Shifting gears: The tools and mindset modern CFOs need to succeed

How are CFO skills evolving from reporting to revenue?

The CFO role has expanded far beyond the finance function. In the past, CFOs were primarily seen as the stewards of financial reporting. Now, they’re expected to play a leading role in revenue growth and strategic transformation. This shift demands CFO skills that encompass business acumen, cross-functional leadership, and digital capability. The traditional toolkit is no longer enough—modern CFOs must now help shape product decisions, optimize pricing models, and drive enterprise-wide initiatives.

What CFO skills are needed to drive transformation?

To lead transformation successfully, CFOs need to master a new set of capabilities. It’s not just about interpreting the numbers—it’s about influencing outcomes. That means developing CFO skills in change management, communication, and cross-departmental collaboration. Modern CFOs must build strong relationships with CEOs, boards, and operational teams to drive sustainable change. Soft skills like influence, adaptability, and strategic foresight are now as critical as financial expertise.

Why is commercial mindset a key CFO skill?

A strong commercial mindset allows CFOs to connect financial performance with business strategy. It’s one of the most important CFO skills today because it enables finance leaders to identify growth levers, evaluate new markets, and contribute meaningfully to customer and product strategy. CFOs with commercial intuition don’t just protect margins—they expand them. They anticipate how financial decisions impact brand, culture, and operations.

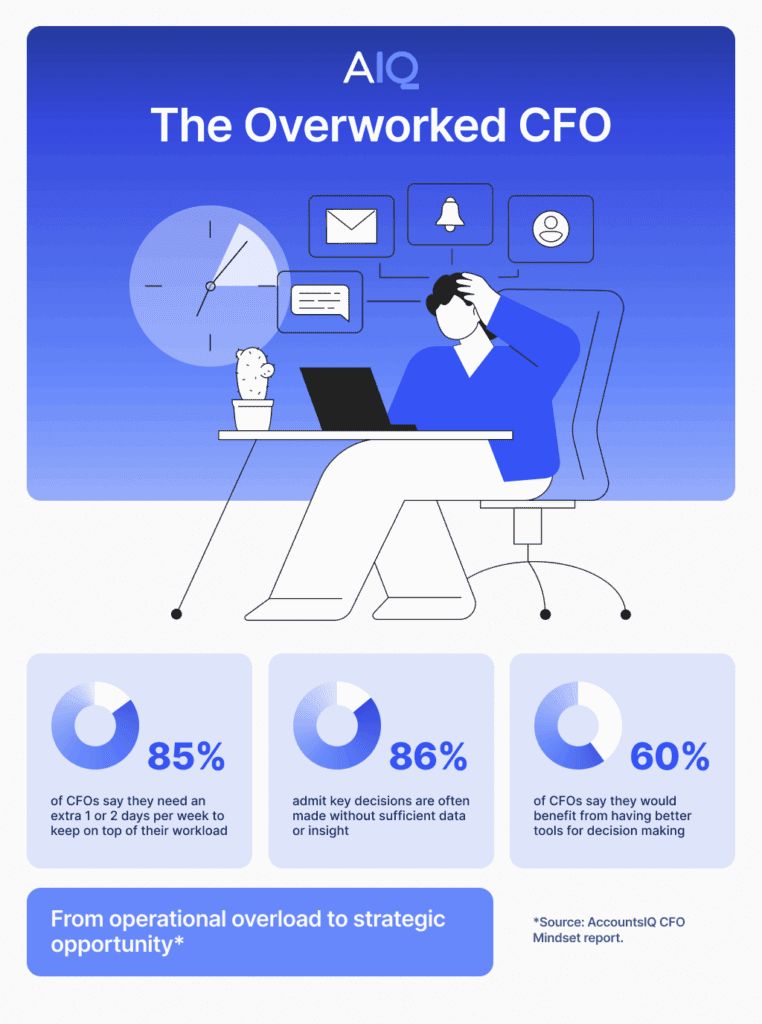

How should CFOs use data to lead with confidence?

The most successful CFOs are leveraging real-time data to make faster, better decisions. But it takes more than dashboards. Developing CFO skills in data storytelling and insight generation is key to influencing others. CFOs should use data to shape decisions—not just explain them. That means embracing automation, building robust forecasting tools, and using predictive insights to stay ahead of the curve.

What tools support modern CFO skills?

From performance management platforms to scenario modeling tools, today’s CFOs have access to more advanced technologies than ever before. But without the right CFO skills, these tools can’t reach their full potential. To extract value, CFOs must know how to choose the right tools, implement them effectively, and translate outputs into business action. The tech stack should support—not replace—human judgment.

Why is strategic mindset now a non-negotiable CFO skill?

Strategy isn’t just for the CEO. Today’s CFOs are co-pilots in shaping company direction. This requires CFO skills rooted in strategic thinking, prioritization, and decision-making under uncertainty. Whether it’s scenario planning, resource allocation, or risk management, CFOs must lead with a future-focused mindset. The goal isn’t just to manage costs—it’s to create long-term value.

What’s the next step to develop your CFO skills?

TThe modern CFO journey is constantly evolving—and staying ahead starts with the right insights. This report unpacks the capabilities today’s finance leaders need to thrive in a changing world. Once you’ve explored the findings, take the next step by developing your CFO skills through hands-on experience, peer learning, or a program like GrowCFO’s Future CFO initiative.