How Can Finance Teams Learn AI and Automation?

What’s the best way for finance teams to build skills in AI and automation?

Finance teams can learn AI and automation by building foundational knowledge in finance AI use cases, adopting the right tools, and engaging in targeted upskilling programs. From streamlining reporting to forecasting and fraud detection, the key is to combine strategic understanding with hands-on practice — something GrowCFO’s Automation Accelerator was designed to support.

Why should finance teams learn AI and automation now?

The finance function is no longer just about reporting past performance — it’s about anticipating the future. Finance AI and automation are transforming how finance teams operate, helping reduce manual tasks, increase forecast accuracy, and make faster, data-informed decisions.

According to industry insights, finance AI enables real-time insights, risk mitigation, and faster close cycles — giving finance leaders a competitive edge. As these technologies evolve, so do expectations. Teams that don’t upskill risk falling behind in both performance and strategic influence.

What are the key benefits of adopting finance AI?

Learning and applying finance AI unlocks several advantages: Improved Efficiency: Automation eliminates repetitive tasks like invoice matching, reconciliations, and report generation. Data-Driven Decisions: AI models support scenario planning, trend analysis, and financial forecasting with greater precision.

Cost Reduction: By automating workflows, teams can reduce human error and resource waste. Stronger Compliance: Finance AI can flag anomalies, identify fraud risks, and improve audit readiness. Strategic Role Elevation: With operational tasks offloaded, finance professionals can focus more on business partnering and strategic input. These benefits aren’t theoretical — they’re already playing out in high-performing finance teams globally.

What skills do finance teams need to start using AI and automation?

To fully leverage finance AI, teams need a mix of strategic understanding and technical fluency. This includes: AI literacy: Understanding the types of AI (like machine learning or natural language processing) and how they apply to finance use cases Data management skills: Being able to clean, interpret, and structure data for AI inputs Tool proficiency: Familiarity with AI-enabled platforms like Oracle, SAP, or Microsoft Power BI Analytical thinking:

Ability to assess insights and translate outputs into actionable strategies Change management: Knowing how to embed AI in workflows and gain internal buy-in. These are trainable skills — and they’re most effective when learned in the context of practical finance AI scenarios.

Where can finance teams go to learn AI and automation?

There are three main paths finance teams can take:

| Learning Path | Pros | Cons |

| Self-paced online courses | Flexible and cost-effective | Generic content, low accountability |

| Enterprise vendor training (Oracle, Microsoft, etc.) | Tool-specific training, often included with software | Focused on platforms, not finance strategy |

| Finance-specific accelerator programs | Tailored to finance teams, combines strategic and practical learning | May require more upfront time investment |

The most effective approach is a hybrid model — pairing short bursts of self-paced learning with structured programs like GrowCFO’s Automation Accelerator, which walks finance teams through real-world finance AI tools, use cases, and integration methods step-by-step.

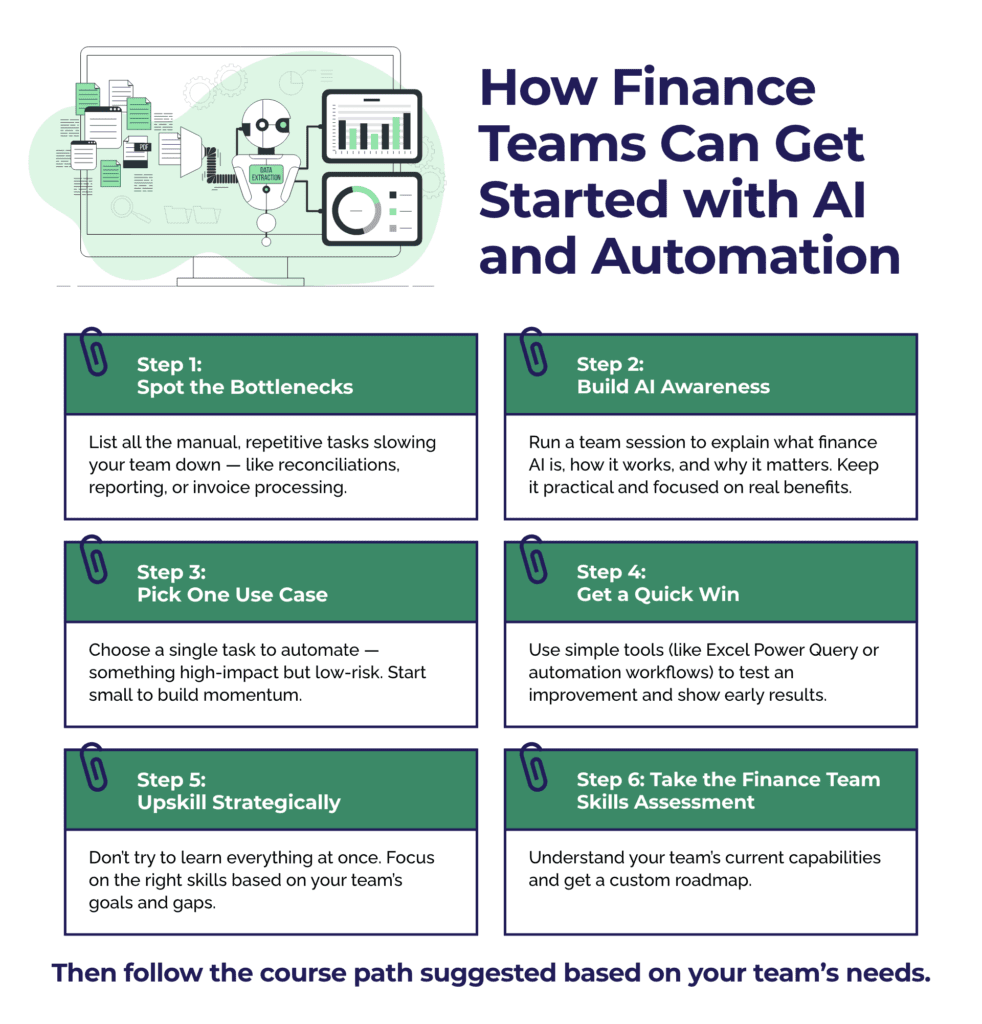

What are the first steps finance leaders can take to get started?

You don’t need a data science degree or a six-figure software investment to begin. Instead, focus on the following five steps:

1. Audit current processes – Identify bottlenecks, manual tasks, and pain points across your finance workflows.

2. Educate your team – Start with AI literacy sessions and explain the business benefits. Make it accessible, not technical.

3. Choose one use case – Select a single process to automate — like accounts payable or management reporting — and test a solution there.

4. Get quick wins – Start with low-risk, high-impact automations to build confidence and demonstrate value.

5. Invest in training – Enroll your team in a structured program like GrowCFO’s Automation Accelerator to fast-track adoption and develop repeatable finance AI systems.

How does GrowCFO help finance teams upskill in AI and automation?

The Automation Accelerator is designed specifically for finance professionals who want to harness the power of finance AI without the tech overwhelm. It covers: how to identify high-impact automation opportunities, hands-on practice with tools like Power Query, Power Automate, and ChatGPT, guidance on embedding automation into your workflows, and real-world examples from senior finance leaders who’ve implemented automation successfully.

Plus, GrowCFO’s Premium Membership gives your team ongoing access to mentoring, upskilling sessions, and expert-led training — so you’re always ahead of the curve.

Ready to future-proof your finance team with AI and automation? Explore GrowCFO’s Premium Membership or Automation Accelerator and take the first step toward a smarter, more strategic finance AI function.

Responses