What Does a CFO Do?

What are the main responsibilities of a CFO in today’s business landscape?

A Chief Financial Officer (CFO) oversees all financial activities of an organization — from managing cash flow and financial reporting to shaping business strategy. If you’re asking what does a CFO do, the answer spans financial stewardship, operational leadership, and strategic influence across the business. Today’s CFOs are expected to be as comfortable with analytics and digital transformation as they are with balance sheets.

What Is a Chief Financial Officer?

A Chief Financial Officer (CFO) is the senior executive responsible for managing a company’s financial actions. This includes tracking cash flow, budgeting, financial forecasting, and ensuring accurate financial reporting. CFOs also analyze financial strengths and weaknesses and recommend strategic corrective actions to optimize business performance.

According to Investopedia, the CFO role overlaps with that of a controller or treasurer, as they also oversee accounting departments and ensure compliance. In essence, a CFO blends financial expertise with executive leadership.

What does a CFO do in 2025?

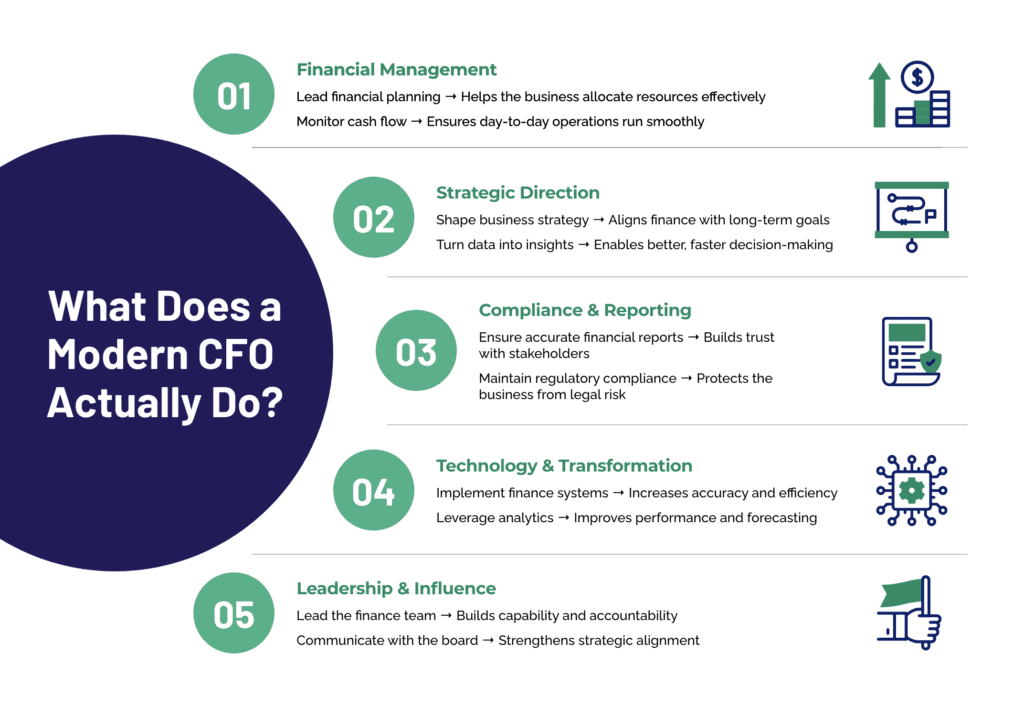

Today’s CFOs are more than just finance gatekeepers — they are business partners to the CEO and strategic influencers across the executive team. Here’s what their role typically entails:

1. Financial Management

- Lead budgeting, forecasting, and financial planning

- Monitor cash flow and working capital

- Oversee investment decisions and financial risk

2. Strategic Direction

- Contribute to corporate strategy development

- Translate financial data into strategic insights

- Align financial goals with business objectives

3. Compliance & Reporting

- Ensure financial statements are accurate and timely

- Maintain compliance with regulations and tax laws

- Coordinate audits and internal controls

4. Technology & Transformation

- Adopt and oversee financial systems and automation tools

- Support digital transformation efforts across finance

- Use data analytics to drive better business decisions

5. Leadership & Influence

- Lead the finance and accounting teams

- Influence cross-functional decision-making

- Communicate financial health to the board and investors

How has the CFO role evolved?

The role of CFO has significantly expanded in the last decade. According to McKinsey, CFOs are no longer siloed in finance — they’re now playing an integral role in digital transformation, talent strategy, sustainability, and even innovation.

In a data-driven, uncertain business environment, CFOs must provide real-time financial insight and act as translators between numbers and strategy. Their credibility and influence across the organization are vital for steering through volatility.

How do CFO responsibilities differ by company size?

Here’s a comparison to illustrate how a CFO’s role varies based on business maturity:

| Startups & SMEs | Mid-size & Enterprise CFOs |

| Often hands-on with bookkeeping & compliance | Delegates technical tasks, focuses on big-picture strategy |

| May wear multiple hats (Ops, HR, Finance) | Works closely with COO, CIO, CHRO, etc. |

| Focus on cash flow, fundraising, and survival | Focus on governance, global expansion, M&A |

| Reports directly to founders or board | Active in investor relations and long-term planning |

What makes a great CFO?

A strong CFO blends technical expertise, strategic thinking, and emotional intelligence. It’s not just about knowing the numbers — it’s about using them to tell a compelling story, influence decisions, and guide long-term success.

Essential attributes include:

- Financial acumen

- Strong communication skills

- Change leadership

- Integrity and objectivity

- Tech and data fluency

The best CFOs are those who don’t just report on the past — they shape the future.

How can you prepare for a CFO role?

GrowCFO offers structured pathways to help aspiring and current CFOs sharpen the skills required to lead effectively:

- CFO Competency Framework — assess your readiness and skill gaps

- Future CFO Program — prepare for boardroom presence and strategic leadership

- Finance Leader Courses — upskill in FP&A, business partnering, and digital finance

Start with the GrowCFO Competency Assessment to benchmark your capabilities and accelerate your development.

Responses