How Do You Become A CFO?

What are the steps to getting your first CFO role?

To become a CFO, you need a blend of technical finance expertise, strategic thinking, leadership ability, and cross-functional credibility. Most CFOs build their careers by progressing through finance roles, gaining qualifications like a CPA or MBA, and demonstrating business impact. If you’re asking how do you become a CFO, the key is to grow from financial contributor to trusted business partner — with both the skills and the presence to lead at the highest level.

What does a Chief Financial Officer do?

A Chief Financial Officer (CFO) is responsible for the financial direction and health of an organization. They oversee finance and accounting teams, ensure fiscal compliance, and drive business growth through financial strategy.

A CFO’s duties often include:

- Managing financial reporting and analysis

- Overseeing cash flow, budgeting, and forecasting

- Supporting mergers, acquisitions, and investment decisions

- Leading capital-raising efforts

- Working closely with the CEO on strategy and long-term planning

- Aligning financial objectives with business goals

- Managing risk and internal controls

This role demands both deep technical knowledge and the ability to lead, influence, and make high-stakes decisions at the executive level.

What qualifications do you need to become a CFO?

When asking, how do you become a CFO, while there’s no one-size-fits-all path, most CFOs share common credentials and experience:

|

Requirement |

Why It Matters |

|

Bachelor’s degree in finance, accounting, or economics |

Provides foundational financial knowledge and credibility |

|

Professional certification (e.g. CPA, ACCA, CIMA) |

Demonstrates technical mastery and regulatory understanding |

|

Master’s degree (e.g. MBA) |

Expands strategic, operational, and leadership capabilities |

|

10–15 years of progressive experience in finance |

Builds deep operational insight and a track record of impact |

Companies also prioritize CFO candidates with strong business acumen, cross-functional experience, and the ability to lead through transformation.

How can you build the skills needed for the CFO role?

To move into your first CFO position, you’ll need to shift from specialist to strategist. Here’s how to develop the right skill set:

- Master core finance disciplines

– FP&A, treasury, compliance, and reporting are essential foundations. - Understand the business, not just the numbers

– Get involved in operations, sales, and product to see how finance connects to value creation. - Lead teams and influence stakeholders

– Build people management experience and practice cross-functional communication. - Learn to tell the financial story

– Develop the ability to turn complex data into clear, persuasive insights for senior audiences. - Become digitally fluent

– Stay current on automation, analytics, and financial systems — they’re core to modern finance leadership.

GrowCFO’s Future CFO Program is designed specifically to build these capabilities, helping you become boardroom-ready and influence at the highest level.

What experience will help you stand out?

To land your first CFO role, it’s not just about what you’ve done — it’s about how you’ve contributed to growth and transformation. Focus on:

- Leading strategic projects like restructures, cost-saving initiatives, or acquisitions

- Improving forecasting accuracy or profitability through financial planning

- Driving finance automation or ERP system upgrades

- Influencing board-level decisions with compelling financial analysis

- Building and mentoring high-performing finance teams

Document your impact clearly in your CV and during interviews. Employers want CFOs who can drive results, not just maintain the status quo.

How important are relationships in your first CFO role?

Building strong internal relationships is critical — especially in your first 90 days. According to Sage, successful CFOs:

- Immerse themselves in company culture and values

- Collaborate with stakeholders to shape the financial vision

- Build trust and alignment with the CEO early

- Meet with direct reports to understand team strengths, gaps, and dynamics

People will look to you for clarity and direction — and the relationships you build will determine your influence.

Final Thoughts

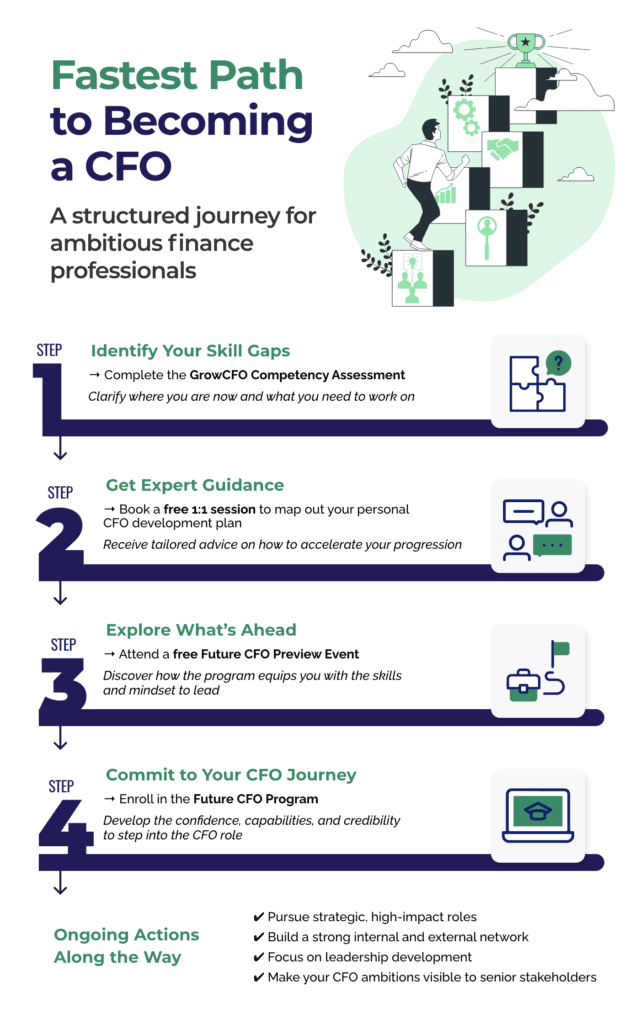

If you’re wondering how do you become a CFO, the real question is: How can you grow into a leader who drives financial strategy, builds high-performing teams, and influences the future of the business? With the right experience, mindset, and development plan, your first CFO role is within reach.

Join our Future CFO Preview Event to discover how the GrowCFO Future CFO Program prepares aspiring finance leaders to step into their first CFO role with confidence. Learn what skills you need, how to overcome common roadblocks, and how to position yourself for success at the top.