The Cash-Flow Killer Hiding in Plain Sight (and How CFOs are Fixing It)

💥 55 % of all B2B invoices are paid late, and 42 % of companies sit on a DSO north of 60 days. That’s cash you’ve already earned—but can’t deploy toward growth, head-count, or debt reduction. In sectors like equipment manufacturing and healthcare, average DSO pushes past 90 days, triggering real liquidity crunches.

When working capital tightens, even the best product or pricing strategy stalls. That’s why forward-looking CFOs are treating accounts receivable as their most urgent digital-transformation frontier.

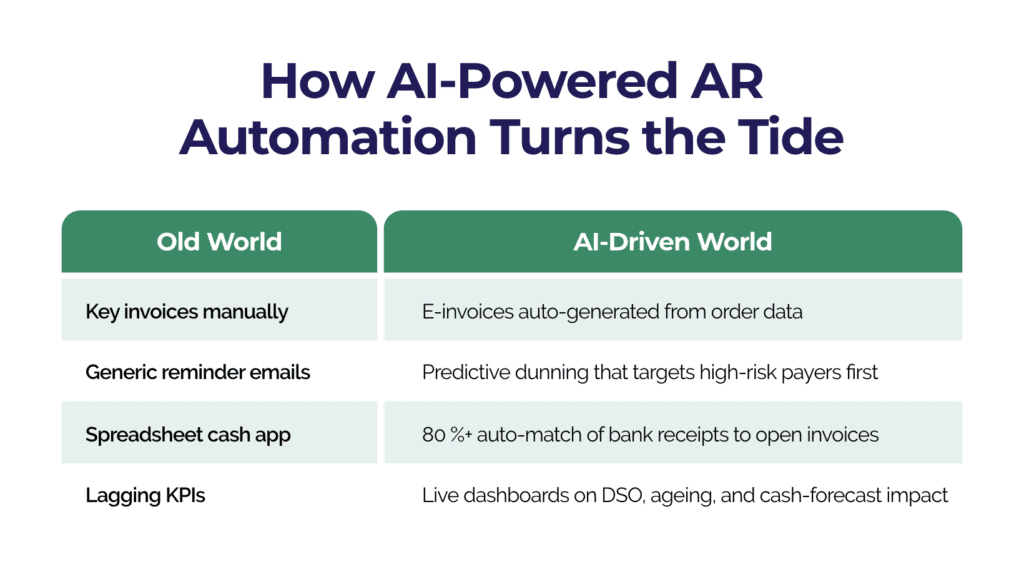

Revenue leakage – billing errors, failed subscription payments, and mis-applied discounts silently erode 1-5 % of EBITDA every year.

Companies adopting these platforms (HighRadius, Billtrust, Versapay, YayPay, Gaviti, BlackLine AR, etc.) report 10-20-day DSO reductions and, in heavy-equipment manufacturing, a 75 % jump in available cash within the first year.

Order-to-Cash Tech Showcase: AI Agents that Automate, Accelerate & Collect Faster

📅 Wednesday 25 June 2025 | 🕒 3:00 – 5:30 PM BST

Live demos from the innovators leading the charge in AR automation

👉 Register free here.

Finance Leadership Starts with People To lead effectively, CFOs must be great people managers — not just financial experts. Your ability to align, motivate, and…

Is it possible to complete a virtual FBP course, and how effective are online options for finance business partner training? Yes, a virtual FBP course…

Finance pros keep saying the same thing about AI: “We’re looking into it.” I’ve heard that sentence in almost every finance conversation this year. But…

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Responses