How Can CFOs Create More Business Value?

What are the most effective ways CFOs can contribute to company value creation?

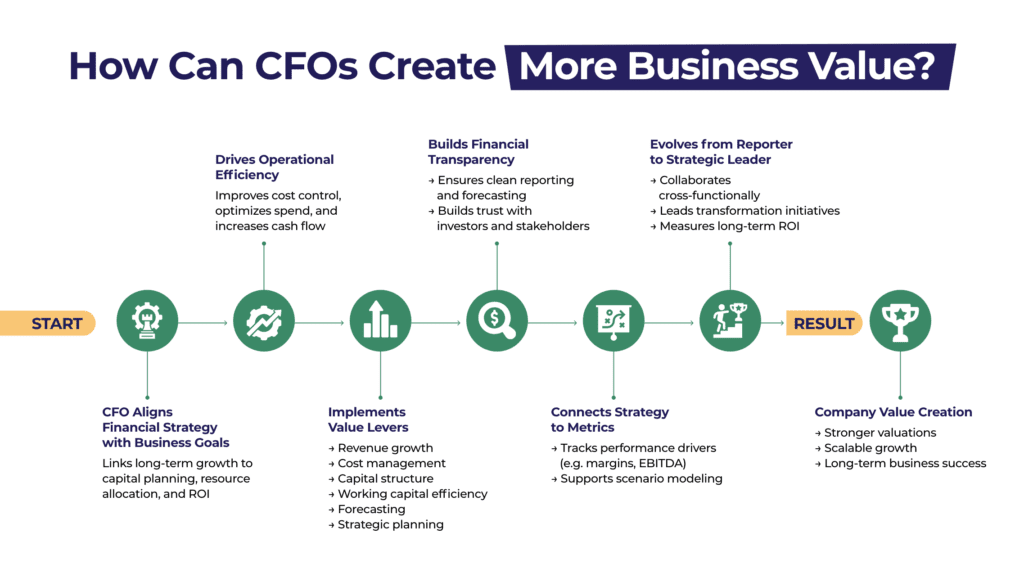

CFOs drive company value creation by aligning financial strategy with long-term growth, improving operational efficiency, and delivering investor-ready insights. From cash flow discipline to strategic investment decisions, their influence spans the core levers that shape valuation. If you’re wondering how CFOs create more business value, it begins with their ability to turn financial data into strategic action.

Why Is Company Value Creation a Core CFO Responsibility?

Traditionally seen as financial stewards, modern CFOs are now viewed as value architects. They have a 360° view of the business — revenue, risk, cost, capital, and future performance — making them uniquely positioned to lead company value creation.

CFOs impact value through:

- Strategic investment planning

- Revenue and margin optimization

- Efficient capital deployment

- Operational cost discipline

- Investor and stakeholder alignment

Their role is no longer passive reporting. It’s proactive decision-making that shapes enterprise value, both short-term and long-term.

How Does a CFO Influence Business Valuation?

An experienced CFO plays a critical role in any business valuation. Whether preparing for investment, sale, or expansion, CFOs help define what the business is worth — and why.

Here’s how they contribute to valuation accuracy and confidence:

- Builds financial transparency: Ensures clean, audited statements and accurate forecasting

- Identifies performance drivers: Clarifies which metrics (e.g., EBITDA, revenue quality, cost structure) drive value

- Supports scenario modeling: Provides visibility on upside, downside, and exit strategies

- Aligns business strategy with financial metrics: Links operational plans to measurable value outcomes

- Enhances credibility with stakeholders: Delivers the clarity investors and buyers require

Company value creation isn’t just about growing numbers — it’s about telling a story of sustainable, scalable growth.

What Are the Core Levers of Company Value Creation?

CFOs influence value through multiple business levers. Here’s a simplified view:

| Value Lever | How CFOs Create Impact |

| Revenue Growth | Guide pricing strategy, customer mix, and margin focus |

| Cost Management | Identify inefficiencies and optimize operational spend |

| Capital Structure | Balance debt and equity for maximum value and flexibility |

| Working Capital Efficiency | Improve cash flow and liquidity |

| Risk & Compliance | Reduce exposure, safeguard reputation |

| Financial Forecasting | Improve confidence in future performance |

| Strategic Planning | Allocate resources toward high-value initiatives |

When these levers are aligned, CFOs not only protect value — they create it.

How Can CFOs Shift From Cost Controllers to Value Creators?

The value-creator mindset means shifting from backward-looking reporting to forward-looking strategy. This includes:

- Asking “Where are we going?” not just “What did we spend?”

- Collaborating cross-functionally to identify growth and margin opportunities

- Leading data-driven transformation projects

- Measuring ROI of every financial decision, from hiring to tech investments

This shift often requires upskilling in communication, influence, and broader commercial understanding — the kind of development built into a GrowCFO CFO leadership program.

What Are Common Pitfalls That Undermine Company Value Creation?

Even experienced CFOs can unintentionally stall value creation. Common traps include:

- Focusing too narrowly on cost-cutting

- Delaying strategic investments due to short-term pressure

- Reporting without context or narrative

- Lacking alignment between financial targets and operational execution

- Underestimating the role of culture and people in long-term value

A CFO who can spot and overcome these pitfalls unlocks real, lasting value.

How Can GrowCFO Help CFOs Build Company Value?

Company value creation is a learned skill — not just a financial function. GrowCFO supports this transformation through:

- Future CFO – A structured development program to prepare for strategic leadership

- CFO Competency Assessment – Benchmark your ability to lead value creation today

Want to create more business value in your role?

Join our free Future CFO Preview Event to explore how GrowCFO can help you lead company value creation with confidence.

Responses