AI Agents: Hype or Reality?

AI is everywhere right now. It’s in every boardroom pitch, every vendor demo, every headline. From generative copilots to autonomous agents, the hype cycle is in full swing—and finance leaders are being bombarded with bold claims and shiny dashboards. But behind the noise lies a very real challenge: CFOs don’t always know what’s truly possible—or where to begin.

And that uncertainty comes at a cost. When you’re unsure what’s real and what’s ready, it’s easier to delay. But delaying AI adoption means missed revenue, operational drag, and falling behind competitors who are already automating smarter and forecasting sharper. The reality is: doing nothing is no longer the safe option.

So, let’s separate hype from impact—and explore where AI agents are already delivering measurable results in the finance function.

What the GrowCFO Q2 2025 Tech Innovation Report Reveals

The recent GrowCFO Q2 2025 Tech Innovation Report dives deep into how modern finance teams are adopting AI to overhaul revenue operations—particularly across accounts receivable, forecasting, billing, and usage-based revenue models.

Key takeaways:

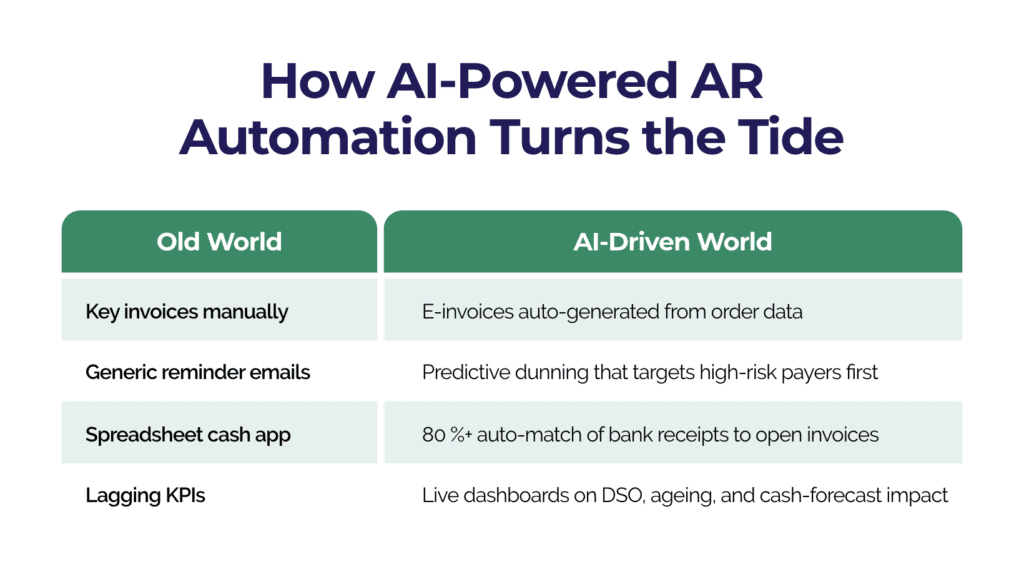

- AI‑powered AR automation: Tools like Stuut use AI to prioritise invoice collections intelligently, increasing recovery rates without adding headcount.

- Complex billing, simplified: SaaS revenue leakage from billing errors and unbilled usage is being tackled by platforms like Zenskar, which automates revenue recognition across hybrid billing models.

- Live cash forecasting: AI-driven forecasting tools offer real-time visibility, helping CFOs improve liquidity planning and avoid cash flow surprises.

These aren’t theoretical use cases—they’re live deployments, solving real problems. As the report puts it: “Revenue leakage remains one of the most pressing yet under-addressed challenges in SaaS finance.”

Why This Matters for CFOs

Despite healthy scepticism, AI agents are proving their mettle:

- They automate routine, error‑prone tasks at scale.

- They augment human decision-making with speed and precision.

- They uncover hidden value, like rescuing uncollected revenue.

- They free your team to focus on high-impact, strategic work.

Still, there are good reasons CFOs remain cautious. Trust, transparency, integration, and governance all top the list of concerns. But the takeaway is clear: AI is not a one-click fix. It’s a strategic capability—and it needs to be implemented with structure and purpose.

Practical Action Points

If you’re just beginning your AI journey, here’s where to focus:

- Start with high-ROI workflows: AR, billing, and forecasting are ripe for transformation.

- Embrace “human-in-the-loop” models: Let AI do the heavy lifting, while your team brings the context and judgment.

- Build for scale and trust: Choose tools with strong data security, compliance, and auditability.

- Upskill your finance team: Equip them to collaborate with AI rather than compete with it.

Don’t Miss: GrowCFO Q2 Tech Showcase – Today!

Want to see AI agents in action?

Join us on Wednesday, June 25th at 15:00 BST, 10:00 ET for the GrowCFO Q2 Tech Showcase. We’ll showcase live demos from innovative platforms like Stuut, Zenskar, Revving, and Agicap, highlighting practical AI deployments that are driving finance transformation today.

Final Word

AI agents are no longer just a glimpse of the future—they’re delivering results today. But their real power lies not in hype, but in disciplined, finance-led execution. For CFOs, the choice isn’t whether to embrace AI. It’s how fast, how smart, and how strategically you’re willing to move.

Join us at the Tech Showcase today and see what’s working, what’s real—and what’s next.

Companies adopting these platforms (HighRadius, Billtrust, Versapay, YayPay, Gaviti, BlackLine AR, etc.) report 10-20-day DSO reductions and, in heavy-equipment manufacturing, a 75 % jump in available cash within the first year.

Five CFO Actions to Capture the ROI

- Map the order-to-cash journey – quantify where cash stalls and what it costs.

- Prioritise AR automation – start with invoicing, dunning, and cash application; set a measurable DSO target.

- Tighten credit & collections policies with data-driven customer risk scoring.

- Instrument real-time dashboards so everyone—from sales to treasury—sees the same cash picture.

- Pilot AI forecasting to link collection patterns directly into liquidity planning.

Ready to See the Tools Live?

Order-to-Cash Tech Showcase: AI Agents that Automate, Accelerate & Collect Faster

📅 Wednesday 25 June 2025 | 🕒 3:00 – 5:30 PM BST

Live demos from the innovators leading the charge in AR automation

👉 Register free here.