Why CFOs Are Missing the ROI Opportunity in Accounts Payable

Why accounts payable may be the biggest untapped lever for efficiency, compliance, and strategic value.

IDC’s latest research reveals a staggering figure: by 2030, every new dollar invested in AI will generate an additional $4.90 in value. That kind of ROI is hard to find anywhere else in finance. And yet, many CFOs are missing one of the most powerful starting points for this transformation—accounts payable (AP).

For too long, AP has been treated as a back-office cost center. Manual invoice processing eats up time, creates errors, and frustrates staff. But in today’s environment, where CFOs are expected to be strategic architects of growth, resilience, and transformation, ignoring AP is leaving money—and insight—on the table.

Why Accounts Payable Must Change

The IDC InfoBrief From Bottleneck to Powerhouse, commissioned by Rossum, highlights a clear reality: AP is a high-volume, data-heavy process that touches everything from cashflow to forecasting.

“In 25% of organizations, more than 10% of AP transactions require correction.”

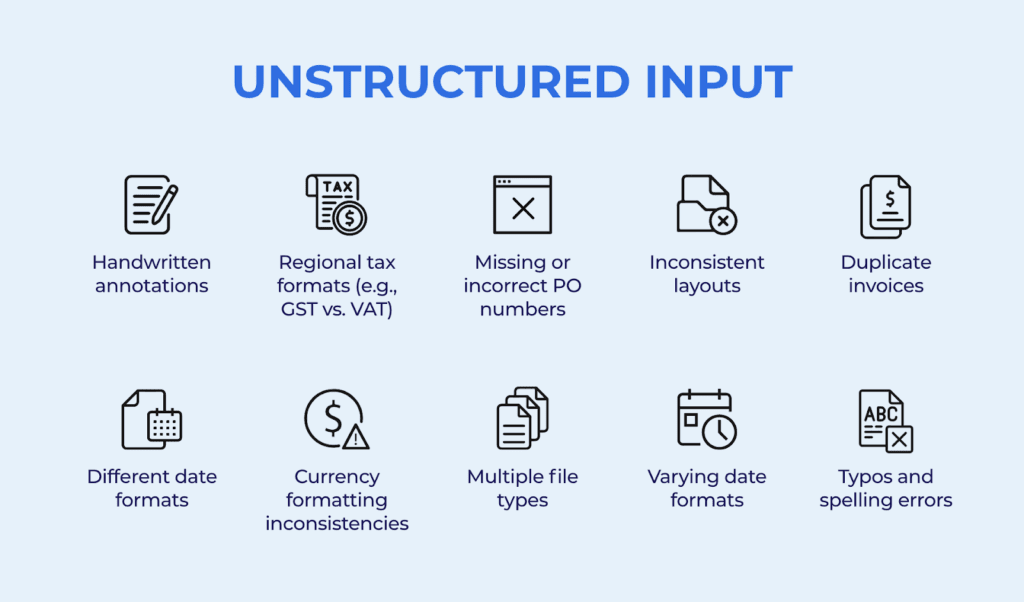

And yet, it’s also one of the least modernized functions in many finance teams. According to the IOFM, in around 25% of organizations, more than 10% of transactions require correction. That means wasted time, added costs, and higher risk—all because of messy, unstructured inputs that AP teams are forced to work with, such as:

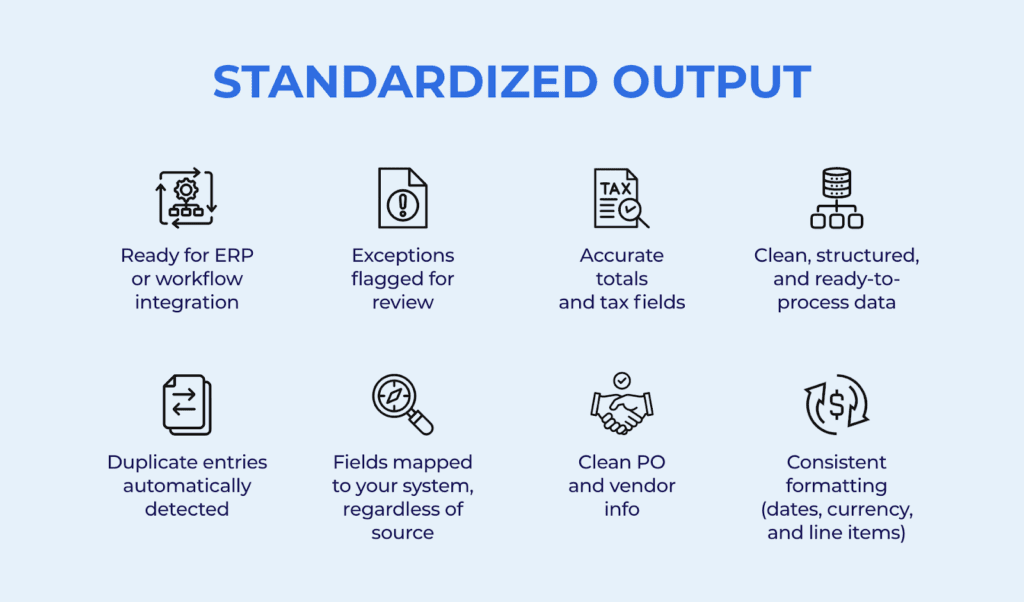

By contrast, an AI-powered document processing platform can standardize and structure AP data so it becomes:

This shift doesn’t just eliminate errors—it changes the KPIs that matter most to CFOs:

- Efficiency: Faster approvals, higher PO match rates, and captured early payment discounts deliver immediate financial gains. Automated workflows also reduce payroll costs and protect EBITDA.

- Effectiveness: AI aligns AP with broader business goals, from optimizing working capital to improving forecasting accuracy.

- Experience: Finance teams and suppliers benefit from reduced manual workloads, fewer disputes, faster payments, and stronger relationships.

“Automation reduces payroll costs and protects EBITDA — a key metric for private equity-backed firms.”

Why Accounts Payable is Still Lagging Behind

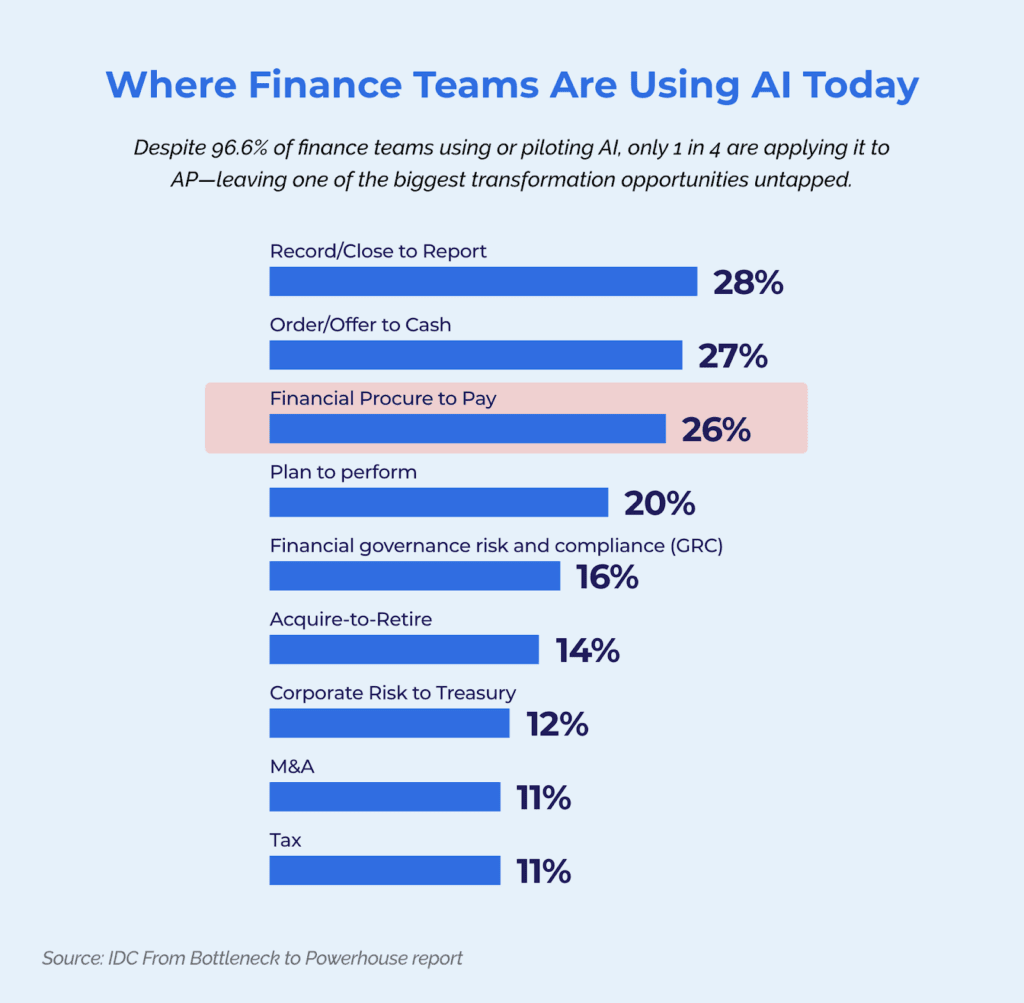

AI is no longer experimental in finance. According to IDC, 96.6% of finance teams are already using or piloting AI, with adoption strongest in areas like record-to-report and order-to-cash.

“96.6% of finance teams are already using or piloting AI — but only 26% apply it to accounts payable.”

But when it comes to accounts payable, adoption drops off sharply: only 26% of organizations have implemented AI in their procure-to-pay processes.

That gap represents a huge opportunity. While AP is one of the most data-heavy, error-prone, and strategically critical functions in finance, too many CFOs are leaving it stuck in the manual era—missing out on faster close cycles, improved working capital, and cleaner compliance.

How Rossum Turns AP into a Strategic Powerhouse

Rossum, the AI-first platform for document automation, was designed to solve this exact problem. Instead of treating AP as a bottleneck, Rossum transforms it into a source of clean, reliable, decision-ready data.

Here’s how:

- Any document, any format: Extracts invoice data from any language, type, or layout.

- Trust, but verify: Applies country-specific rules and exception handling across entities to ensure compliance.

- Automated matching: Validates invoices against POs, line items, and contracts to minimize exceptions.

- Tax & VAT compliance: AI-driven mapping keeps entries accurate and regulation-ready.

- Human-in-the-loop: A simple interface lets finance teams review and approve flagged items, combining AI speed with human oversight.

“Rossum transforms messy, unstructured invoices into clean, decision-ready data.”

The result is faster, more accurate, and fully compliant invoice processing that frees finance teams from low-value manual tasks—and equips the CFO office with better visibility and control.

From Bottleneck to Powerhouse

As IDC concludes, accounts payable is the first domino in financial transformation. Modernizing AP with AI isn’t just about cost reduction—it’s about enabling CFOs to unlock efficiency, agility, and strategic value across the enterprise.

Rossum makes this shift possible. With AI-first document automation, CFOs can finally realize the promise of “$1 in, $4.90 out”—turning AP into a true powerhouse for growth.

👉 Discover how Rossum transforms AP with AI

Responses