The skills that differentiate CFOs from other board members

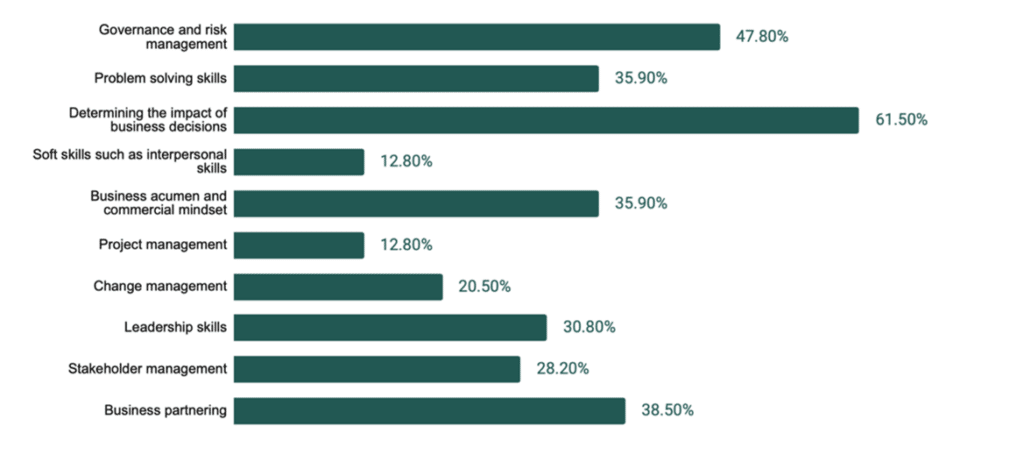

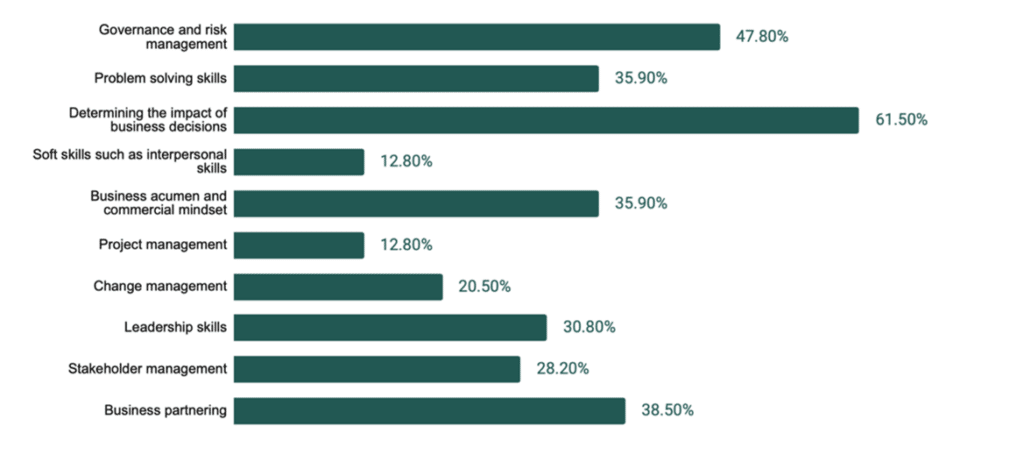

Poll Results: In addition to financial expertise and knowledge of the performance data, which of the following skills positively differentiate CFOs from most other board members?

In the GrowCFO community’s opinion, there are two big skills that differentiate CFOs from their board members:

- Determining the impact of decisions

- Governance and risk management

It is important to note that there are also many other skills that are very important for CFOs, such as soft skills, that score quite low. That’s because whilst these skills are important, they happen to be skills that are also well developed right across the board.

Governance and risk management

Governance is an important aspect of any company, regardless of its size or industry. The purpose of governance is to ensure that your company is run in a responsible and effective manner, and that the employees are held accountable to certain standards. The CFO plays a key role as a board member to contribute towards strong governance and hold others accountable for their actions.

No business can be successful without taking risks. However, every business decision impacts profits either positively or negatively. By taking steps to assess and mitigate risks, the CFO can encourage everybody in your company to protect your business from potential losses.

Finance is usually the owner of the risk register and typically runs both compliance and internal audit. Whilst all board members play a key role in governance, the CFO is uniquely placed to ensure that risks are both identified and addressed in a timely manner.

The CFO is also responsible for ensuring that the company has enough money to operate effectively. This means overseeing the budgeting process, monitoring cash flow, and making sure that the company has access to appropriate financing. In addition, the CFO must be able to effectively communicate the financial status of the company to the other board members, so that they can make informed decisions about the future of the business.

Determining the impact of decisions

Making well-informed decisions and determining their likely outcome is essential for running and successful business. Without this, companies would be taking unnecessary risks that could jeopardize their entire operation.

CFOs play a key role at board level to determine the potential impact of the decisions made by the company. This requires you to have strong knowledge of the performance data within the company’s financial model and a robust understanding of how the key business drivers impact the numbers.

In order to make sound decisions, the board must have access to accurate and timely information. The CFO is responsible for providing this information in a clear manner, as well as offering guidance on how the decision will impact the company’s financial performance. This allows other members of the board to understand the potential risks and rewards associated with each decision, and ultimately make better choices for the business

Your ability to translate business decisions into their impact on both the company’s finances and beyond is a key skill for any successful CFO. As a result, CFOs are often seen as one of the key players in any boardroom.

Assess Your Skills!

There are 45 key skills required to become a successful CFO and most of the finance community struggle to identify exactly how they rank against each of them. To deliver your full potential, you need to maximize the impact of your biggest strengths whilst mitigating the consequences of any skills gaps.

Aspiring and existing CFOs should complete your GrowCFO Competency Framework for free to benchmark yourself against your finance leader community and receive tailored insights to help create your personalized learning action plan.

Responses