GrowCFO Finance Software Survey

Introduction

GrowCFO completed an independent finance systems survey across our finance leader community comprising thousands of members. Within our survey, we asked companies a number of questions, including the following:

- How long did it take to implement your finance system?

- How much did it cost and did you need third-party support?

- Which companies would you recommend your finance system to based on their size and complexity?

The purpose of this article is to present GrowCFO’s community feedback. All comments are based upon community feedback and do not necessarily represent the views of GrowCFO.

Observations from GrowCFO’s Finance Systems Expert (Chris Tredwell)

Responses to the survey covered public, private and not-for-profit organisations across a broad range industries, business sizes and types. 29% of the responders operate single entity organisations versus 71% who manage multiple entities. 27% account in a single currency, with the remaining 73% having multi-currency requirements. Across the responders, 32 different accounting systems were reviewed.

* 70% of the responders stated their software was cloud-based, 26% suggested theirs was on-premise but with remote access while the final 4% said theirs was on-premise and they didn’t have remote access.

Observations – it is clear there is still a misunderstanding of the difference between cloud and on-premise software that is available remotely. This was apparent given some people replied ‘cloud’ to known on-premise solutions. Indeed there were several instances where there were conflicting responses for the same product (Both can’t be right!). For those readers who are still uncertain, there is a useful article in the portal that you can read here

* For responders who identified themselves as Startup / Small Businesses, the majority suggested their implementation was completed within 1 month. Most were able to implement without help (Self Service) and on average they completed the implementation for less than £1,000.

Observations – Xero was both dominant in the volume of responses over other alternatives in the space but also ranked highest across the capability and satisfaction criteria. The other key players in this space, Quickbooks, Sage 50, and Free Agent were ranked less favourably.

It was also interesting to see that there are still a number of people using Excel (not just startups) to run their finance function.

* For responders who identified themselves as Mid-Sized Businesses, the majority suggested their implementation took between 1-3 months. Almost all of the responders suggested they needed support to implement but that this was provided by the supplier. The cost to implement these solutions ranged from £10,000 – £100,000.

Observations – Aqilla and Netsuite performed best against the capability and satisfaction criteria. Others reviewed in this space included Financial Force, SAP Business One, Microsoft Dynamics and Infor Sunsystems all of which ranked less favourably. There were no reviews of Sage Intacct provided by any of the community (may be given it is relatively new to the UK market). It wasn’t a surprise that the traditional legacy branded software were much more expensive to implement than the modern cloud tech and explains the wide range of cost to implement in the mid sector.

* For responders who identified themselves as Enterprise Businesses, the majority suggested their implementation took over 6 months to complete with many spending longer than 1 year. They all identified that they required help through the process, typically from a third party (consultant/implementation expert). All projects cost in excess of £250,000 to complete.

Observations – Workday and SAP Hana performed best against the capability and satisfaction criteria. Others reviewed in this space included Oracle ERP which ranked less favourably. There were no reviews of Unit4 provided by any of the community.

* 66% of responders rated their software’s sophistication lower than 7

Observations – This may be misleading as you would not rank an entry-level system as 10 out of 10 but many of the mid-enterprise solutions were also ranked lower than a 7. Of course there is a level of subjectivity here but it is interesting that there was a consistantly low opinion of some established solutions.

* 64% of responders with multiple entities say their software cannot manage consolidations.

Observations – For those running multiple entity organisations, to not be able to manage group consolidations within your finance system is a big feature flaw. It is imagined most will be turning to Excel to support this requirement but this brings with it a number of challenges in itself. There is a great article within the community all about Group Consolidations, read it here

* 43% of responders with a multi-currency requirement said it performed average at best

Observations – Similar to the last point, this is a big feature flaw in many available systems. The survey doesn’t drill into the challenges faced by users to result in them scoring their system down here and it would be interesting to hear in the comments below what issues they have and how they overcome them currently.

* 30% of responders have not integrated any other software into their finance system. Of those that had, the most popular integrations were Expenses, CRM, Business intelligence and Excel.

Observations – This was an open question so may again be slightly misleading. Some responders may have some of the above functionality (such as expenses or Business Intelegence) as part of their core software and therefore have no need to integrate them. That being said, an overwhelming majority have begun integrating their wider IT infrastructure and clealy see the value of doing so.

* Only 42% people felt they would still be using their system in 5 years time.

Observations – Again, this stat could be skewed given several of the start up/small businesses may have already identified that they will outgrow thier current solution and need to upgrade their systems to support their growth stratergies. However, several of the legacy products were also reviewed as unlikley to still be in place and this is indicative of the migration towards modern cloud technology.

* 11% would not recommend their solution to anyone!

Observations – Generally speaking, this was related to legacy on-premise software. It’s worth noting that this software still has a prominant market share and in some cases is still winning its fair share of new business. This is thanks to these providers refreshing the user interface and making thier products avaliable to use remotely. However, this is largely smoke and mirrors given the old arcitecture is still there under the surface.

* 92% of responders can access the software remotely (cloud or remote access to on-premise)

Observations – as mentioned prevously, it is clear there is still a misunderstanding of what true cloud software is. It would be interesting to get the readers view on what actually matters to them? True cloud software (as you see the merits it provides) or just remote access?

* Only 50% of responders get automatic updates to their software

Observations – this could explain why some responders are not happy with their current system whereas others felt the same piece of software performed well. Regular, automatic updates are a big strength of SaaS, cloud software. Many organisations only update their software when they deem a new feature relevant. This results in many responders working on historical versions of their software. Having to pay for a maintenance contract and/or functional updates is a true sign you are using a legacy on-premise solution, even if you are accessing it remotely.

* 25% of responders rated their finance system a 5 or less with respect to it how closely it meets their current requirements. 46% rated it as an 8 or above.

Observations – It is generally accepted that you’re doing well if your system does 80% of what you need it to. Once you are doing more outside your system than you are inside it (workarounds such as Excel) it’s a true sign its time to make a change!

* Of the 16 mainstream systems reviewed, only 7 performed 7 or higher for ‘Meets Requirements’

Observations – I would suspect that a big reason some responders have rated their current solution poorly but not making a change is due to being locked into long term fixed contracts with ageing technology. A lot of the traditional known ‘brands’ have been buying their cloud native solution rather than building it from the ground up (eg. Sage Intacct to replace Sage 200) and trying to migrate them over.

* Only 5% suggested they would not be implementing anything which suggests that the adoption of tech is front of mind in the industry currently.

Observations – This echo’s the pressure on finance teams to find efficiencies (through automation for example) and/or improve the reporting capabilities for their organisation.

* 10% of responders are already in the process of replacing their current solution

The Future

* The Top 5 innovations responders plan to implement in the years ahead are:

- API Integrations

- Advanced Business Intelligence

- Workflows

- Mobile Expenses

- Cloud Technology

Observation Summary

- Modern cloud software was the overall clear winner over traditional on-premise alternatives

- A lot of people appear to ‘settle’ for their software and find workarounds to fill voids. This could be due to being fixed into contracts with old tech. I imagine in several cases legacy systems were implemented by a predecessor and result in people who are unhappy with the systems they have in place.

- I suspect there is also a fear of the cost to change or the disruption it will cause in an already busy area of the business.

- It should be noted that your current system might do more than you suspect. Especially if you have had the system in place for a long time or you took ownership of it from your predecessor. If your system has not been updated in a few years there will no doubt be new features and functionality that could address your shortcomings. Challenge your incumbent supplier on their ability to address your shortcomings. This also echos another benefit of automatic updates v optional paid upgrades.

- As with everything, if your foundations are not right your future plans will eventually suffer. Old software will increasingly struggle to adapt to innovation.

- It’s clear there is still a big miseducation around what cloud really means. To read more on this topic take a look at this article

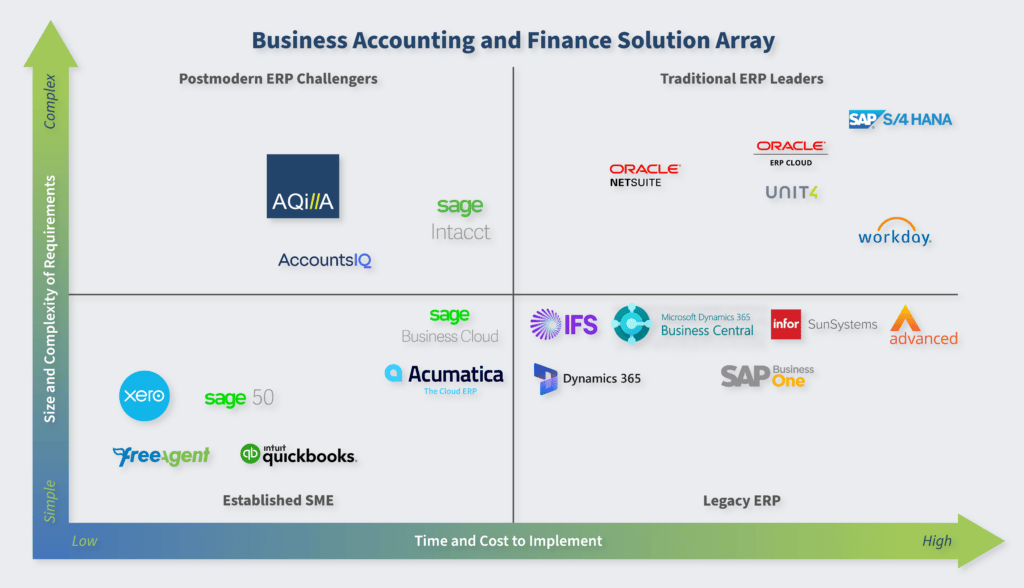

The Solutions Array

The last few years have seen a massive amount of change and disruption to businesses everywhere. With the reopening of economies, businesses need to be highly adaptable in adopting new methods and processes, embracing digital transformation for the good of all stakeholders, customers and staff.

This Solution Array assesses the performance and capability of leading vendors across four distinct segmentations, relevant to an organisation’s size, scale and agility compared with the cost of acquisition and ownership.

Established SME

Fulfilling the needs of the millions of micro, small, and small-to-medium sized businesses, the traditional large brand plays from the likes of Sage and Intuit (the authors of QuickBooks) have been besieged for something like 10 years by new entrants based purely on Cloud-based technologies.

Xero, in particular, has been very successful in building market share against Sage in many territories, mining almost exclusively the SME accounting practice market in which its main competitor used to dominate.

Even Intuit, despite its dominant market position in the US, has had to respond by almost completely abandoning the original on-premise Quickbooks, replacing it with the new and solely cloud-based Quickbooks Online, sometimes at a cost of functionality being lost to users.

Legacy ERP

For larger, more complex, organisations the market is still very much dominated by a vast array of legacy, on-premise solutions that have evolved, in some cases, from products first released over 30 years ago.

They are complex to install, complex to manage and even more complex to remove or replace. Market growth has been stalled by restrictions arising out of the use of often complex in-house and/or “in-premise” IT infrastructure required to serve end-users.

While extensions such as Microsoft CRM have been developed for the Cloud (a tactic adopted to counter disruptors such as SalesForce.com), the widespread migration of Legacy systems has been met with significant resistance. An overall reduction in functionality, coupled with poor user experiences of software not designed for use in a browser-based environment, has led to stalled growth for Legacy systems.

Traditional ERP Leaders

Big (in the main US-based or quoted) vendors continue to dominate the enterprise space as they have done for decades. SAP, the biggest software company in the world, has adapted well in the new Millennium (after a couple of false starts with mid-range cloud-based systems – its SAP Business One product still relying on hosted options) with SAP S/4HANA (“High-Performance Analytic Appliance” or in-memory database technology) which has replaced the old SAP R/3 and SAP ERP solutions.

Oracle continues to be competitive having adopted for the largest enterprises similarly large scale data-centric applications hosted in its own Oracle Cloud (think big data centres also owned by Oracle); and by the acquisition of NetSuite, one of the early stage Cloud-based vendors based in the US; along with a quite diverse collection of disparate legacy acquisitions in other business sectors (e.g. the old Siebel CRM product).

Postmodern ERP Challengers

Combining stability, flexibility and maturity of functionality enjoyed by many thousands of organisations who understood the need for digital transformation in recent years as, with an enviable cost of ownership model (normally based around flexible per-user subscriptions), the new breed of “Designed for Cloud” solutions are challenging the tradition vendors across all markets.

As evidenced by the inability or lack of agility to convert older solutions or build new ones, the likes of Sage (similarly Oracle) chose to acquire one instead, in their case the US-centric Intact. Outside the US it is not uncommon for organisations such as Aqilla, who have the experience and proven track record in delivering solutions to organisations of a more complex nature than those served by the SME vendors (going well “beyond book-keeping” if you will), to be serving organisations with sophisticated requirements across multiple companies, taxonomies and territories, maximising the agility a true Cloud/browser-based solution affords combined with enterprise-class, adaptive functionality.

Deeper Dive

Having reviewed the results from over 100 responses in some detail, below we share the average scores our members gave about their experience with the various software vendors.

*The scores (where relevant) are out of 10.

*The results are based on the average response from our members. If you have had a differing experience feel free to share your thoughts in the comments below.

*A few results are ‘unknown’ as some responders either couldn’t remember, didn’t have those requirements or were not involved in the initial implementation.

Enterprise Level Software Results

*No other Enterprise Level Software was represented in the survey responses inc Unit 4

Mid Level Software Results

*No other Mid Level Software was represented in the survey responses inc Sage Intacct

Entry Level Software Results

*Xledger results based on a single response only

*No other Entry Level Software was represented in the survey responses

Recommendations

We split businesses into 6 brackets (seen below) and asked the responders to suggest which they would recommend their solution to:

- Small-sized company with low complexity requirements

Xero / Quickbooks / Sage50 / Free Agent / XLedger / Excel / SAP Business One / FinancialForce / OneAdvanced / Infor SunSystems - Small-sized company with medium complexity requirements

Xero / Quickbooks / Sage50 / Free Agent / XLedger / Aqilla / Sage200 / SAP Business One / FinancialForce / OneAdvanced / Infor SunSystems - Small-sized company with high complexity requirements

Xero / Quickbooks / Sage50 / XLedger / Netsuite / Aqilla / Sage200 / SAP Business One / OneAdvanced / Infor SunSystems - Medium-sized company with low complexity requirements

Xero / Quickbooks / Sage50 / Free Agent / XLedger / Netsuite / Aqilla / Sage200 / SAP Business One / FinancialForce / OneAdvanced / Infor SunSystems / Workday / Oracle ERP - Medium-sized company with medium complexity requirements

Xero / XLedger / Netsuite / Aqilla / Microsoft Dynamics / Sage200 / SAP Business One / OneAdvanced / Infor SunSystems / SAP S/4HANA / Workday / Oracle ERP - Medium-sized company with high complexity requirements

Netsuite / Aqilla / Microsoft Dynamics / OneAdvanced / Infor SunSystems / SAP S/4HANA / Workday / Oracle ERP - Enterprise-sized company with low complexity requirements

Netsuite / Aqilla / Sage200 / OneAdvanced / Infor SunSystems / SAP S/4HANA / Workday / Oracle ERP - Enterprise-sized company with medium complexity requirements

Netsuite / Aqilla / Microsoft Dynamics / OneAdvanced / SAP S/4HANA / Workday / Oracle ERP - Enterprise-sized company with high complexity requirements

Netsuite / Microsoft Dynamics / SAP S/4HANA / Workday / Oracle ERP

We also gave them the option to respond “I would not recommend our finance system to any business” with the following products falling into this bucket:

Sage50 / Quickbooks / Microsoft Dynamics / Sage200 / OneAdvanced / Infor SunSystems / Oracle ERP

Watch back on demand

Dan Wells (GrowCFO CEO/Founder) & Chris Tredwell (GrowCFO Systems Expert) discuss the research results and share their observations.

Supporting Podcasts…

Conclusion

The typical upward growth of successful organisations is demonstrated through their software journey. Most small businesses will begin with software that is placed in the SME category of the Solution Array, when the business model is simple and the finance is likely to be undertaken by an individual who may not be an accountant. Products such as Quickbooks and Xero caters toward a requirement for simplicity.

As the requirements change, so does the software. Organisations that grow to have a complex structure require software that can handle these requirements, an expense that has become engrained culturally within the business world.

As finance departments look to the future, the allure of Legacy ERP systems has begun to stall, with Traditional ERP and increasingly Postmodern ERP solutions the more popular options as organisations look for a balance between security and functionality. Products such as Netsuite provide full functionality as well as contractual simplicity when using a singular vendor for all business system solutions. However, the costs and lengthy implementations associated with Traditional ERP systems increasingly prove too much for Mid-size enterprises that can implement a Postmodern ERP.

Postmodern ERP solutions can be implemented in stages, allowing organisations to spread out the implementation costs across their business systems. With this flexibility, they can implement the systems they most urgently require at a fraction of the cost and time that they would otherwise spend.

Responses