy, compliance, and transparency

- Work with ERP systems like SAP or Oracle to integrate company financials and streamline processes

Without these technical finance business partner skills, it is difficult to earn credibility with senior leaders or build the financial clarity needed to inform strategy.

Why are interpersonal skills more important than technical expertise?

A critical insight for finance business partners is that numbers alone rarely drive change. Data only adds value when it is communicated effectively and applied to real-world decisions. Interpersonal finance business partner skills are therefore just as important, if not more important, than technical expertise.

Key interpersonal skills include:

- Empathy: Understanding the challenges and perspectives of non-finance stakeholders

- Influence: Sharing insights in a way that resonates with decision-makers and motivates action

- Collaboration: Building strong relationships across departments to align goals

- Confidence to challenge: Encouraging teams to question the status quo and explore better solutions

By applying these skills, finance business partners act as change agents who not only interpret data but also inspire transformation across the business.

How does business acumen strengthen finance business partner skills?

Business acumen is the ability to understand how different parts of an organization operate and connect. For finance business partners, this means knowing what drives value in marketing, operations, HR, or sales, and tailoring financial insights to those contexts.

A partner with strong business acumen can answer the question: How does this financial data translate into risk, growth, or opportunity for this department?

Finance professionals who build this skill position themselves as trusted advisors rather than back-office analysts.

Which project management and problem-solving skills matter most?

Finance business partnering is not just about analysis, it’s about execution. Strong project management skills ensure that insights lead to action. This includes:

- Setting milestones and holding teams accountable

- Coordinating cross-functional projects and initiatives

- Following through on agreed actions and tracking results

Problem-solving is also core to finance business partner skills. By identifying bottlenecks, proposing practical solutions, and aligning stakeholders, finance professionals can create tangible improvements in performance.

What role does communication play in finance business partnering?

Communication is often the skill that determines whether financial insights make an impact. Finance business partners must be able to:

- Translate complex financial terms into clear, accessible language

- Tailor messages differently for CEOs, boards, and operational teams

- Use storytelling techniques to make financial data engaging and memorable

In short, communication is the bridge that connects data with decision-making.

Comparison: Technical vs. Interpersonal Finance Business Partner Skills

| Skill Category | Examples | Why It Matters |

| Technical Skills | Financial modeling, data analytics, accounting, ERP systems | Builds credibility and ensures accurate insights |

| Interpersonal Skills | Empathy, influence, collaboration, communication | Drives adoption of financial insights across the organization |

| Strategic Skills | Business acumen, challenging the status quo, problem-solving | Aligns finance with long-term growth and value creation |

The strongest finance business partners balance all three skill categories, combining analytical rigor with human connection and strategic vision.

How can finance professionals develop stronger business partner skills?

Finance business partner skills can be learned and refined with practice, but structured training accelerates the process. Programs like the GrowCFO Business Partner Course are designed to help finance professionals develop these capabilities. Through practical workshops and scenario-based learning, participants learn how to influence decisions, communicate effectively, and align finance with business strategy.

The skills of a finance business partner extend well beyond technical expertise. While financial analysis and data tools provide the foundation, interpersonal and strategic skills unlock real value.

Responses